May 23, 2019

Wrangler Jeans Are Headed to China

, Bloomberg News

(Bloomberg) -- Kontoor Brands Inc., whose Lee line is already the biggest denim brand in China, plans to bring its other big American jeans name to the world’s largest consumer market within a year.

“In January 2020, we are introducing Wrangler to the Chinese market because there’s an appetite,” Chief Executive Officer Scott Baxter said in an interview on Bloomberg Television. “The global consumer now shops all around the globe and wants to bring that product back into the marketplace, but they also want to have that product available for them” at home.

Kontoor, which officially started trading Thursday on the New York Stock Exchange after splitting off from VF Corp., is expanding in China at a precarious moment in U.S.-China relations as the trade war between the two countries escalates. However, Baxter says he’s not worried and has seen no pushback from there.

The spinoff was intended to help Vans and North Face owner VF pivot away from denim to focus on faster-growing trends such as athleisure and outdoor apparel. Shares of Kontoor fell as much as 9.3% Thursday on a day when the wider S&P 500 index was down about 1.3%. VF Corp. was little changed.

Stretchy Pants

The Kontoor spinoff comes at a potentially challenging time. Kontoor joins an increasingly crowded market: Rival Levi Strauss & Co. went public earlier this year, and both Old Navy and J. Crew’s Madewell -- two denim-centric chains -- are planning IPOs. Meanwhile, Diesel USA Inc., known for its popular five-pocket jeans, filed for Chapter 11 in March.

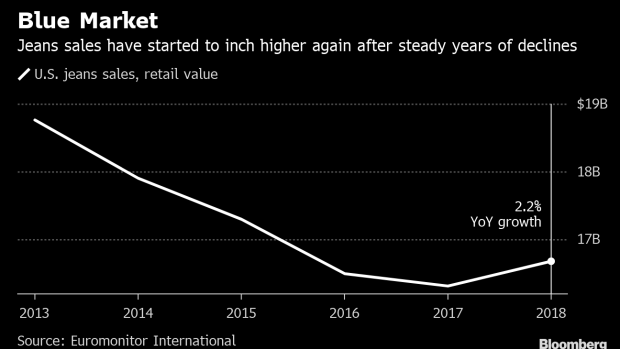

U.S. imports of elastic knit pants surpassed those of denim for the first time in 2017, with the American jeans category growing an anemic 2.2% last year after four straight years of declines. Still, Kontoor’s jeans brands have been leaning into the trend by adding things like athletic waistbands to some of its men’s denim and casual pants to compete with the soaring athleisure sector, Baxter said.

In addition to letting Kontoor focus on growing globally, the separation will give the company room to expand in digital sales and mull other apparel acquisitions beyond the denim space, Baxter said.

“We don’t want to be over the long term just a denim company going forward. Now we have the ability with the Kontoor name to be anything in the apparel space as we consider acquisitions in the future,” he said, declining to elaborate on what kinds of companies it may look to buy.

Envious Tariff Position

Meanwhile, as retailers around the U.S. brace for tariff hits, the company says it’s pretty well positioned. Baxter said only 2% of its production comes from China, primarily on the accessories side, after it moved most of its output outside of the country years ago to places including Bangladesh and countries outside of Asia.

“We produce and manufacture 38% of all our products in the Western Hemisphere, so that gives us a real advantage for speed, for quality and also the flow of new innovation into our product,” he said. “So we feel pretty lucky and feel pretty good about where we are from a sourcing standpoint.”

To contact the reporters on this story: Taylor Riggs in New York at triggs2@bloomberg.net;Anne Riley Moffat in New York at ariley17@bloomberg.net

To contact the editors responsible for this story: Crayton Harrison at tharrison5@bloomberg.net, Lisa Wolfson

©2019 Bloomberg L.P.