Sep 7, 2022

‘Winter Is Coming,’ Taiwan Warns as Exports Slow to a Crawl

, Bloomberg News

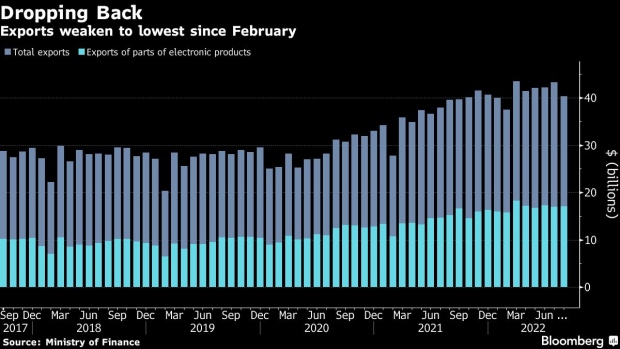

(Bloomberg) -- Taiwan’s exports grew at the slowest pace in more than two years, the latest sign that a slowdown in global demand is weighing on the economy and could cause more trade pain in the months to come.

Overseas shipments grew just 2% in August compared to a year earlier, according to a statement from the Finance Ministry in Taipei on Wednesday. That was the slowest pace of growth since July 2020, when exports expanded 0.3% as the pandemic hit.

Economists surveyed by Bloomberg had forecast an increase of 11.6%.

Imports increased 3.5% in August, compared to a 19.4% expansion in July. Economists had projected an 8.7% increase.

“Winter is coming” earlier than expected, said Beatrice Tsai, chief statistician of the Ministry of Finance at a Wednesday briefing. The ministry said it saw little chance of double-digit export growth in the third quarter, adding that September exports could even shrink by as much as 3% from a year earlier.

“While demand for integrated circuits and mineral products continued to be hot, export sales of traditional products such as plastics and base metals were sluggish due to weak end-user demand,” according to a statement from the finance ministry.

Read More: Factory Slowdown in Europe and Asia Is Warning for Global Trade

The figures came as the global economy has slowed, impacting demand and snagging trade.

“There are clearer signs showing that the tech sector has entered a downturn, driven by weakening global demand for mobile phones, PCs and other consumer electronics products, which also weighs on demand for the upstream semiconductors,” said Ma Tieying, economist at DBS Group Holdings Ltd.

Widespread Covid lockdowns in China have also threatened demand coming from Taiwan’s largest export market, as business and consumer confidence in the world’s second-largest economy struggles. Earlier data showed Taiwan’s export orders unexpectedly contracting in July, as demand from Chinese customers plunged.

The fallout continued in Wednesday’s data, which showed that Taiwan’s combined exports to China and Hong Kong fell 9.9% in August, compared with a 2.3% increase for the US, the No. 2 destination for shipments.

Earlier data released Wednesday also captured the demand issues in China, where imports grew just 0.3% in August.

Read More: China’s Economy Takes Hit From Global Slowdown as Exports Weaken

Taiwan’s trade figures are closely watched for signals that could point to a sharp decline this year in global trade, especially as other indicators have flashed warning signs about exports and manufacturing.

Taiwan’s manufacturing purchasing managers index fell to 42.7 in August, its lowest level since May 2020. There’s also been a cut in the prices Taiwanese manufacturers charged their customers, the first reduction in more than two years, according to S&P Global, as they passed on a fall in input costs in an effort to attract sales.

Geopolitical tensions also rose in August as US House Speaker Nancy Pelosi visited the island, sparking retaliatory economic sanctions from Beijing. The value of trade targeted by China’s sanctions contributes less than 1% to Taiwan’s gross domestic product, according to economists.

Taiwan officials on Wednesday said those sanctions had little impact on the trade figures.

(Updates with additional comments from Taiwan officials and more context.)

©2022 Bloomberg L.P.