Oct 20, 2020

Yuan Rallies to Strongest in Two Years in Renewed Test for PBOC

, Bloomberg News

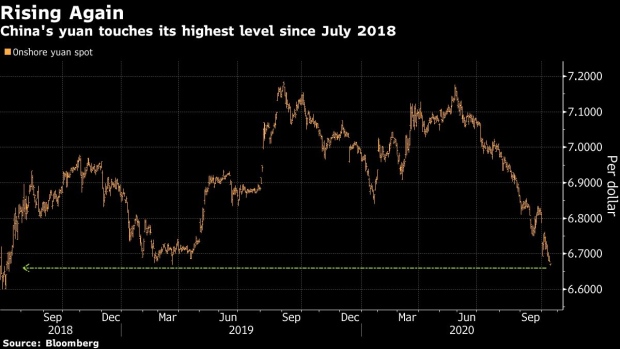

(Bloomberg) -- The yuan briefly climbed to its strongest level since July 2018, presenting China’s central bank with another test of how much appreciation it will tolerate.

The yuan gained as much as 0.16% to 6.6664 a dollar in early trading in Shanghai. The People’s Bank of China fixed its daily reference rate at 6.6781, which was slightly weaker than expected.

The latest push higher will have traders watching to see whether the People’s Bank of China will act to slow gains. One of its preferred measures is to fix the currency’s daily reference rate -- which limits moves to 2% in either direction -- at levels weaker than market watchers expect. It also has other tools at its disposal, such as relaxing capital controls installed after a shock devaluation five years ago and mobilizing state-backed banks to sell the yuan.

The PBOC said on Oct. 10 it was scrapping a rule that made it expensive to bet against the yuan. In the first session after that change, the onshore yuan slumped the most in nearly seven months.

The currency of the world’s second-largest economy has surged 4.7% over the past three months, the most in Asia after the South Korean won.

The yuan’s rally has been aided by a weak dollar, China’s rate premium over U.S. government debt climbing to a record and the economy’s rebound from the virus pandemic. That recovery continued in the July-September period, when gross domestic product expanded by 4.9% from a year earlier.

©2020 Bloomberg L.P.