Mar 22, 2023

‘Zombie’ Developers Increase in Korea as Property Market Wobbles

, Bloomberg News

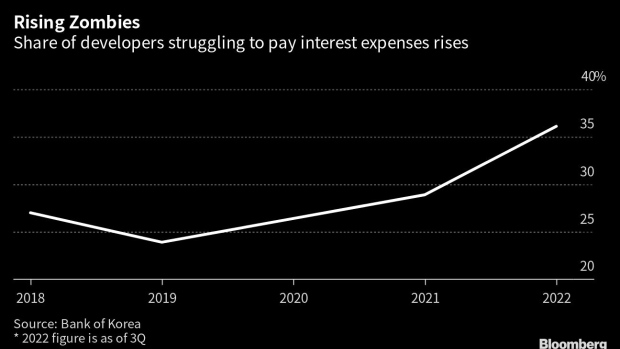

(Bloomberg) -- The share of South Korean developers struggling to pay interest expenses on their loans rose by a quarter last year as the central bank aggressively tightened policy and the local housing market began to wobble.

Some 36.1% of listed developers were unable to fully cover interest expenses with operating profit as of the third quarter of last year, according to a Bank of Korea report released on Thursday. That’s up from from 28.9% in 2021.

The share of so-called zombie firms may increase again this year as the BOK has since raised rates further. A growing number of unsold homes is also making it difficult for developers to pay back short-term debt known as project-financing.

PF was at the heart of a credit rout last fall when the government-backed developer of Legoland Korea missed a debt payment. It has since met its obligations.

Korean policy makers see PF loans in the construction sector as among the larger risks the economy faces this year because financial firms are often behind them.

Risks are larger for mid- and small-sized developers, the BOK said, calling for more scrutiny of their debt position. Rising commodity costs were another factor that amplified their financial difficulties, it said.

©2023 Bloomberg L.P.