May 10, 2022

Yellen Cites UST Breakdown While Calling for Stablecoin Rules

, Bloomberg News

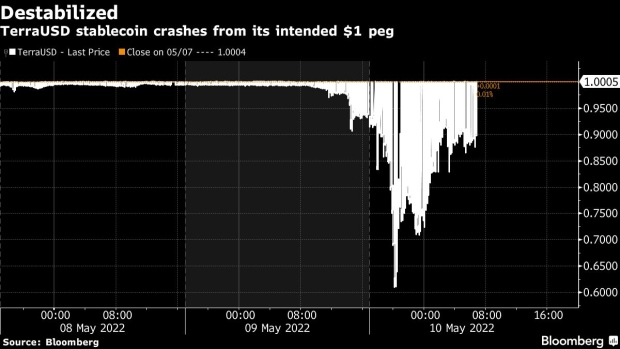

(Bloomberg) -- Treasury Secretary Janet Yellen said the de-pegging of TerraUSD shows the urgency to have a regulatory framework on stablecoins, which aim to minimize the volatile price swings seen in most cryptocurrencies.

“A stablecoin known as TerraUSD experienced a run and had declined in value,” Yellen said during testimony before the Senate Banking, Housing and Urban Affairs Committee on Tuesday. “I think that simply illustrates that this is a rapidly growing product and that there are risks to financial stability and we need a framework that’s appropriate.”

Her response was to a question by Senator Pat Toomey, the top Republican on the Banking Committee, on the urgency to pass a regulatory framework for the stablecoin sector. She said it would be “highly appropriate” to aim for passing a legislation this year.

Yellen reiterated that the current regulatory framework does not provide “consistent” and comprehensive standards to the risks of stablecoins as a new type of payment product.

TerraUSD, or UST, is an algorithmic stablecoin that’s supposed to work like its centralized counterparts like Tether or USD Coin. But instead of maintaining a constant price, its value plummeted far below $1 since Saturday as all of the mechanisms to maintain its value stopped working.

The Federal Reserve also warned of the financial risks posed by stablecoins, saying they are “vulnerable to runs.” In its semi-annual Financial Stability Report published Monday, it said the increasing use of stablecoins to meet margin requirements in leveraged crypto trades may heighten redemption risks.

Stablecoins are an important part of the digital-asset space. Crypto traders use them as a place to park their money to avoid wild swings in crypto in lieu of regular dollars. Stablecoins are also used for day-to-day payments by many people around the world. The biggest stablecoins by market value are Tether, USD Coin, Binance USD, and UST.

©2022 Bloomberg L.P.