Jun 2, 2020

World’s Hottest Bond Market Fueled by RBA’s Big No to Below Zero

, Bloomberg News

(Bloomberg) -- The Reserve Bank of Australia’s refusal to entertain the prospect of negative interest rates is making the country one of the hottest destinations for global bond managers.

The central bank’s reluctance to contemplate life below zero is helping set it apart from developed-market peers, drawing the likes of PGIM Inc. and JPMorgan Asset Management to the $482 billion sovereign bond market. Australia’s 10-year bond yield discount to Treasuries flipped to a premium in March as the Federal Reserve slashed borrowing costs, spurring bets U.S. rates would turn negative next year.

Australian bonds are “competitively well supported and they represent a good storehouse of value that requires less of a leap of faith than most developed markets” to invest in right now, said Robert Tipp, head of global bonds and chief investment strategist at PGIM Fixed Income, which oversees $868 billion. Investors should consider going “long Australia on a core basis.”

A gauge of Australian bonds is the best-performing among Group-of-10 peer equivalents, showing a 9% total return for the second quarter to June 1, according to Bloomberg Barclays indexes.

Anchoring demand for Australian bonds is the RBA’s pledge to maintain benchmark three-year yields at the 0.25% cash rate. That’s in stark contrast to regional neighbors New Zealand, where the central bank is openly discussing the possibility of negative rates and Japan where they have been below zero since 2016.

“QE measures and the RBA’s posturing on negative rates are helping to keep yields positive and that could be attractive for some,” said Raymond Lee, a money manager at Kapstream Capital who is long three-year Aussie bonds as a hedge for riskier credit bets. “Australia has a yield advantage compared to places like New Zealand which is open to the idea of negative rates, or even the U.S. where the Fed is keeping yields low.”

Yield Appeal

The RBA’s yield control may be particularly attractive to investors cornered by $11.7 trillion of negative-yielding debt, according to John Vail, chief global strategist of Nikko Asset Management Co. in Tokyo.

“In a way, yield-curve control represents almost unlimited firepower,” said Vail. “It can be a lot less disruptive to the banking systems and even to the exchange rate compared to other tools such as negative rates -- some people will be drawn to that.”

Australian bonds stand out particularly against New Zealand where swap markets started pricing the chance of negative rates in 2021.

“Australia’s long-end offers some value,” said Kaspar Hense, portfolio manager at BlueBay Asset Management in London. “There’s not much room for investors to move especially in small, AAA-rated countries while looking for yield.”

Foreign investors own over 50% of Australian sovereign debt, and there are signs demand is rebounding after a record sell-off in the first quarter during the worst of the virus-induced market panic.

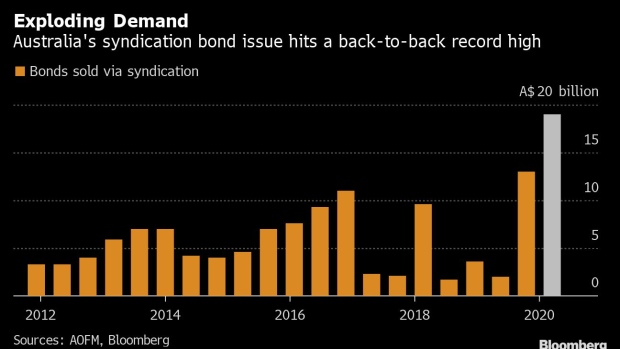

Japanese investors snapped up a net 107.9 billion yen ($1 billion) of long-term Aussie debt in March to mark their biggest purchase since June 2019. In May, Australia sold A$19 billion of bonds, a second record-breaking deal in two months as the government seeks to fund a A$130 billion stimulus package.

Trade Risk

To be sure, not everyone is convinced Australian securities present the best bang for their buck.

The country’s economic fortunes remain closely tied to China and brewing tensions between the two nations may see Aussie assets come under pressure, according to Brandywine Global Investment Management. As Australia leads calls for a probe into the origin of the coronavirus, volatility could rise and spur fresh sell-offs, said Jack McIntyre, portfolio manager in Philadelphia.

“I do worry that Australia is poking the China bear,” he said. “They are at the front-line of U.S.-China tensions as well.”

It’s a coin toss on how Aussie assets will perform if the tensions reach boiling point, according to Kapstream’s Lee.

“China is Australia’s biggest trading partner and if it affects fundamentals here, that would have an impact on rates,” Sydney-based Lee said. “Ultimately though I think a lot will depend on what’s happening between the U.S. and China -- risk-off sessions could lead to bids in Treasuries and benefit Australia.”

©2020 Bloomberg L.P.