Jun 7, 2023

Zero-Coupon Bonds Take Off in India as Insurers Grow After Covid

, Bloomberg News

(Bloomberg) -- A trade that splits bonds into two parts is picking up traction in India more than a decade after its introduction, a sign the nation’s $1 trillion government debt market is starting to mature.

Life insurers are snapping up more and more so-called strip bonds – securities in which the principal and coupon payments are sold and traded separately — to better match their assets and liabilities, and customize cash flows. Strips, also known as zero-coupon bonds, were first issued in India in 2010 with little success, but volumes are now surging as insurers seize an ever-larger proportion of the market.

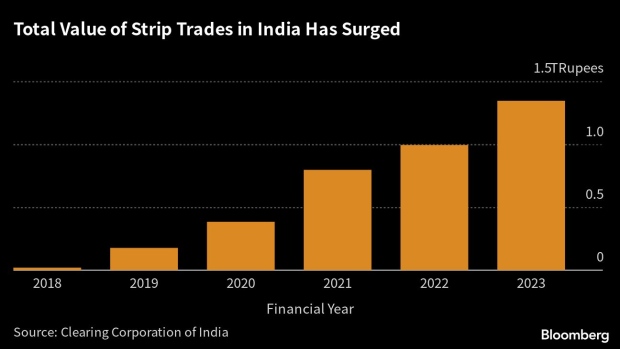

India’s bond market, which has long been dominated by banks and restricted for foreigners, is showing increasing signs of sophistication as cash-rich insurers drive demand for a wider variety of securities and derivatives. The total face value of strips traded in India jumped to 1.3 trillion rupees ($15.8 billion) in the fiscal year to March, from 380 billion rupees three years earlier, Clearing Corporation of India Ltd. data show.

“Insurance companies use strips to meet the duration demand in their traditional book,” said Churchil Bhatt, executive vice president Kotak Mahindra Life Insurance Co. in Mumbai. “It is a useful instrument to manage the asset liability mismatches, if any.”

Insurers typically favor longer-maturity strips, whereas banks are the main purchasers of those due in less than 10 years, Bhatt said.

Strips — which is also an acronym for Separate Trading of Registered Interest and Principal of Securities — have long been a popular product in advanced markets such as the US. The amount of zero-coupon Treasuries has surged in the past decade as the amount of debt outstanding has ballooned along with the government’s widening deficit.

Pandemic Boost

Demand from India’s insurers for strips and other forms of government debt has been rising as the firms themselves have seen rapid growth, particularly after the pandemic. The companies are now the biggest investors in the nation’s bond market after banks, owning about a quarter of outstanding securities. Strip bonds now comprise 4% of total outstanding government debt, central bank data show.

The expanding product range offered by insurers has meant they need to better manage their risks in long-term guaranteed products by using tools like strips, forward-rate agreements, and partly paid bonds, said Sampath Reddy, chief investment officer at Bajaj Allianz Life Insurance Ltd. in Pune.

“Insurance companies have seen good inflows and traction in traditional products over the past few years,” he said.

The increasing presence of insurers has also boosted demand at government debt sales. Their preference for longer maturities has helped flatten the nation’s yield curve, with the spread between five-year and 30-year bonds shrinking to zero in February.

“We expect investor demand in the bond market to continue,” said B. Prasanna, group head for global market sales, trading and research at ICICI Bank Ltd. in Mumbai. “ If you have a look at duration of liabilities that insurance companies have sourced out to retail people over many many years, and the bonds they have bought, they are under-invested.”

--With assistance from Liz Capo McCormick.

(Updates to add outstanding value of strips in seventh paragraph.)

©2023 Bloomberg L.P.