Mike Cagney’s Figure Technology Taps Tannenbaum as Its New CEO

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

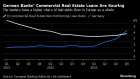

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Apr 14, 2023

, BNN Bloomberg

Repeated reports on Toronto real estate that peg the average price of a house at around $1 million prompt a necessary question: will homes ever be affordable in the Greater Toronto Area?

Housing experts told BNNBloomberg.ca it’s unlikely, with affordability poised to pose a challenge for young people for years to come, even those earning average or relatively high-paying salaries.

“I’m really concerned about this question,” Ene Underwood, chief executive officer of Habitat for Humanity’s Greater Toronto Area office.

“My answer is ‘I hope so,’ but I am very concerned as to whether it will ever be affordable.”

INCOMES VS PRICES

Underwood was a member of a task force on housing affordability set up by the Ontario government to probe the issue and offer solutions.

In their final report published in 2022, the group flagged the gap between house prices and incomes for Ontarians. House prices grew 180 per cent over a decade while incomes grew about 38 per cent over the same period, the report said.

David Amborski, another task force member who is also director of the Centre for Urban Research and Land Development at Toronto Metropolitan University, said he, too, predicts it will be “very difficult” for young people who earn solid incomes to make down payments on a $1 million mortgage.

He said it’s unlikely prices will come down dramatically. One issue is that the commonly cited solution of building more supply to mitigate long-term price increases isn’t going to drop prices in the short-term.

The gap between average incomes and house prices is also tricky to address, he added, because quickly raising wages to catch up with housing costs could have the opposite of the intended effect.

Underwood said she has seen the income versus cost gap play out in her work at Habitat for Humanity.

Since she joined the organization in 2013, Underwood said the non-profit has had to increase the incomes for clients they serve, with more people now at a median household income level rather than just low-income earners.

“I would argue the majority of our young people and newcomers need housing options that are below market,” she said.

Habitat for Humanity’s clientele include workers in health-care, education and city services, among other essential jobs, Underwood said, but people working in those crucial roles in Toronto “cannot afford housing without help.”

WHO CAN AFFORD HOMES?

Some young people are able to get into the housing market, but usually with some form of a financial leg up – including the “bank of mom and dad,” Underwood said, with help from their families.

Amborski said people can take creative paths to entering the real estate market, such as buying a cheaper property and renting it. People can also save through the new tax-free first home savings account, though with a lifetime limit of $40,000, Amborski said it “won’t get you very far.”

“There are different ways people have been able to manage, some people have, but it's not as much the norm as the exception,” Amborski said.

RENTAL COSTS

The high cost of rent in Toronto is another part of the picture.

Davelle Morrison, broker at Bosley Real Estate Ltd, simply responded “no” when asked if rent would ever be affordable to someone on an average income again.

“I don’t think that it will be,” Morrison said in an interview. She said there may be windows of time such as during the early months of COVID-19 pandemic when rent prices drop, but she expects prices will stay elevated without serious focused efforts on affordable rental supply.

“It’s going to take that sort of shock or anomaly for rents to come down, and then they're only going to come down on a brief basis and then they'll just shoot right back up again.”

Morrison said she considers a monthly rent of around $1,500 to $1,600 affordable, and she’s been “floored” to see mostly basement apartment units going for that price recently.

Expensive rent is another challenge hopeful homebuyers must contend with, because it makes it harder to save for a down payment, Amborski added.

MORE SUPPLY AND OTHER SOLUTIONS

Increasing the supply of homes has been pinpointed as a necessity to blunt Ontario’s housing crisis.

The affordability task force recommended Ontario build 1.5 million new homes in a decade to address the shortage. But Underwood noted that the ambitious goal will be challenging to reach, and it’s unclear exactly how much it will bring down prices.

“What will supply do, in terms of will it bridge that income and price gap? The answer is it’s necessary, but not sufficient,” she said.

Experts BNNBloomberg.ca spoke with said people may need to change their expectations around home ownership in order to enter the market.

That could mean looking outside the Toronto area or opting to buy a condo rather than a ground-level home, said mortgage broker Leah Zlatkin. Underwood also suggested alternative ownership models such as co-ownership and shared equity models, and more

As for rentals, Morrison said the government will ultimately need to get involved to bring down costs.

“The government needs to start building them, because they can't rely on private individuals to fix the affordable housing crisis,” she said.

With files from Daniel Johnson.