Oct 20, 2021

World’s Appetite for Treats Is Tightening Sugar Market

, Bloomberg News

(Bloomberg) -- The world is coming back to sweets and desserts as more lockdowns ease, especially in emerging nations, and it’s causing a spike in prices for short-term refined sugar supplies.

Nations from Pakistan to Sudan are buying on world markets again after a long period of absence. That’s tightening supply, and recently drove the December white sugar contract in London to a record premium over March futures.

Sugar prices are trading near a four-year high after frosts and drought hurt output in Brazil, the top producer, and on uncertainty over Indian exports. Higher costs for securing near-term supplies could add to global concerns over food inflation following other rallies in agricultural commodities from wheat to coffee.

“We feel that there is a bounce in the demand which is materializing in the London market,” Wilmar International Ltd. head of analysis Karim Salamon said at the S&P Global Platts European Sugar Conference on Tuesday, citing spreads.

White sugar for December delivery traded at $501.30 a ton in London on Wednesday. Its premium over March futures was at $6.60, and reached $9.40 on Monday, the highest since the spread started.

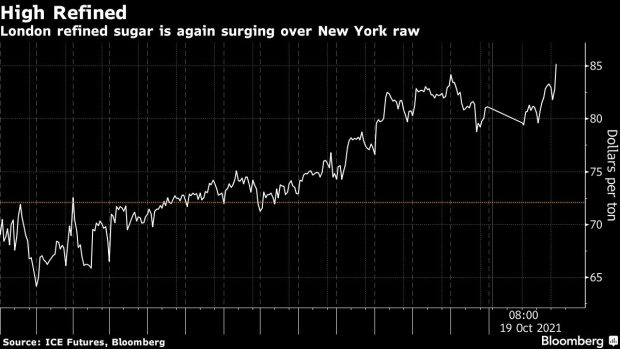

Refined sugar has in recent weeks outperformed raw futures in New York, where prices have come under pressure partly due to improved prospects for Brazilian production.

Emerging markets have been suffering from tight credit, so now “those markets are now slowly coming back, in part because their stocks have been drawn down and they need them back,” ED&F Man’s head of commodities research, Kona Haque, said at the conference.

Europe is another importer seeing renewed, post-lockdown demand for sugar.

The EU is “absorbing the rally in the world market,” and local prices are rising to meet that of imports, said Daniel Kerkhof, president of the European Association of Sugar Traders.

(Updates with spreads and price from fifth paragraph. An earlier version corrected the name of Wilmar analyst in fourth paragraph.)

©2021 Bloomberg L.P.