Feb 27, 2023

Yen Bulls Stymied by Relentless Japanese Demand for Foreign Debt

, Bloomberg News

(Bloomberg) -- Japanese investors are loading up on overseas debt, a trend that stands to keep yen bulls on the sidelines.

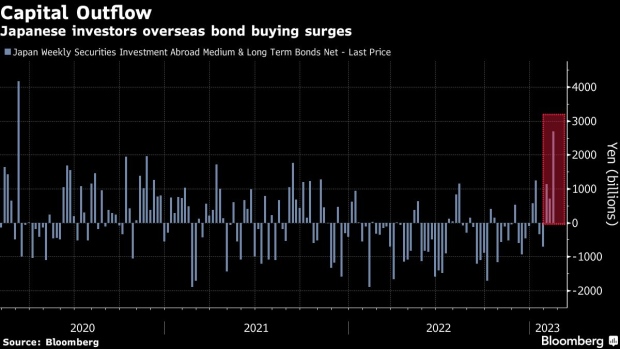

Asset managers in Japan bought a net ¥2.7 trillion ($19.8 billion) of overseas debt in the week ending Feb. 17, according to a Friday release. That’s the largest net outflow of capital from Japan since Covid shocked global markets in March 2020 and about twenty times the average weekly drain over the past decade.

The buying follows a record amount of overseas debt sales by Japanese investors last year, a likely contributor to yen volatility in 2022. Money managers in the Asian nation cut holdings of foreign fixed-income securities by ¥23.8 trillion ($181 billion) over the period, according to balance-of-payments data published by the Ministry of Finance.

Japanese investors may also be driven to buy foreign debt on an unhedged basis due to the prohibitively high cost of safeguarding against currency swings.

Read: What We Learned About Bank of Japan Nominee Ueda From Hearings

The cost of a three-month currency hedge is over 5% for dollar exposures and 3% for euro ones — and they’re likely to stay high for some time. Bank of Japan Governor nominee Kazuo Ueda said it was appropriate to keep monetary easing until there is an improvement in the price trend. By contrast, the Federal Reserve is seen lifting policy rates at least three more time and holding them above 5%.

In the meantime, February’s outflows are outpacing any month on record. This helps explain why analysts have scaled back their bullish yen calls, with Morgan Stanley switching to a bearish stance on the Japanese currency.

©2023 Bloomberg L.P.