Jul 1, 2022

Yuan-Ruble Trades Rise in China as Easing Curbs Boost Exports

, Bloomberg News

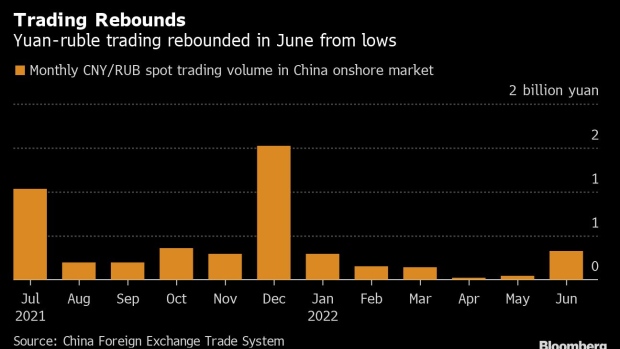

(Bloomberg) -- Spot trading of the yuan-ruble pair in China climbed to a six-month high in June as foreign-currency transactions picked up and the nation boosted shipments to Russia after Covid curbs eased.

Trading volume on the pair rose to 321 million yuan ($48 million) in the interbank market last month, according to data from the China Foreign Exchange Trade System. The ruble is one of 24 currencies which can be directly traded with the yuan.

The increased volume came on the heels of a 14% rise in Chinese exports to Russia in May, and reflects growing trade ties between the two nations as Kremlin seeks substitutes for goods blocked by Western sanctions. The rise in shipments means local exporters may have more receipts in the ruble to settle, which tends to boost trading of the currency pair.

“The rebound in the trading volume could be related to the warming up of China-Russia cargo trade,” given there’s no incentive for Chinese currency traders to trade the pair for profits, said Qi Gao, strategist at Scotiabank.

US Rivals Shunning Dollar Lifts Yuan-Ruble Trading by 1,067%

Shipments from China may have accelerated in June as Covid-related bottlenecks on production and logistics cleared up. Activity in Chinese financial markets has also resumed after lockdowns eased, with daily dollar-yuan spot trading volumes in the onshore market rebounding last month.

©2022 Bloomberg L.P.