Aug 16, 2022

Zinc Surges as Trafigura-Owned Smelter to Halt Production

, Bloomberg News

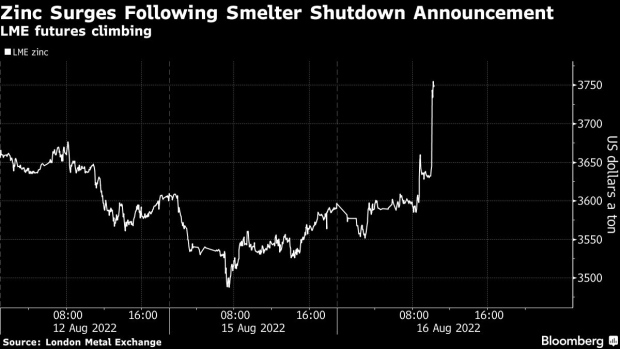

(Bloomberg) -- Zinc surged after one of Europe’s largest smelters said it would halt production next month as the continent’s energy crisis threatens to hobble heavy industries.

The Budel smelter in the Netherlands -- controlled by Trafigura Group’s Nyrstar -- will be placed on care and maintenance from Sept. 1 “until further notice,” according to a company statement. Zinc trading on the London Metal Exchange jumped as much as 7.2% to the highest intraday level in two months as traders priced in even tighter supply.

Earlier this month, top zinc producer Glencore Plc warned that Europe’s energy crisis posed a substantial threat to supply. Smelters across the region are barely turning a profit and the Nyrstar plant, which accounts for about 2% of global output, has been operating at a reduced rate since the fourth quarter of last year.

Read: Europe’s Power Crunch Cuts Zinc and Aluminum Capacity in Half

Industries from fertilizer to aluminum are being crippled by soaring energy costs as Russia squeezes gas flows to Europe following its invasion of Ukraine. Benchmark power prices surged to a fresh record Tuesday as the worst energy crisis in decades looks set to persist well into next year.

The decline in European zinc production has seen local LME stockpiles fall close to zero this year, while global inventories remain near the lowest in more than two years.

“There will be a bit of capacity juggling going on,” said Tom Price, an analyst at Liberum Capital. “If the EU needs their metal, they will probably have to import more semi-refined material or the metal itself.”

Supply concerns are still being balanced by the impact of the energy crisis on demand, which has caused many economists to predict a recession in Europe. Economic data on Monday from China, the world’s top metals consumer, added to those fears as the nation struggles to mitigate the impact of Covid-19 curbs, the property slump and the recent heat waves.

China is also facing an energy crunch which could hit metals output. Soaring temperatures are stretching power supplies and drying up water for hydro-electricity, forcing key aluminum-hub Sichuan to vow it will prioritize electricity production for residential use.

Aluminum production is incredibly power-intensive, and Europe’s smelting capacity has already been slashed by half in the past year. Further cuts could be coming as the region prepares for a winter that is set to push countries to the brink of electricity shortages.

Zinc on the LME rose 3% to settle at $3,672 a metric ton at 5:53 p.m. London time. Aluminum and copper were little changed.

©2022 Bloomberg L.P.