Dec 6, 2022

Winter Blast Puts Pressure on UK and Nordic Energy Systems

, Bloomberg News

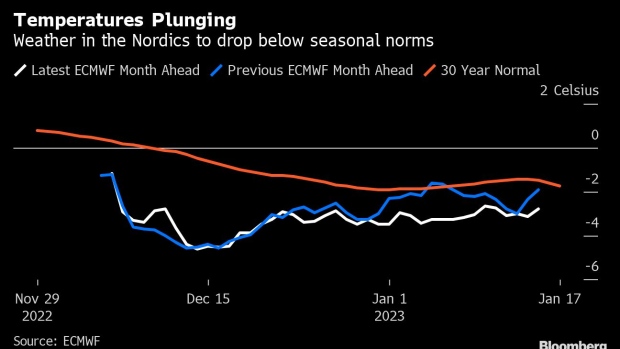

(Bloomberg) -- Northern Europe faces freezing temperatures for the next two weeks, with an expected jump in heating demand adding pressure to the region’s stretched energy systems.

Nordic countries will feel the brunt of the cold snap, with a low of -9.5C (14.9F) in Oslo expected next Tuesday, forecaster Maxar Technologies Inc. said in a report. Arctic air will also sweep across the UK and Germany, with temperatures in London sinking to 7.7C below the seasonal average on Monday.

Following a mild autumn, which allowed utilities to replenish depleted natural gas reserves, the winter’s first prolonged cold spell will test Europe’s power supplies. The frigid temperatures threaten a repeat of the price jump seen early last week, when UK hourly contracts touched €1,162 a megawatt-hour.

“There is a high probability of spiking prices during Monday morning and afternoon peak hours, both in UK and continental Europe,” said Bengt Longva, an analyst with StormGeo-Nena AS in Oslo.

Britain’s Met Office issued yellow warnings for ice this Thursday in Northern Ireland, parts of Scotland, Wales and eastern England.

Europe’s power traders have been on edge for months, with lengthy shutdowns at multiple French reactors adding strain to supplies in France and neighboring countries. Wind power generation will also play a crucial role in determining prices as winter rolls in, with calmer conditions tightening the market further.

Wind output will likely “return to relatively low levels for the year in the next couple of days, but remains higher than what we saw Monday/Tuesday last week,” said Fabian Ronningen, an analyst at Rystad Energy AS.

German wind generation is forecast to peak at 22,175 megawatts at 9 a.m. this Wednesday, but is currently just over 3,000 megawatts, according to European Energy Exchange AG data and Bloomberg models.

The cold spell won’t stretch across the whole continent, with southern Europe continuing to see unseasonably mild weather. Temperatures in Madrid are expected to hit 5.3C above normal on Tuesday next week.

- For Bloomberg’s weather functions, see WFOR and EFOR

--With assistance from Josefine Fokuhl.

(Updates with analyst comment in fourth paragraph.)

©2022 Bloomberg L.P.