Feb 26, 2021

Wirecard Regulator Pursued Critics After a Probe Found Nothing

, Bloomberg News

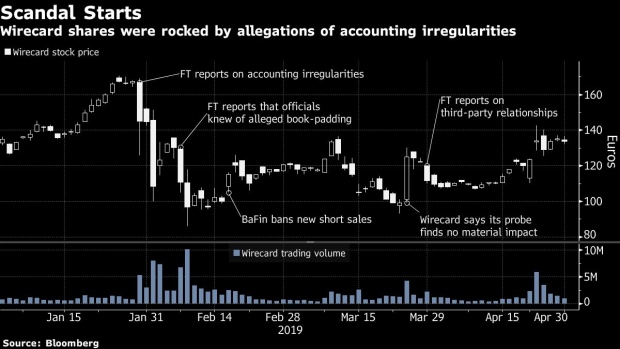

(Bloomberg) -- Germany’s financial regulator pursued criminal complaints over alleged manipulation of Wirecard AG shares even after a review of more than half of the overall trading volume found no clear evidence of wrongdoing.

BaFin issued the complaints against short sellers and Financial Times journalists in April 2019, almost two months after the probe by a surveillance unit at the payment company’s main exchange in Frankfurt. It’s not clear why the regulator chose to pursue the complaints, although it does have access to more trading information.

The report examined trading of stocks, options and certificates on Deutsche Boerse AG’s Xetra Classic, Xetra Frankfurt and Eurex, according to a copy seen by Bloomberg. Together, the three platforms accounted for about 59% of Wirecard share trading in 2019, data compiled by Bloomberg shows.

The regulator sees more trading data than what was included in the report, according to a spokeswoman for BaFin. It has a lower threshold for notifications on short positions and access to reports of suspicious trading activities on exchanges outside Germany, she said, declining to specify the information that led to the complaints.

Wirecard collapsed in June last year after saying that 1.9 billion euros ($2.3 billion) in cash probably never existed, sparking a parliamentary inquiry into how BaFin and other authorities handled one of the country’s biggest-ever corporate scandals. At issue is why the regulator took actions that benefited the member of Germany’s benchmark DAX Index, but failed to detect the fraud after multiple warnings.

Officials from BaFin are scheduled to testify to the German parliament’s investigating committee on Friday.

The legal fallout is still unfolding. Former Chief Executive Officer Markus Braun has been in a jail since last year awaiting trial. The probe into short sellers by prosecutors in Munich remains open, while the case against FT journalists has since been dropped.

It emerged on Wednesday that Frankfurt prosecutors visited BaFin’s offices in Bonn to follow up on criminal complaints into staff responsible for overseeing the Wirecard scandal.

Joined by federal police in an unusual show of force, they submitted a letter requesting information as they look into whether to open a probe over the regulator’s handling of Wirecard and allegations it didn’t do enough to prevent insider trading among its staff.

The surveillance unit at the Frankfurt exchange began its review shortly after the FT published stories critical of the company in early 2019, which whipsawed the stock.

The pursuit of Wirecard critics wasn’t the only example of BaFin actions that were at odds with other authorities. The regulator, whose president announced his resignation last month, banned short selling of Wirecard shares in February 2019, even though the Bundesbank had said it wasn’t needed for financial stability. BaFin said it was aimed at preserving “market integrity.”

Internal documents of the German parliament’s investigation committee also show that BaFin inquired about a possible trading ban for Wirecard shares in February 2019, but was advised against such a move by the Frankfurt stock exchange’s surveillance unit.

“BaFin wanted the ban on short sales no matter what,” said Danyal Bayaz, a member of the parliamentary committee from the Green party. “We think the short-sale ban was illegal. As the legal supervisor, the finance ministry bears responsibility here and should have reviewed the action and intervened.”

Finance Minister Olaf Scholz, the Social Democratic party’s candidate for chancellor in September’s elections, is set to face the committee’s questions in the coming months. He’s said he will strengthen BaFin by hiring more people and create a task force for forensic probes and investigations into accounting fraud.

©2021 Bloomberg L.P.