May 31, 2023

Yen Intervention Warnings Are Early, Focus Still on Pace of Drop

, Bloomberg News

(Bloomberg) -- Warnings of official intervention may have come earlier than some yen watchers expected, but just like last year they are focusing on the pace of declines in the Japanese currency rather than any specific levels.

A breach of the closely-watched 140 per dollar level seems to have pushed officials to get ahead of speculation of government action by holding an unscheduled meeting Tuesday. Last year, it was a move toward 146 that triggered Japan’s first intervention since 1998, though in the build up to that there were repeated official comments warning direct action was possible.

Strategists were quick to highlight the different environment now with last September when the currency was down more than 20% on the year and facing into an abyss. While the Bank of Japan’s super-easy monetary policy continues to weigh, with higher interest rates abroad favoring the likes of the dollar and euro, the country’s trade deficit is less of a drag and factors like higher tourism arrivals will offer some support.

“Last year’s experience suggests to us that we can’t rule out of the possibility of an intervention depending on the speed of yen depreciation or exchange rate levels,” said Shusuke Yamada, head of Japan currency and rates strategy at Bank of America in Tokyo. However, “with oil prices stabilizing, wages rising and foreign tourists returning, the cost-benefit calculus for a weaker yen has been improving, so there may not be much urgency.”

On Tuesday, a top currency official said the government would take action if needed on the weakening yen, in comments after the first three-way meeting between the Ministry of Finance, Bank of Japan and Financial Services Agency since March. That followed a warning from Finance Minister Shunichi Suzuki on May 26, a day after the yen dropped past 140 per dollar for the first time since November.

“The authorities probably don’t have a line in the sand, but market participants may eye a level of 145 because intervention happened near 146 in September,” said Takuya Kanda, general manager at Gaitame.com Research Institute Ltd. “As the top MOF currency official said, the important thing here is the speed and the depth of fluctuation and the recent moves such as about 1 yen or less per day should be seen as in line with fundamentals, not providing a justification for intervention.”

There are some benefits for Japan’s economy from a weaker currency as it would help goals like a recently increased target of ¥100 trillion ($715 billion) in inward foreign direct investment by 2030. The stock market is also benefiting with the Topix index reaching its highest since 1990 this month while official data showed more than 1.9 million foreigners visited the Asian nation in April, around two-thirds of pre-Covid levels.

“The weaker yen seems to bring benefits like the stronger performance of equities and help with inbound tourism and Japan’s attempt to invite foreign investment, while its decline is more gradual than last year,” said Daisuke Uno, chief strategist at Sumitomo Mitsui Banking Corp. “It was within expectation that verbal intervention begins at around 140 like last year, but the situation this year is different.”

Uno sees little chance of intervention until last year’s low of 151.95 per dollar is breached. The Japanese currency traded around 139.75 on Wednesday, down about 6% year-to-date.

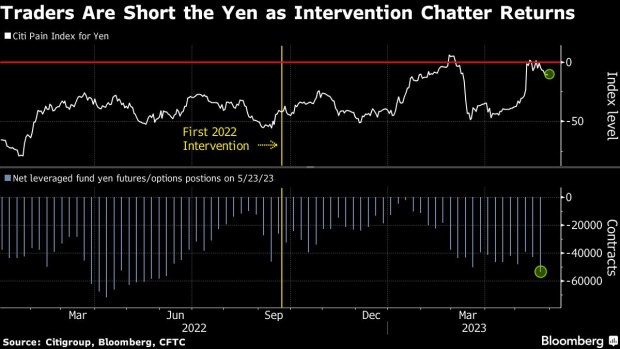

Hedge funds hold more bearish bets on the yen than they did at the time of September’s intervention, according to the latest data from the Commodity Futures Trading Commission. However, a gauge of overall trader positioning from Citigroup Inc. shows bearish wagers are less extreme.

That could tempt more bets on the yen weakness continuing, not least because BOJ Governor Kazuo Ueda has maintained a dovish tone and repeatedly said he will keep monetary easing to achieve an inflation target of 2%.

“In the short term, the dollar-yen may remain on an uptrend as the real interest rate has continued to fall in Japan and the BOJ remains dovish,” said Teppei Ino, the Tokyo head of global markets research at MUFG Bank Ltd. “It is hard to see the yen’s rebound until the BOJ takes action on monetary policy.”

--With assistance from Hiroko Komiya and Daisuke Sakai.

©2023 Bloomberg L.P.