May 25, 2022

Zimbabwe’s Inflation Is Back Above 100% After Currency Plunge

, Bloomberg News

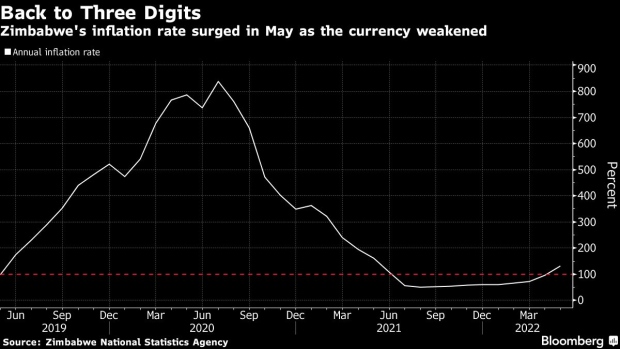

(Bloomberg) -- Zimbabwe’s inflation rate jumped back into triple digits in May after the central bank effectively devalued the local currency by introducing a new interbank rate at which most commerce will take place.

Annual inflation quickened to 131.7% from 96.4% in April, ending a 10-month period in which the rate was below 100%. Costs rose 21% in the month, the fastest pace since July 2020. Food prices increased more than 150% from a year earlier.

More than four years after the ousting of the southern African nation’s former leader Robert Mugabe, who oversaw plunging economic output and hyperinflation, Zimbabwe is still struggling to get back on track.

The Reserve Bank of Zimbabwe introduced the new interbank rate at 276 per dollar on May 9. That was two days after President Emmerson Mnangagwa temporarily barred banks from lending and introduced other measures in a bid to halt the plunge in the Zimbabwe dollar on the black market, where it trades at more than 400 to the greenback. The interbank rate is now at 296.

©2022 Bloomberg L.P.