Sep 12, 2021

With Economies on the Brink, Southeast Asia Chooses to Reopen

, Bloomberg News

(Bloomberg) -- Even as they struggle with one of the world’s worst Covid-19 outbreaks, nations across Southeast Asia are slowly realizing that they can no longer afford the economy-crippling restrictions needed to squash it.

On the factory floors of Vietnam and Malaysia, in the barbershops of Manila or office towers of Singapore, regulators are pushing forward with plans to reopen, seeking to balance containing the virus with keeping people and money moving. That’s leading to a range of experiments including military-delivered food, sequestered workers, micro-lockdowns and vaccinated-only access to restaurants and offices.

In contrast to Europe and the U.S., which have already moved down the reopening path, the region’s low vaccination rates leave it among the world’s most vulnerable to the delta variant. But with state finances stretched by previous rounds of stimulus and dwindling monetary policy firepower, lockdowns are becoming less tenable by the day.

“It’s a tricky balance between lives and livelihoods,” said Krystal Tan, Australia & New Zealand Banking Group Ltd. economist, noting that even Singapore has struggled with infection spikes despite having a world-leading vaccination rate. The risks of stop-start re-openings are higher in the rest of the region, where coverage is considerably lower, Tan said.

Southeast Asia’s factory shutdowns have rippled across the world to create supply chain hiccups, with automakers including Toyota Motor Corp. slashing production and clothing retailer Abercrombie & Fitch Co. warning the situation is “out of control.”

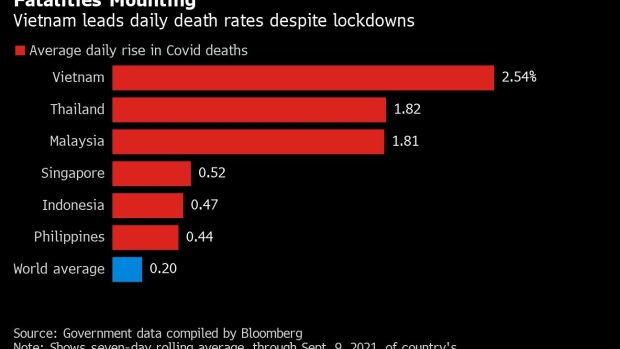

The daily death rate in many Southeast Asian countries has surpassed the global average, helping push them to bottom spots of the Bloomberg’s Covid Resilience Ranking.

Yet officials are increasingly worried about what it means economically if restrictions linger too long despite slow inoculations. Malaysia cut its 2021 growth forecast in half to 3%-4% as daily cases hit records. Thailand’s hoped-for rebound on a critical tourism revival is swiftly vanishing.

‘Pipe Dream’

Even where the outlook appears impressive -- Vietnam is set to grow 6% this year and Singapore officials see theirs as high as 7% -- there’s increasing pressure to address global supply-chain blockages and to avoid dampening foreign investor appetite for the dynamic region.

According to Oversea-Chinese Banking Corp. economist Wellian Wiranto, Southeast Asian nations are being worn down both by the economic costs from successive rounds of lockdowns and an increasing sense of exhaustion among their populations as the crisis drags on.

“Any hope of a broad border reopening that can facilitate trade and tourism flow across various Asean countries is going to remain a distant pipe dream,” Wiranto said.

When it comes to impacts on global supply chains, the stakes have been among the highest in Vietnam, where increasingly stringent lockdowns have exacted a high cost for manufacturers and exporters while failing to halt delta’s spread.

Read more: Tangled Vietnam Supply Chain Highlights Threat to Global Economy

The country’s trade ministry warned this month that it risks losing overseas customers because of tough restrictions that have shuttered factories. The European Chamber of Commerce in Vietnam estimated that 18% of its members have relocated part of their production to other countries to ensure their supply chains are protected, with more expected to follow.

Endemic Shift

Patience among the public is wearing thin across the region, especially as they’ve battled the virus for longer than most of the world. In Malaysia, the social angst helped force regime change after extended lockdowns fueled job losses but failed to reduce cases.

Street protests against the Thai government that predate Covid have evolved into pandemic-related rallies. The plight of the working poor in Vietnam -- away from promising middle-class jobs for multinational companies -- is increasing pressure on the government to re-open.

In Singapore and the Philippines, businesses are becoming more vocal about difficulties in long-term planning due to the lack of certainty around government policies.

As a result, there is now a growing shift in Southeast Asia to treat Covid-19 as endemic, with the likes of Malaysia, Indonesia and Thailand emulating Singapore’s strategy to learn to “live with the virus.”

Indonesia, the region’s biggest economy, is focused on the long game. Ministers are attempting to cement rules like a years-long mask mandate rather than implementing on-and-off mobility curbs. They’re also rolling out “road maps” for specific areas like offices and schools in order to outline more permanent rules in the new normal.

Reporting the number of daily cases is now becoming less important than their severity. This is especially true for the two most-vaccinated in Southeast Asia -- Singapore, which ranks among the world’s best above 80%, and Malaysia, with about half the population fully inoculated.

Targeted Lockdowns

In place of national or regional lockdowns, the Philippines is looking to apply mobility curbs in more targeted zones -- down to the street or even house. Vietnam, too, is testing this strategy, with Hanoi instituting travel checkpoints as officials vary restrictions based on virus risk in different areas of the city.

Only those with vaccine cards can enter malls and places of worship in Jakarta, or head to the cinemas in Malaysia. Restaurants in Singapore are required to check the vacciation status of diners. In Manila, officials are considering “vaccine bubbles” for workplaces and public transport.

While this strategy may reduce the damage to the broader economy, the risk is that an unequal distribution of vaccines -- in Malaysia, for instance, to economically vital states rather than poorer areas -- may unfairly disadvantage lower-income residents.

©2021 Bloomberg L.P.