Aug 15, 2022

Yuan Tumbles to Three-Month Low, Putting PBOC Fixing in Focus

, Bloomberg News

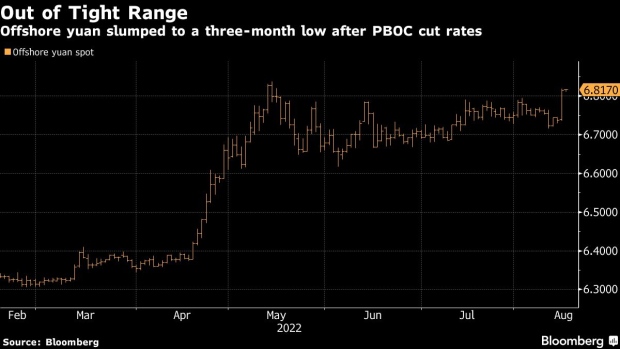

(Bloomberg) -- China’s central bank set its fixing for the yuan weaker on Tuesday, failing to show any overt pushback after the currency slid to a three-month low against the dollar the previous day.

The People’s Bank of China set the yuan reference at 6.7730 per dollar, 0.5% lower than the previous print, the largest daily cut since Aug. 3. The level though was virtually in line with the average estimate in a Bloomberg survey of analysts and traders. The offshore yuan slid as much as 1.2% Monday after the central bank bucked the global tightening trend to ease policy.

The yuan’s slide on Monday pushed it through the closely watched 6.8 level, widening its discount to the onshore rate to the largest since May. An expanding discount is often seen as a sign of growing pessimism on the currency and may prompt the PBOC to take further action to limit its decline.

“PBOC may be comfortable with recent yuan swings so far and would prefer market forces to drive the dollar-yuan pairing,” said Fiona Lim, a senior foreign-exchange strategist at Malayan Banking Bhd. in Singapore. “However, we cannot rule out stronger guidance from the fix should speculative pressure on the yuan increase, especially if dollar strength persists.”

The offshore yuan gained 0.2% to 6.8048 per dollar as of 5:33 p.m. in Hong Kong. The onshore currency dropped 0.2% to 6.7865 as it caught up with the overnight move. That’s after the PBOC unexpectedly reduced a key policy interest rate on Monday, putting its monetary policy further apart from global peers such as the Federal Reserve that are hiking borrowing costs to tame inflation. The policy divergence undermines the attractiveness of yuan assets and leads to capital outflows.

Yuan derivatives indicate the currency may face further declines. Dollar-yuan option volumes topped $15 billion, making it the most actively traded pair globally, with call spreads projecting that the currency pair may rise to 7 per dollar by year-end. Moreover, the relative cost of shorting the yuan versus the dollar in the offshore market declined to the lowest in more than a decade as the yuan forwards slumped following the PBOC rate cut.

China’s central bank will maintain a bias for weaker fixings given sluggish economic data, as a weaker currency would benefit exporters said Mitul Kotecha, head of EM strategy at TD Securities in Singapore.

Dollar-yuan spot trading volumes picked up Tuesday with the turnover rising past $50 billion as of 5:33 p.m. Shanghai time, set to be the highest since October 2021.

ING Bank’s strategists including Chris Turner wrote in a note the PBOC isn’t actively encouraging speculation of a weaker yuan, nor delivering a stern warning against overnight yuan selloff. The dollar-yuan’s move through 6.82-6.84 would raise speculation of something larger afoot akin to the 6% yuan devaluation during April to May, they wrote.

‘Further Easing’

“We expect interest-rate differentials to move further in favor of the US this year as the Fed continues to hike and the PBOC delivers further easing,” Capital Economics Ltd. economists including John Higgins wrote in a note. “This informs our forecast for the renminbi to depreciate to 7 per dollar by end-2022,” he said using the yuan’s formal name.

China’s economic slowdown deepened in July due to a worsening property slump and continued coronavirus lockdowns, with retail sales, industrial output and investment all falling short of economists estimates.

Overseas investors have cut holdings of Chinese bonds this year as the securities lost their yield premium to Treasuries. Global funds trimmed total ownership of yuan-denominated debt in the interbank market to 3.51 trillion yuan ($518 billion) at the end of July, from 4 trillion yuan in 2021.

China has so far held back from heavy-handed intervention to prop up the yuan. The authorities supported the currency with stronger fixings earlier this year and a reduction in foreign-exchange reserve requirements in April.

(Updates with spot yuan turnover in the 8th paragraph and ING comment in the 9th.)

©2022 Bloomberg L.P.