Jan 14, 2019

Zimbabweans Are Left Reeling as Cash-Starved Economy Implodes

, Bloomberg News

(Bloomberg) -- Chronic shortages of fuel and foreign exchange, surging inflation and mass strikes have driven Zimbabwe to the brink of economic collapse and made a mockery of President Emmerson Mnangagwa’s claim that the country is open for business.

Many shops and factories have shut their doors because of a lack of customers and those that continue to trade are open to haggling over prices to secure hard currency. At an appliance shop in the capital, Harare, a salesman whispers that a Whirlpool Corp. washing machine priced at about $5,000 if paid for electronically will sell for $1,500 in cash, while at a nearby electrical warehouse, a $600 invoice is whittled down to $145 for payment in dollar bills.

Motorists have formed snaking lines outside filling stations in the hope of buying gasoline when and if supplies arrive, waiting for hours or even days at a time.

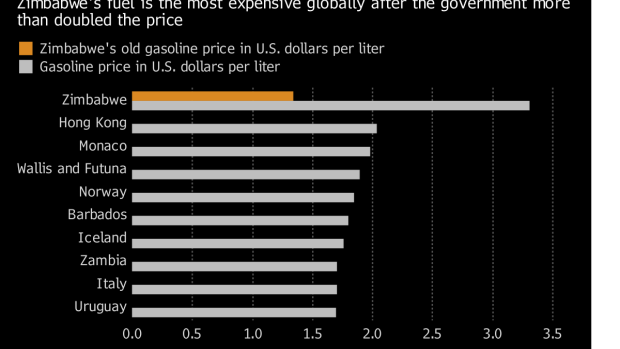

On Sunday, the government raised the official price of gasoline to $3.33 a liter, the world’s most expensive when compared to prices quoted by GlobalPetrolPrices.com. The Zimbabwe Congress of Trade Unions, which represents most labor unions in the southern African nation, responded to the price increase by calling a national strike that began Monday.

Hyperinflation Era

The last time things were this bad was in 2008, when the country was contending with hyperinflation that saw prices doubling every day, left shop shelves empty and forced people to buy groceries from neighboring countries or on the black market. The following year, the government abolished the Zimbabwean dollar in favor of the use of other currencies, primarily the U.S. dollar.

Here’s what Zimbabweans have to deal with on a daily basis:

- The official inflation rate stands at 31 percent, well short of 2008 levels but still high enough to drive consumers to the black market or import their own food and other basics.

- Goods paid for electronically cost as much as four-and-a-half times more than if cash were used. Retailers have resorted to a dual-pricing policy and offering cash discounts, defying the government’s threats to act against them.

- Supermarkets have stopped selling a number of goods and stock outages of everything from bread to coffee are commonplace. Zimvine, a Facebook group, is being used to request and share information on where to find food, fuel and other goods and how to contact lawyers specializing in immigration.

- The head of Zimbabwe’s main industry body has warned that many companies that continue operating will shut this month due to the currency shortage.

- The city authority in Harare has scaled back refuse removal and other services because it can’t access diesel for its trucks.

- Doctors staged a six-week strike to demand improved working conditions and that their salaries be paid in cash. While the labor action was called off on Jan. 10, it could take months to clear operation backlogs.

- Teachers and other state workers have warned that they’ll down tools unless the government pays them in cash.

To contact the reporter on this story: Brian Latham in Harare at blatham@bloomberg.net

To contact the editors responsible for this story: Karl Maier at kmaier2@bloomberg.net, Mike Cohen, Paul Richardson

©2019 Bloomberg L.P.