Mar 18, 2021

Why the future is bright for North American lithium clay exploration

- As the electric vehicle (EV) market continues to grow, renewable energy and minerals associated to it, such as lithium, are increasing in price

- The current market for EVs has yet to be sizeable as battery improvements continue to develop, however, the sector can accelerate worldwide electrification

- Nevada has significant lithium deposits, both clay and brine, as well as being host to multiple operating lithium mines with experienced exploration teams

In a recent article written by journalists Ernest Scheyder and Trevor Hunnicutt, the two explain that the U.S. has a desire to both encourage the electrification of vehicles and also to reduce the country’s dependence on China for rare earths, lithium and other minerals needed for Electric Vehicle (EV) batteries.

The article also notes that “The administration has called the reliance on China a national security threat.”

“You can’t have green energy without mining,” says Mark Senti, chief executive of Florida-based rare earth magnet company, Advanced Magnet Lab Inc. “That’s just the reality.”

The article also explains that “Two sources familiar with White House deliberations on domestic mining told Reuters that the Biden administration plans to allow mines that produce EV metals to be developed under existing environmental standards, rather than face a tightened process that would apply to mining for other materials, such as coal.”

It goes on to note that “Furthermore, President Biden is open to allowing more mines on federal land, the sources say, but won’t give the industry carte blanche to dig everywhere. That will likely mean approval of mines for rare earths and lithium.”

Demand for metals used in EV batteries is expected to rise sharply as automakers including Tesla Inc. (NASDAQ: TSLA), BMW (XETRA: BMW.DE) and General Motors (NYSE: GM) plan major expansions of EV production. “California, the biggest U.S. vehicle market, aims to entirely ban fossil fuel-powered engines by 2035.”

The Biden administration has promised to convert the entire U.S. government fleet – about 640,000 vehicles – to EVs. If this plan is successful, President Biden would increase the total number of EVs in the U.S. “By more than 50 per cent.”

That plan alone could require a “12-fold increase in U.S. lithium production by 2030”, as well as increases in output of domestic copper, nickel and cobalt. “Federal land is teeming with many of these EV metals, according to the U.S. Geological Survey.”

“There is no way there’s enough raw materials being produced right now to start replacing millions of gasoline-powered motor vehicles with EVs,” explains Lewis Black, CEO of Almonty Industries Inc, which mines the hardening metal tungsten in Portugal and South Korea.

Scheyder and Hunnicutt write that, “Despite that shortage, proposed U.S. mines from Rio Tinto Ltd, BHP Group Ltd, Antofagasta Plc, Lithium Americas Corp, Glencore Plc and others are drawing stiff opposition from conservation groups. The projects would supply enough lithium for more than 5 million EV batteries and enough copper for more than 10,000 EVs each year.”

They add that Former U.S. President Donald Trump and the mining industry “Pushed the narrative that we need to mine everywhere and undercut environmental safeguards in order to build more batteries,” notes Drew McConville of The Wilderness Society, a conservation group.

“We have confidence that the Biden administration is going to see through that false narrative.”

According to Scheyder and Hunnicutt, “Earthworks and other environmental groups are now lobbying automakers to only buy metals from mines deemed environmentally friendly by the Initiative for Responsible Mining Assurance (IRMA), a nonprofit group. BMW, Ford Motor Company (NYSE: F) and Daimler AG (XETRA: DAI.DE) have agreed to abide by IRMA guidelines, and other automakers may follow suit.”

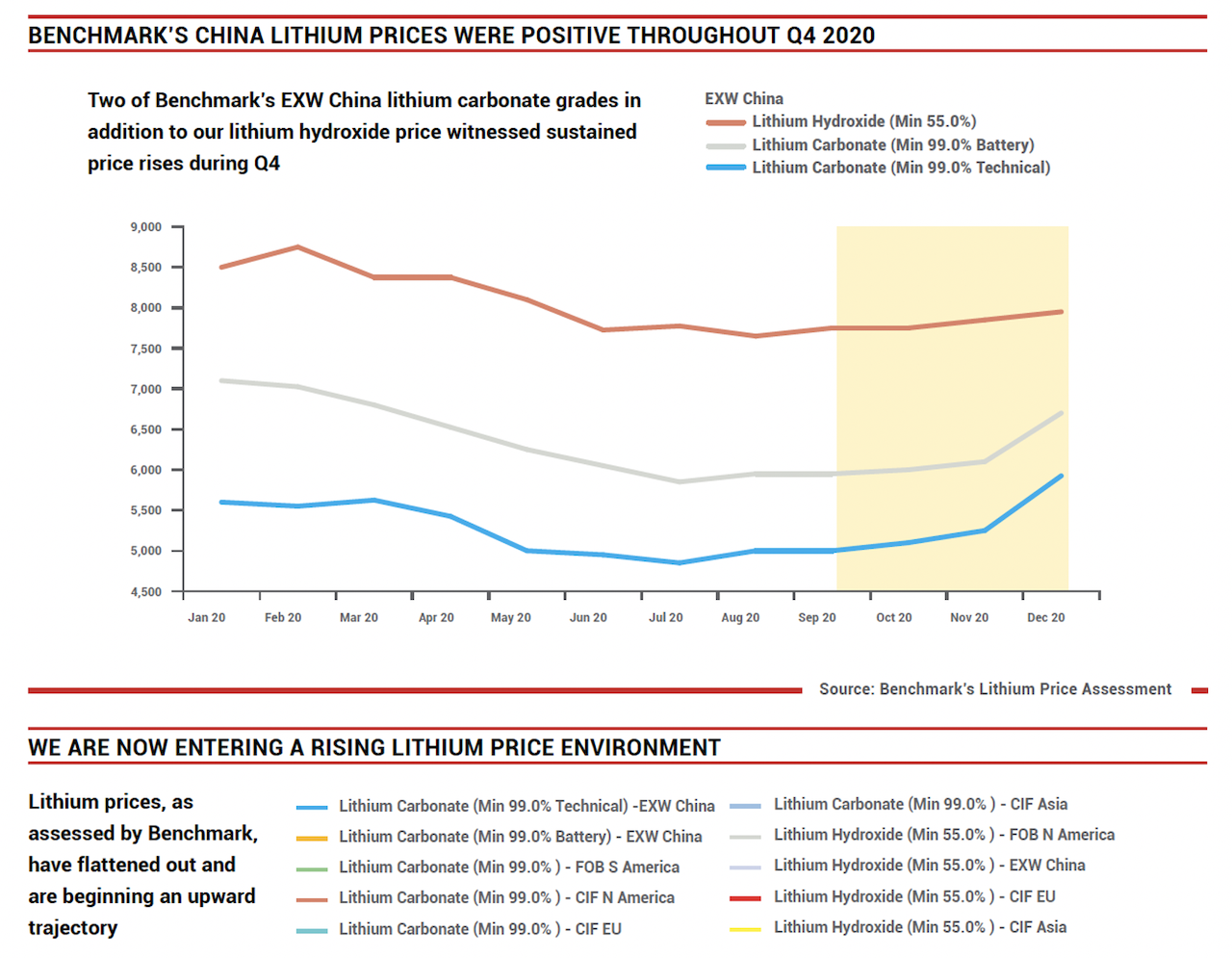

Benchmark Lithium, a division of global research giant Benchmark Minerals Intelligence, recently published in its Q4 2020 Review Publication, Crude Awakening, the article “Lithium sees first rise for 3 years.”

In this article, Benchmark researchers comment that Lithium prices have seen their first sustained rise in 3 years and lithium prices within China are beginning to rise for the first time in three years marked by rises in Chinese domestic chemical prices throughout Q4 2020, bringing an end to lithium’s two and a half year (2.5) year bear market.

The driver behind the lithium upswing

When assessing why prices have risen, Benchmark researchers comment that the main driver behind the upward movement of lithium carbonate prices in China is the strong growth in lithium iron phosphate (LFP) cathode which is finding renewed interest in passenger EVs in addition to electric buses.

Furthermore, although China’s EV subsidies have been maintained, there is less incentive – particularly at current raw material pricing – to push towards the higher-nickel chemistries that fueled the focus on NCM 811 around 2018.

This, within the context of improved battery demand sentiment moving into the new year, saw a run on lithium carbonate volumes towards the end of Q4. As was demonstrated in the industry’s previous price spike, which began in late-2015, demand growth at a rate that exceeds industry expectations can have profound implications for the future growth trajectory.

China has often proven a bellwether for the direction of global prices, with greater liquidity in the domestic market making pricing more responsive to market imbalances.

While it is too early to say whether this could be replicated in 2021, a reversal in the relationship between carbonate and hydroxide in China’s domestic market has often marked the peaks and troughs of lithium’s price cycle.

Also recently reported in the Financial Post on January 28, 2021, journalist Peter Tertzakian wrote an in-depth article entitled, “Another commodity super cycle is coming – this time driven by renewable energy and EVs.”

The article explains that the transition to a global electrified clean energy economy is going to result in a monumental draw on metals and minerals from the earth's crust. Notably, prices of lithium, copper, nickel, cobalt, platinum and rare earth elements are all inflating as electric vehicles and the wider electrification trend starts pulling on constrained resources.

With dozens of electric vehicle manufacturers at various stages of development around the world, EV car sales volumes are predicted to substantially increase. Here, Tesla Inc. is the clear EV market leader with over 500,000 vehicles sold last year alone, and with notification of companies like Volkswagen AG, BMW, Ford and General Motors Co. devoting billions to EV design and manufacturing, the market is expected to accelerate considerably by mid-decade.

Upstart and established car companies are collectively raising billions of dollars to roll out new models. Expectations for EV sales are at all-time highs, and now those expectations are impacting the resource sector, leading to investment analysts speaking openly about a forthcoming “Commodity super cycle.”

This is starting to happen, even though current EV sales have not yet achieved a sizable market share of overall car sales, due to the fact that improvements in battery storage technologies have created an acceleration to the overall electrification of the global economy.

Furthermore, the resource world doesn’t move nearly as fast as the technology world, which is why commodity value is now chasing technology value.

And the larger lesson is that the new economy can’t go anywhere without the old. You don’t need a PhD in Economics to realize that the transition to an electrified clean energy economy is going to result in a surge in demand for additional metals and minerals from the earth’s crust.

It is going to result in dramatic metal commodity price increases. In the past few months, rising commodity prices are a wake-up call to that reality.

The increased use of key energy metals like lithium, nickel, and cobalt will continue to lead to future demand and commodity price increases which result in good news for energy metal explorers.

Sure, the challenges can be overcome. When commodity prices rise, more resource projects are permitted, financed and built, often in unsavory places.

How Nickel Rock can capitalize on current EV trends

That is why nickel exploration companies, like Nickel Rock Resources (TSXV: NICL | OTCQB: NIKLF), who both explore for these valuable metals and operate in ethical mining jurisdictions within North America, are highly sought after by multi-national companies focused on energy metals like Glencore PLC (LON: GLEN) and Tesla Inc. (NASAQ: TSLA).

Nickel Rock is a Canadian based exploration company whose primary listing is on the TSX Venture Exchange. The company maintains a focus on exploration for high value battery metals like lithium and nickel required for the EV market.

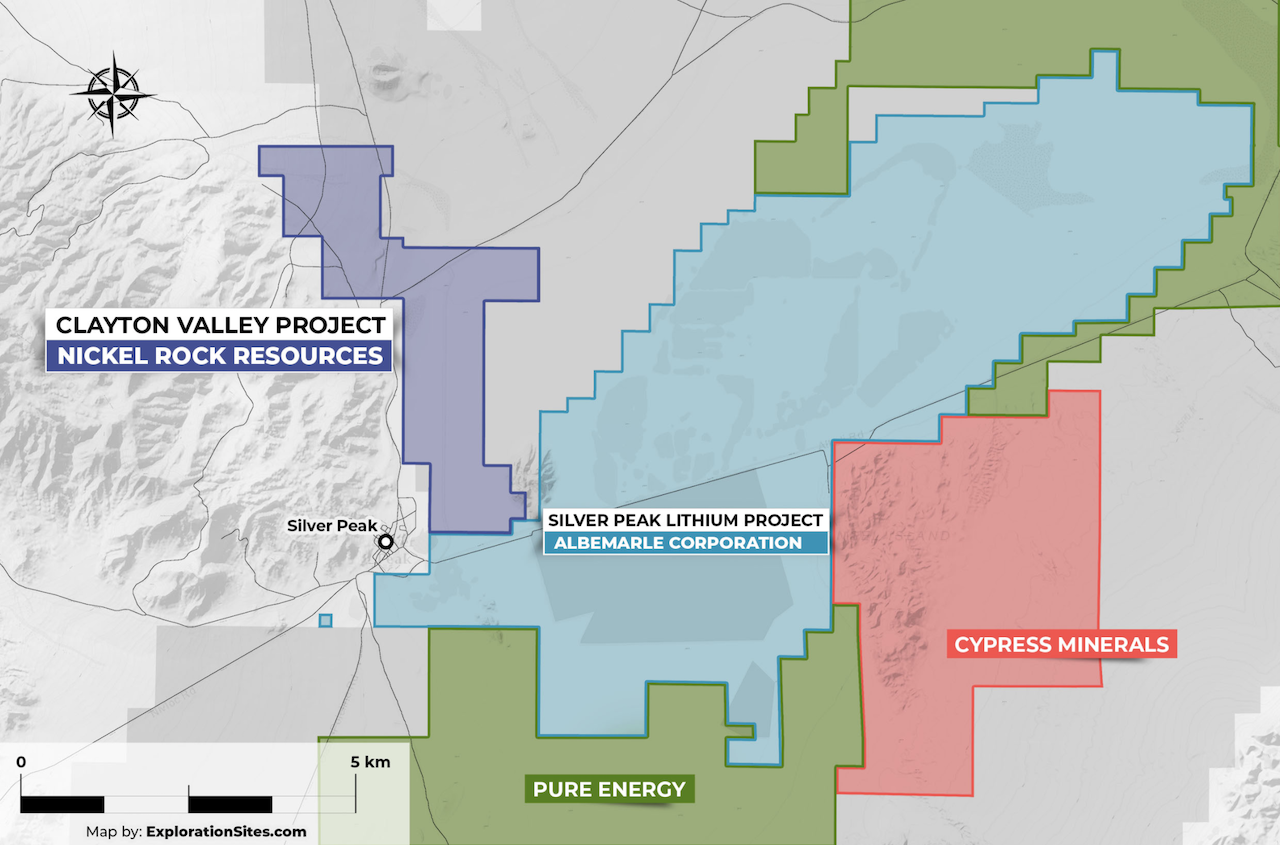

The company recently announced its work program associated with a lithium clay exploration property in Nevada which includes approximately 3,000 ft of reverse circulation (RC) drilling. The project calls for a drilling program that will result in up to six exploration holes at the company’s recently expanded claim block at Silver Peak, Clayton Valley, Esmeralda County, Nevada.

The Nickel Rock land package directly adjoins a western portion of neighbouring lithium producer Albemarle Corporation’s (NYSE: ALB) lithium evaporation ponds and covers approximately 930 Ha of potential lithium bearing clay and brine deposits within lake sediments and ash beds reported in rough drillers logs of historic water quality monitoring wells on file with the Nevada State Engineers office (permit #66034A).

Albemarle recently announced on January 7, 2021 that it will commence exploration for clay and evaluate technology that could accelerate the viability of lithium production from clay resources in the region.

It has been widely reported that Albemarle is planning to double its lithium production by 2025 in Nevada at the Silver Peak mine by committing between USD$30 million and USD$50 million in additional investment on the property.

The Nickel Rock land package is also nearby the 2197.4 Ha of lithium clay properties owned by Cypress Development Corp. referred to as the “Cypress Clayton Valley Lithium Clay Project,” which is immediately east of the Albemarle Silver Peak Mine.

Exploration and development by Cypress has discovered a large world-class resource of lithium-bearing claystone adjacent to the brine field to the east and south of its property. At this property, lithium mineralization occurs within montmorillonite clays throughout the sediments to a depth of at least 150 m and metallurgical testing indicates low-cost processing can be achieved by leaching with low acid consumption (125 kg/t) and high lithium recovery over 85 per cent lithium.

These high extractions prove the dominant lithium-bearing minerals present are not hectorite, a refractory clay mineral which requires roasting and/or high acid consumption to liberate the lithium.

On February 9, 2021, Cypress Development Corp. announced an upsized bought deal offering of $17,000,000 which shows the significant interest in this property and the lithium clay deposit.

Mr. Robert Setter, the company’s President and CEO comments, “The clay layers encountered in the wells at Nickel Rock’s Clayton Valley Lithium Project are beneath gravel and alluvial cover and do not form obvious outcrops.”

He adds, “Additionally, the company claims cover likely concealed faults shown in geophysical studies conducted by Sierra Geothermal Power Corporation in the 2008- 2010, which the company believes to be important in the formation of lithium-bearing clays.”

“We are excited about capturing this renewed investor interest for the potential of lithium bearing clays in the region.”

Nickel Rock claims cover various geothermal features like tufa (hot spring limestone carbonate formations) and sinters (sedimentary rock formations primarily composed of silica precipitated from hot waters) representing locations of upwelling hydrothermal fluids that may play a role in the formation of lithium rich clay deposits.

Clayton Valley has several known occurrences of lithium bearing clays and tuffs as documented by academic publications and recent drill results released by Cypress Minerals and others.

Nickel Rock Resources - Clayton Valley, Nevada Lithium Project

Nickel Rock is also exploring for commercially important groundwater deposits enriched in dissolved lithium on its Clayton Valley project at Silver Peak, near Tonopah, Nevada.

In Clayton Valley, all producing lithium brine deposits share several first-order characteristics:

- Arid climate

- Closed basin containing a playa or salar

- Tectonically driven subsidence

- Associated igneous or geothermal activity

- Suitable lithium source-rocks

- One or more adequate aquifer

- Sufficient time to concentrate a brine

The company’s Clayton Valley Project is an early-stage lithium brine prospect in Esmeralda County, Nevada. A total of 77 placer claims covering about 640 Ha were staked over the western side of the Clayton Valley playa.

The property position covers an inferred graben bounded by the Silver Peak range front on the west and Goat Island on the east. The exploration concept is the graben is a sub-basin of the larger Clayton Valley basin and may represent a secondary trap for lithium brines within the greater system.

Located contiguous and adjacent to Nickel Rock Resource’s Clayton Valley Project, the Silver Peak Lithium Brine Mine and Processing Facility has been in production since 1966 using traditional evaporation pond technology and is the only producing lithium brine deposit in North America.

Albemarle Corporation (NYSE: ALB) purchased the mine as part of its acquisition of Rockwood Lithium that closed in early 2015. The United States Geological Survey estimates that over 300 million pounds of lithium carbonate have been produced at this facility since 1966.

Advantages of exploration in Nevada

There are several advantages of conducting mining operations in Nevada. Nevada mining and exploration companies have generated several promising projects and are the subject of significant exploration expenditure in 2021.

The Mining Journal has recently stated that for the first two months of 2021, over $175 million has been raised for mining projects in Nevada, roughly half of the $331 million raised for all of 2020.

In addition, Nevada is host to numerous operating mines, good infrastructure, power plus experienced exploration and supporting services. Nickel Rock’s exploration team believes that its land position is strategically situated near to the Silver Peak Mine lithium deposit.

The Mining Journal has recently stated in an article dated March 1, 2021, that the Fraser Institute has found that Nevada is the top international jurisdiction for mining investment in 2020.

Qualified person

Alan Morris is a qualified person as defined by National Instrument 43-101 and has approved the technical information contained within this news release.

NICL Lithium Projects

Clayton Valley is a down-dropped closed basin formed by the Miocene age Great Basin extension and is still active due to movement along the Walker Lane structural zone. As a result, the basin has preserved multiple layers of lithium bearing volcanic ash, resulting from eruptions from the 700,000-year-old Long Valley Caldera system and related events. These ash layers are thought to be the source of the lithium brines extracted by Albemarle and are also likely involved in the formation of the exposed lithium rich clay deposits on the east side of Clayton Valley.

NICL Nickel Projects

The Mount Sidney Williams Group consists of five claim blocks in four groups with a total area of 6,125.32 hectares in the area surrounding Mount Sidney Williams, both adjoining and near the Decar project of FPX Nickel Corp., located 100 kilometres northwest of Fort St. James, B.C., in the Omineca mining division. Metallic mineralization includes nickel, cobalt, and chromium. At least some of the nickel mineralization occurs as awaruite.

The Mitchell Range Group area claim consist of two contiguous claim blocks covering 3,134.70 hectares with demonstrated metallic mineralization including nickel, cobalt, and chromium. Nickel-cobalt mineralization has not been well explored, but the presence of awaruite has been documented. The company is planning detailed exploration for the upcoming exploration season.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward‐looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward‐looking. Forward‐looking statements are not guaranteeing of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to vary materially from forward‐looking statements.

Learn more about Nickel Rock by visit their website here.

Follow Nickel Rock on social media for the most up-to-date news: