Mar 31, 2020

Zambia Seeks Advisers for Reorganization of Foreign Debt

, Bloomberg News

(Bloomberg) -- Zambia has asked banks for proposals on reorganizing as much as $11.2 billion of foreign debt as its debt-service costs rise and metal prices plunge, hurting its economy.

The country “intends to implement a liability management of its external debt portfolio to lengthen maturity and enhance its capacity to meet debt service obligations,” the finance ministry said in a request for proposals sent to lenders, seen by Bloomberg and verified by two of the recipients. The advisers’ mandate would include assisting the government in negotiations with creditors, as well as “formulating restructuring plans for loans” where creditors agree, according to the document.

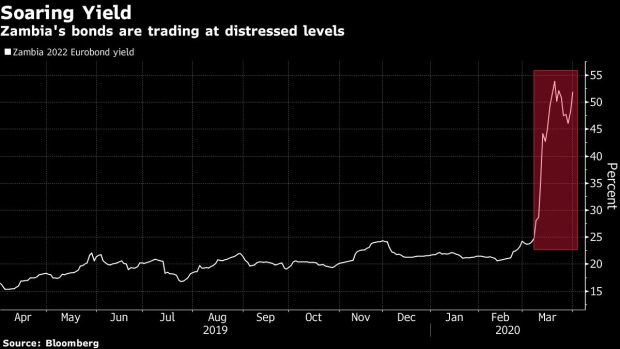

Zambia’s currency is the world’s worst performer after Brazil’s this year, and foreign-exchange reserves have fallen to a record low and cover less than two months of imports. Its $3 billion of Eurobonds have been trading at distressed levels, with yields on notes due 2022 rising above 50%.

The request for proposals is part of Zambia’s plan to put in place measures to ensure debt sustainability and deal with liabilities that will become due in the medium term, Finance Ministry Spokesman Chileshe Kandeta said in an emailed response to questions. The document as sent to lenders including Barclays Plc, Citigroup Inc., Deutsche Bank AG and Goldman Sachs Group Inc.

“The government has no intention of unilaterally restructuring its debt without consulting creditors,” Kandeta said. “The government will respect agreements and use market-based instruments where applicable.”

Yields on Zambia’s $750 million of 2022 Eurobonds climbed 3.6 percentage points to 51.96% on Tuesday. The kwacha currency weakened 1.1% to 18.1750 per dollar, the weakest level on record.

Any restructuring plan will include debt held by multilateral and bilateral lenders, commercial banks, capital-market investors export-credit organizations and others, the document said. Zambia’s foreign debt amounted to $11.2 billion at the end of 2019.

Zambia debuted in the Eurobond market in 2012, when low interest rates in the wake of the global recession,and the ensuing hunt for yield among investors meant it could borrow more cheaply than Spain at the time. Two other Eurobond sales followed in 2014 and 2015.

It’s also contracted billions of dollars in loans for infrastructure projects from lenders including Export-Import Bank of China, Industrial and Commercial Bank of China and Saudi Fund for Development.

©2020 Bloomberg L.P.