Aug 23, 2022

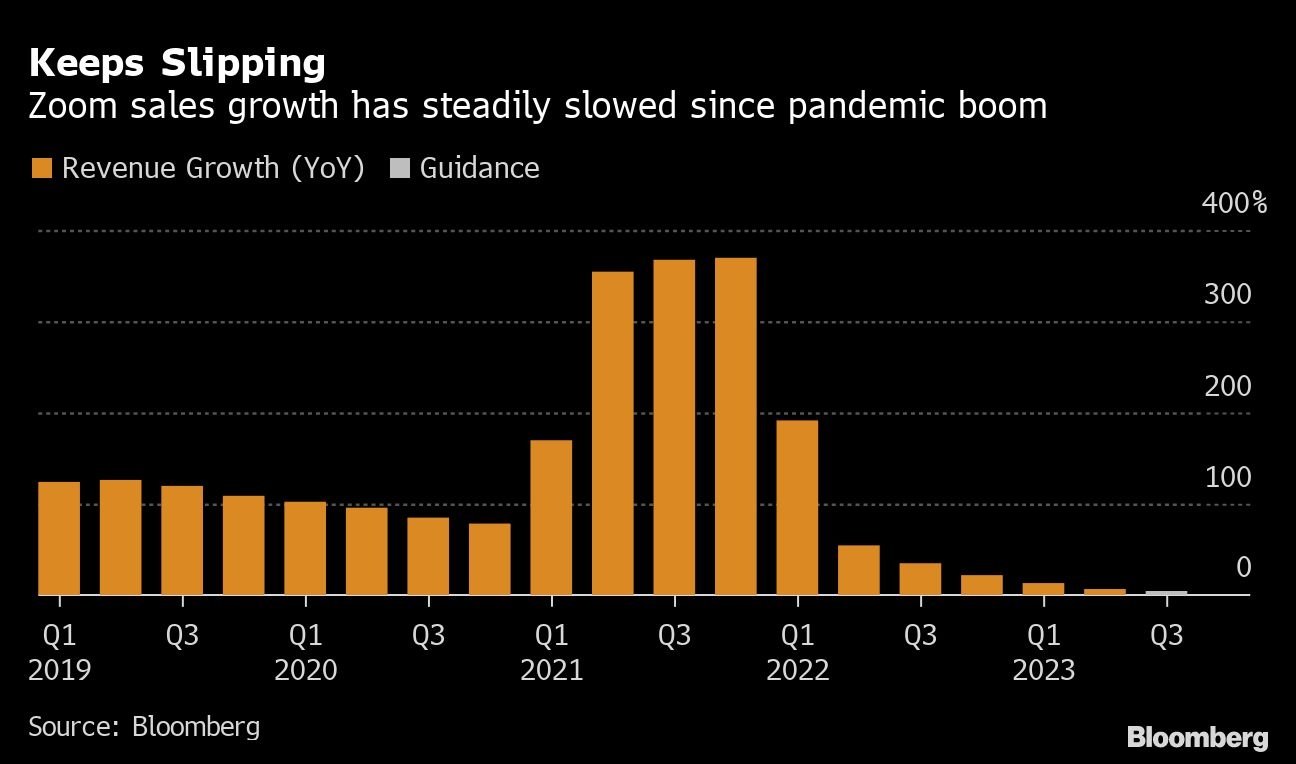

Zoom's enterprise bet is delayed as company cuts sales forecast

, Bloomberg News

This downturn is not like the 2000s: Legendary investor's outlook for big tech

Zoom Video Communications Inc.’s results showed that its transition from an essential COVID-era tool to an enterprise business platform is going to take longer than expected. The shares plunged to a closing price last seen in January 2020 before the company began its meteoric rise.

While Zoom said it’s generating a growing percentage of revenue from enterprise customers, the software maker didn’t add as many in the fiscal second quarter as analysts expected. The company also cut its annual revenue forecast, saying it’s losing sales from consumers and small business faster than anticipated.

The results, said Citigroup Inc. analyst Tyler Radke, were “even worse than we expected.”

Zoom’s breakneck growth during the pandemic has cooled considerably as offices reopen and competition intensifies from Microsoft Corp.’s Teams video communications platform. Online sales to consumers and small businesses are expected to decline 7 per cent to 8 per cent this year, Chief Financial Officer Kelly Steckelberg said on a conference call after the earnings were announced.

The shares dropped 17 per cent to US$81.32 at the close Tuesday in New York, the biggest single-day fall since Aug. 31, 2021. The stock has declined 56 per cent this year, missing out on a rally in technology stocks since mid-June.

Zoom has responded by intensifying its focus on larger enterprise clients and pitching an expanded line of products such as software for customer contact centers. In June, the company unveiled a new service bundle -- Zoom One -- to highlight offerings like internet-connected phones and physical conference rooms. Analysts are generally positive on these secondary offerings, particularly Zoom Phone, but believe they will take time to pay off. Sales to enterprise customers are expected to grow by more than 20 per cent this year, Steckelberg said.

Chief Executive Officer Eric Yuan also expressed confidence in the company’s new products. “Our recently launched Zoom Contact Center and Zoom IQ for Sales products saw some great early wins while Zoom Phone delivered milestone results, hitting a record number of licenses sold in the quarter,” he said in the statement.

Revenue will be about US$1.1 billion in the period ending in October, the San Jose, California-based company said Monday in a statement. Analysts, on average, expected US$1.16 billion, or growth of about 10 per cent from a year earlier, according to data compiled by Bloomberg. Profit, excluding some items, will be 82 cents to 83 cents a share, compared with analysts’ average estimate of 91 cents.

The company also reduced its annual sales forecast to about US$4.4 billion from its May projection of as much as US$4.55 billion. About US$115 million of the cut is due to the “broader economic environment” and US$35 million is due to the stronger US dollar, Steckelberg said during the call.

Fiscal second-quarter sales increased 7.6 per cent to US$1.1 billion, Zoom’s slowest year-over-year growth on record. Analysts, on average, projected US$1.12 billion -- making it the first quarter that the company has missed revenue estimates. Profit, excluding some items, was US$1.05 a share, compared with the average estimate of 92 cents.

Revenue from the region including Europe declined 8 per cent in the quarter due to the Russia-Ukraine war, the strength of the US dollar and weakness in the consumer segment, the company said.

“We recognize that the revenue results are disappointing and below our expectations as we navigate the current environment,” Steckelberg said.

In the period ended July 31, the company said it had 204,100 enterprise customers, an increase of 18 per cent from a year earlier. The growth was lower than a 24 per cent increase in the previous quarter. Analysts, on average, projected Zoom would report 205,854 enterprise customers.

While the enterprise segment saw steady growth in the quarter, customer additions were “quite weak,” which may be a leading indicator of future headwinds, Citigroup’s Radke wrote in a note after the results.

What Bloomberg Intelligence Says:

Though the strength in enterprise bodes well for growth, weakness in the online business could linger beyond year-end as securing new users in this segment may be challenging amid a choppy economy.

John Butler, BI senior telecom industry analyst