Nov 9, 2021

Worst Is Over for Indonesia’s Growth as Consumers Head to Malls

, Bloomberg News

(Bloomberg) -- Indonesia will likely catch up on growth in the fourth quarter as its all-important consumption engine returns to high gear.

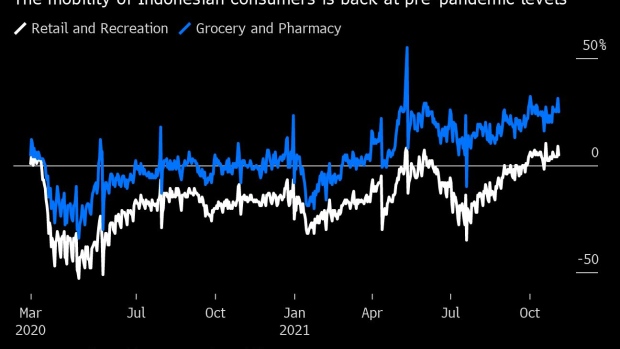

More Indonesians are venturing outside to malls and supermarkets as a sharp decline in Covid-19 cases lets the government ease movement restrictions. Traffic in retail and recreation areas has largely returned to pre-pandemic levels, while mobility in groceries and pharmacies have rebounded well beyond that, according to Google data.

Other indicators show a similar picture. Consumer confidence is at its highest level since March 2020 and businesses are optimistic of holiday spending in the coming months. Retail sales are expected to have jumped 5% in October, which would be the most in five months. That should boost Southeast Asia’s largest economy, which derives over half its gross domestic product from private consumption.

The “worst is over” after Indonesia’s GDP growth tempered to 3.5% in the third quarter due to lockdowns, said Australia & New Zealand Banking Group economists Krystal Tan and Sanjay Mathur. The economy will likely expand 4.9% this quarter as “widespread vaccination restores public confidence and paves the way for a stronger recovery.”

Here’s what analysts say:

Enrico Tanuwidjaja and Yari Mayaseti, economists at PT Bank UOB Indonesia

- Indonesia will steadily reopen as Covid-19 cases decline and key economic centers are mostly vaccinated

- Household consumption should grow 2.5% this year on subdued inflation

- Along with the exports boom and an investment rebound, 2021 GDP growth seen at 3.5%-3.7%

David Sumual, chief economist at PT Bank Central Asia

- Rebound in transactions in the last two months shows pent-up demand, so consumption should rally further as Indonesia enters peak online shopping season in November and December

- 2021 GDP growth is estimated at 4%, in line with the government target

Helmi Arman, economist at Citigroup Inc.

- Indonesians are likely to unleash their recovering purchasing power in early 2022 as the services sector returns to normal and workers return to large cities from villages

- Consumption recovery could be followed by an increase in corporate capital spending, boosting 2022 GDP growth toward 5%

Brian Tan, economist at Barclays Plc in Singapore

- Bank Indonesia will likely maintain its “pro-growth” stance then hike rates by 25 basis points in the second half of next year

- The central bank could be forced to raise rates earlier if a more hawkish Federal Reserve leads to a substantial depreciation of the rupiah

©2021 Bloomberg L.P.