Apr 19, 2024

Currency Traders Turn to Options Market for Geopolitical Havens

, Bloomberg News

(Bloomberg) -- Currency markets are in full risk-off mode amid fears of a widening conflict in the Middle East, with traders rushing for safe havens in both spot and options.

The dollar gained versus all Group-of-10 currencies except for the Swiss franc and the Japanese yen on Friday, after reports that Israel launched a retaliatory strike on Iran. The Bloomberg Dollar Spot Index rose for a seventh day in eight.

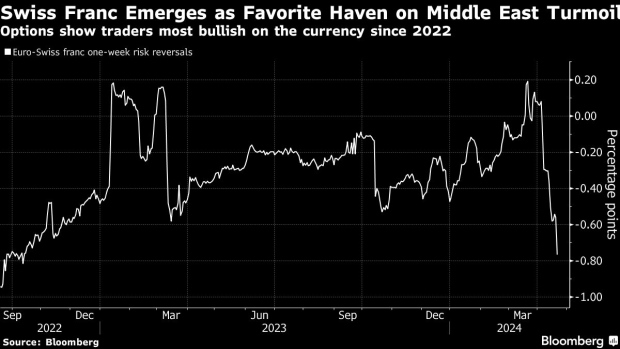

Options also point to a rush for safe havens. Risk reversals, a barometer of market positioning and sentiment, show traders are the most bullish on the Swiss franc versus the euro since late 2022. Demand for options that pay out if the yen strengthens versus the dollar next week rose to the highest since July.

Israel’s retaliation, according to two US officials, comes less than a week after Tehran’s rocket and drone barrage. Iranian media appeared to downplay the incident in the hours that followed the initial reports.

The developments fueled volatility in oil-linked currencies as crude briefly soared above $90 a barrel. The cost of hedging one-week moves on the Canadian dollar rose the most in 15 months on Friday, while Norwegian krone volatility headed for its second-biggest gain this year.

The greenback is also in demand, with one-month risk reversals for the Bloomberg Dollar Spot Index trading close to an one-year high.

(Adds Bloomberg Dollar Spot Index move in second paragraph.)

©2024 Bloomberg L.P.