Oct 3, 2022

Wild Moves in Credit Suisse’s Default Swaps Cap Bank’s Bad Day

, Bloomberg News

(Bloomberg) -- Credit Suisse Group AG’s wretched day in the capital markets resulted in huge distortions in the price of credit derivatives protecting against a default by the Swiss lender.

The rush to hedge against losses pushed credit default swaps on the bank to an all-time high on Monday, according to ICE Data Services. The troubled Swiss bank’s CDS curve inverted as investors rushed to protect themselves against a near-term default within the next 12 months.

Earlier in the day, one-year CDS were quoted at over 500 basis points, versus just over 300 for the five-year, ICE Data Services pricing shows, shooting past the default risk pricing for its European banking rivals, Barclays Plc and Deutsche Bank. The prices indicated a roughly 23% chance the Swiss bank will default on its bonds within five years.

The dramatic moves came after attempts by Chief Executive Officer Ulrich Koerner to reassure employees on the bank’s financial stability, but only added to the sense of turmoil surrounding Credit Suisse and prompting executives to speak with investors and clients during the weekend over concerns about the share price dropping and CDS widening. The bank has seen its stock price halve so far this year. Monday’s sell-off saw the lender’s share price plunge by a further 12%, though it recovered its losses by the end of the day.

CDS prices were starting to fall back from their earlier peaks by close of trading, but traders took particular note of the sharp move in the one-year CDS.

“Bondholders are clearly taking a more doomed view than equity guys,” Benoit Soler, a high yield fund manager at Keren Finance, said.

For Filippo Alloatti, a portfolio manager at Federated Hermes, the market reaction was overblown.

“Everyone knows they need to do a significant restructuring, investors know they need to raise capital through another equity raise, so there are these dramatic developments,” he said.

On the hand, Credit Suisse has good capitalization and liquidity, he added. Its size is also in its favor. “They are a big bank so the state will step in,” he said.

Market Jitters

To be sure, most traders pinned the jump in the default risk to the widespread risk-off mood in markets, rather than a material change in the outlook for the Zurich-based lender.

“The market is concerned, people expect trouble in the short term, this is a classic inversion of the spread,” Prashant Agarwal, a portfolio manager at Pictet Asset Management who is invested in Credit Suisse cash bonds, said. “But I think in these markets fears get overblown.”

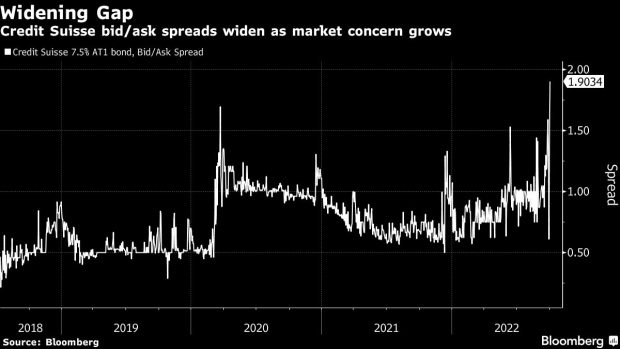

Low volume in Monday trading exacerbated the moves. Gaps between the bid-ask spreads for its bonds widened, highlighting the low level of investor demand. The bank’s August 2023 dollar bond fell the most on record.

Other traders also expressed skepticism over the significance of the price moves for Credit Suisse itself, arguing instead that the market moves are an overreaction that reflect the febrile mood among investors.

Boaz Weinstein, the chief investment officer of Saba Capital Management, wrote on Twitter that the moves on the bank’s CDS are better understood as a proxy for other risks.

©2022 Bloomberg L.P.