Nov 21, 2018

Wiped-out hedge fund manager confesses his losses on YouTube

, Bloomberg News

It looks like the hedge-fund equivalent of a hostage video.

James Cordier, in a dark suit, cuff links and expensive-looking watch, sits in a brown leather chair and stares into a camera, his hands folded in front of him.

Then he delivers the bad news.

His voice near-breaking at times, the hedge fund manager employs nautical terms to tell his clients in a roundabout way that he’s lost all of their money -- in the neighborhood of US$150 million, according to one estimate.

In a 10-minute video posted on YouTube, Cordier says his clients are like "family." But now, blaming a "rogue wave" in the natural gas market, Cordier says he had "capsized the boat," that he had failed to "steer your investment like a boat" and was unable to keep "her afloat."

Recent gyrations in the natural gas and oil markets "likely cost me my hedge fund," he said of his Tampa-based Optionsellers.com.

The collapse is a stunning turnabout for Cordier, who literally co-authored a book on the topic, "The Complete Guide to Option Selling.” In May, perhaps foreseeing trouble, he wrote an article in Futures magazine about the perils of trading in the gas market.

‘So Sorry’

With the firm’s money lost, he names clients and acknowledges his relationship with them is fraught. He expresses regret that he won’t be joining one client in the French Riviera, that he won’t be visiting another investor on the Gold Coast of Australia to watch the sunset, that he owes yet another a Cuban sandwich.

Accounts belonging to Optionsellers.com, which specializes in writing commodities options for high net-worth investors, have been liquidated, INTL FCStone Inc., the brokerage that cleared the firm’s trades, said Monday in a statement to Bloomberg.

“I am so sorry for not managing our ship and keeping her afloat,’’ Cordier says finally.

Cordier hasn’t responded to repeated emails and calls seeking comment. Rosemary Veasey, the company’s office manager, declined to comment on its losses. The U.S. Commodity Futures Commission declined to comment on the fund.

The losses from the failure of the fund could exceed US$150 million, according to Jason T. Albin, a lawyer at ChapmanAlbin LLC, who said he’s been contacted by at least 60 clients of OptionSellers. "Everybody’s account was wiped out," he said in a telephone interview.

Moreover, he said, FCStone borrowed on margin against the accounts to cover money-losing positions. In the end, the clients didn’t just lose all their all their money, they also now owe FCStone for the loans, he said.

Extreme Moves

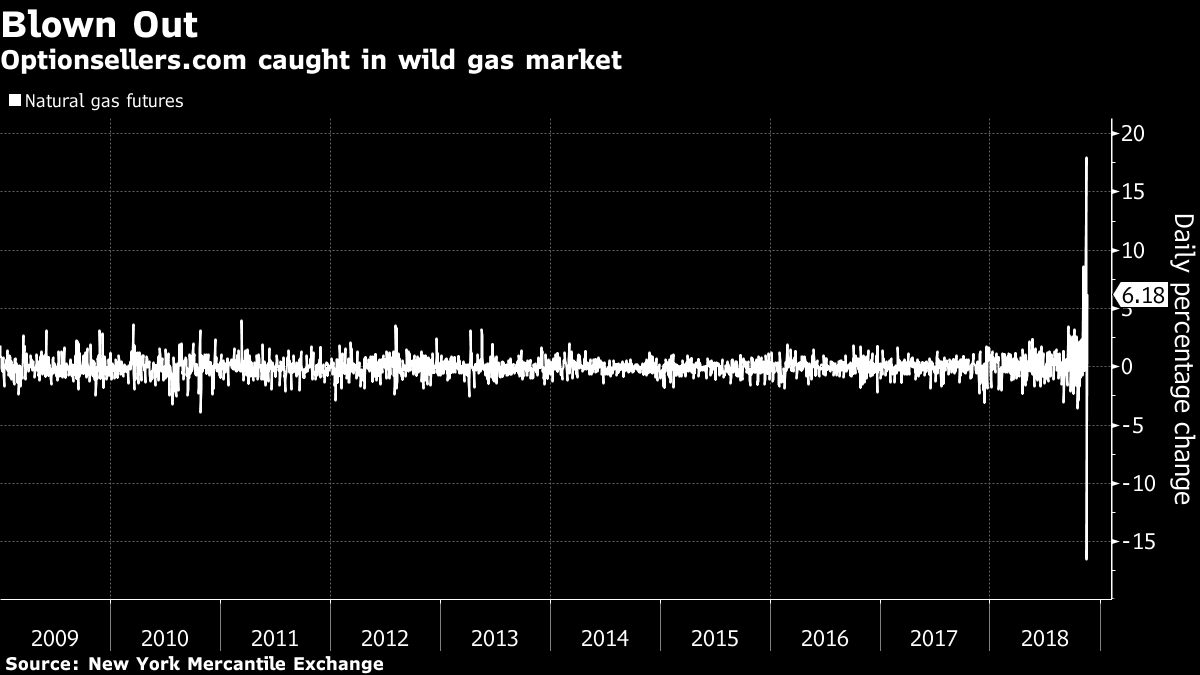

The price moves in energy markets were extreme by almost any measure.

Oil prices slumped on Nov. 13 by the most in three years on a weaker demand outlook. The next day, U.S. natural gas futures jumped as much as 20 per cent for their biggest intraday gain in eight years amid concern that winter weather will be colder than previously expected. Stockpiles of the heating fuel have fallen to a 15-year seasonal low.

The swings in gas were some of the biggest since the shale boom started a little over a decade ago, with some traders comparing the turmoil to the aftermath of the 2006 blow-up of hedge fund Amaranth Advisors LLC. The so-called widowmaker spread in natural gas, the difference between March and April gas futures contracts, blew out to as much as US$1.75 per million British thermal units from about 30 cents just a week earlier. Gas prices then posted a record decline on Nymex on Nov. 15.

FCStone said the volatility in gas "caused liquidity stress for our U.S. Futures Commission Merchant customers both on the commercial and institutional side," but that its commercial customers have met their margin calls.

"Although well collateralized, accounts managed by a Commodities Trading Advisor, Optionsellers.com, had to be liquidated as a result of these moves," FCStone said.

Optionsellers.com’s Cordier wrote in his Futures magazine article about the perils of trading in the gas market.

“Natural gas is a tough market to call in the short term," he said. "Weather forecasts can bring public speculators to the market in mass, causing wild daily fluctuations, especially during the winter months. This makes pure gas futures trades risky.”