Jan 31, 2023

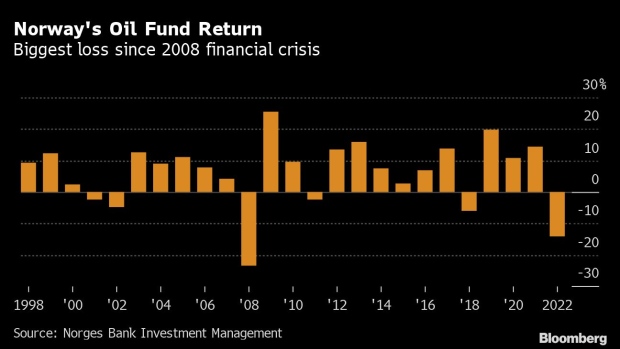

World’s Biggest Stock Holder Returns Slide 14%, Most Since 2008

, Bloomberg News

(Bloomberg) -- Norway’s $1.3 trillion sovereign wealth fund reported its biggest loss since the 2008 financial crisis after markets were pummeled by faster inflation, higher credit costs and the fallout from the war in Ukraine.

The fund that manages Norway’s fossil wealth lost 14.1% in 2022, equivalent to about $164 billion, according to a statement on Tuesday. It’s the world’s biggest single owner of equities, and its returns are highly dependent on market movements.

Chief Executive Officer Nicolai Tangen has spent the past year warning that the fund’s growth over the last 25 years isn’t likely to continue in an environment of rising borrowing costs and soaring inflation that have brought equities down from all-time highs.

“We are now in a very different situation,” Tangen said in a Bloomberg TV interview. “You are seeing a reversal of globalization, you’re seeing rates having moved up and it’s of course very unclear where they’re going from here. So returns going forward will be different.”

Established in the 1990s to invest Norway’s oil riches, the fund has a long-term investment horizon and has achieved an average return of 6% over the quarter of a century during which it’s existed.

Generating excess return in falling markets is key, Tangen has said. The fund managed that last year, outperforming the benchmark against which it measures itself.

Last year, Norges Bank Investment Management lost 15.3% on stocks, with all the sectors declining except energy, and shed 12.1% on its fixed-income investments. Its unlisted real estate holdings edged up 0.1%, while the return on unlisted renewable-energy infrastructure was 5.1%.

The fund is largely an index-tracker, investing according to a strict mandate from the Finance Ministry. It seeks to make the most of its limited leeway to try to beat the benchmark it is measured against, something it has managed in eight of the last 10 years.

After forecasting in 2021 that inflation would become the biggest threat to capital markets, NBIM deployed under-weighting equities, bond duration and credit, and overweighting of integrated energy and mining companies in its stock portfolio. That bet helped it beat its benchmark by 0.74 percentage points in 2021 and by 0.88 percentage points in 2022.

“It’s very, very important for a very large fund like this to be quite index-near because the thing is, if you are too far away from the index and you make big mistakes, the losses are going to be so big that nobody’s ever going to keep their job,” Tangen said in the TV interview. “It needs to be anchored with politicians and in the parliament.”

Tangen has beefed up the fund’s stocks team in preparation for a prolonged downturn and in December unveiled a three-year plan to stem its losses. The key to beating the benchmark will be to “drive the fund to become more long-term, more contrarian and more active on the negative selection,” he said then.

Looking to spend Norway’s oil and gas proceeds to fuel a green transition, the fund is considering investments in renewable energy storage and transmission going forward, expanding the range of renewable infrastructure it is willing to hold. It has acknowledged that’s a competitive space.

Last year, NBIM cut its holdings in the world’s biggest oil and gas companies, taking profits after a run up in energy prices in 2022. It bought big technology companies and pharmaceuticals, and added to the stakes in the four property companies where it has the biggest absolute positions among real estate stocks as the markets fell.

The fund has also recommended looking at adding unlisted equities in the longer term to boost returns. While the fund isn’t currently permitted to make such investments, “we’re seeing more and more indications that a larger share of value creation is taking place in the unlisted market,” it said in a letter to the Finance Ministry that was made public earlier this year.

The government deposited 1.1 trillion kroner ($110 billion) into the fund last year.

--With assistance from Rob Dawson, Tom Keene, Jonathan Ferro and Lisa Abramowicz.

(Updates with Tangen quotes from Bloomberg TV interview.)

©2023 Bloomberg L.P.