Jun 14, 2018

World's largest gold ETF is getting a cheaper little brother

, Bloomberg News

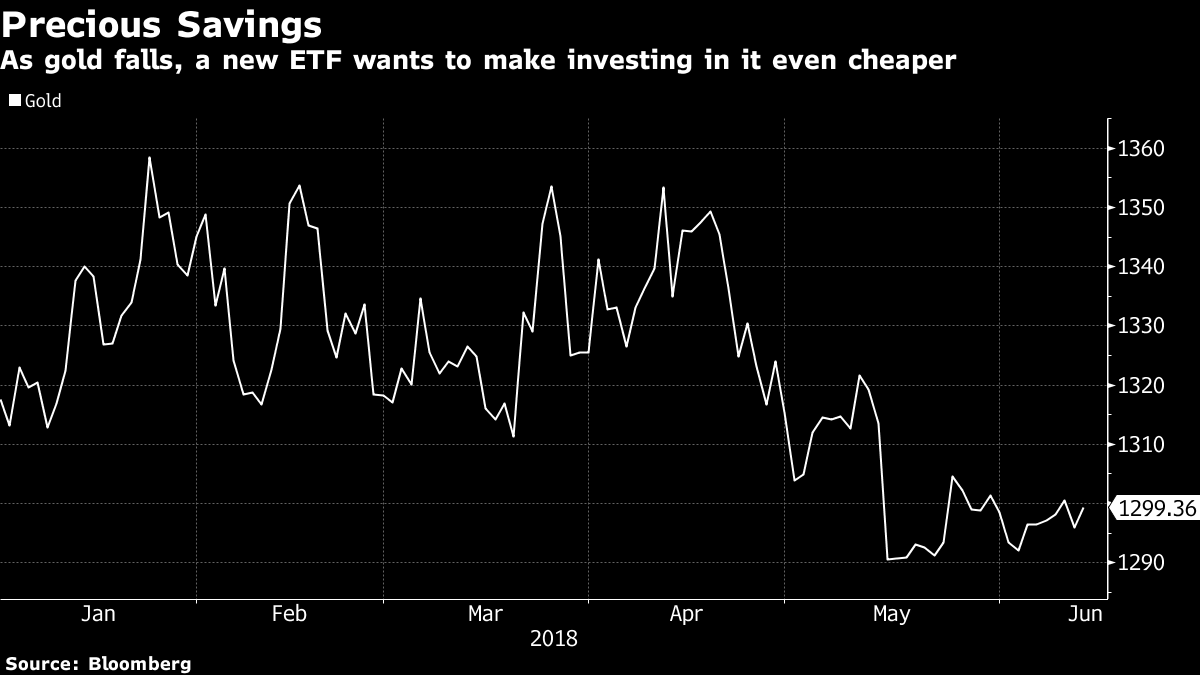

The price of gold is falling, at least for investors in exchange-traded funds.

The World Gold Council is readying a new fund that will charge less than any other gold ETF, regulatory filings show. It will vie for assets with 35 other precious-metals exchange-traded products in the U.S., including SPDR Gold Shares -- known by its ticker GLD -- the US$35 billion market leader, which the council also started.

Despite gold’s recent slump amid higher interest rates, enthusiasm for the commodity as both a trading instrument and a store of value has been strong this year. Trading in GLD soared during February’s volatility as investors sought to bet on, or hedge against, markets heading south. A rival fund from BlackRock Inc., meanwhile, took in more than $700 million in both January and April, the most for any month in two years, Bloomberg data show.

The gold spot price has risen less than 0.1 per cent this year. The metal was trading at US$1,304.47 an ounce as of 9:25 a.m. in New York.

Investors will soon be able to get a piece of that action for a lower price. The SPDR Gold MiniShares Trust, which will trade as GLDM, will cost just 18 basis points in management fees, or US$1.80 for every US$1,000 invested, the filings show. By comparison, GLD charges US$4 for every US$1,000 invested.

The fund will also start trading with a significantly lower share price than GLD, allowing investors to buy in smaller increments, the documents show.

GLDM’s shares will start trading at around US$12.98, the filings suggest, versus about US$123 for the older fund. That would put GLDM on a par with BlackRock’s iShares Gold Trust, which trades at US$12.47 per share. However, it charges US$2.50 for every US$1,000 invested.

--With assistance from Luzi Ann Javier