Apr 24, 2024

Turkey Is in ‘Whatever It Takes’ Mode But Rate Hike Now Unlikely

, Bloomberg News

(Bloomberg) -- Turkey’s central bank probably won more time before having to consider another increase in interest rates, a month after surprising markets with a big hike and delivering additional tightening since then.

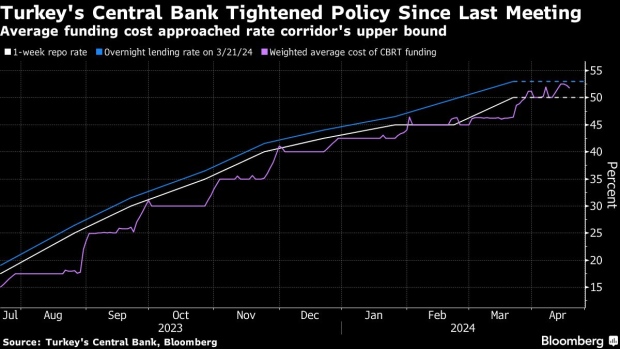

Policymakers have recently been extending costlier liquidity to banks than implied by their benchmark and have room to push the price of funding even higher without needing to raise rates yet. The flexibility of a wider rate corridor means the central bank can skip a hike this week for only the second time since starting its aggressive tightening campaign last June.

All but two economists surveyed by Bloomberg predict the one-week repo rate will be kept at 50% on Thursday, with the rest seeing an increase. The pause will likely last through the third quarter before rate cuts begin in the final three months of the year, according to Bloomberg Economics.

“Financial conditions should remain tight until you see a decline in sequential inflation or a big improvement in expectations,” James Walsh, the International Monetary Fund’s mission chief to Turkey, said in an interview in Washington.

“Fiscal policy should reinforce monetary policy, and in this case that would mean that the fiscal deficit should probably be brought down a little bit this year,” Walsh said. Echoing the central bank’s guidance, he said that “if there’s a worsening of inflationary dynamics, then it makes sense to raise rates.”

As the policy meeting approached, the central bank has been telegraphing a message of resolve. Governor Fatih Karahan pledged to do “whatever it takes” to curb inflation that’s on track to exceed 70% by May and remains under pressure from still-brisk consumer spending.

A central bank survey published last week found expectations for end-year inflation are still well above its own forecast of 36%, which Karahan will update in early May.

Deutsche Bank AG analysts Yigit Onay and Christian Wietoska think Turkish rates are at their peak but don’t rule out hikes this quarter if “inflationary risks persist and inflation expectations continue to lack anchoring” and domestic demand remains strong.

Indicators released since the central bank’s meeting in March show domestic demand is on the rise and appetite for credit is still strong despite higher rates, according to QNB Finansbank economists, who are alone in predicting a hike of 500 basis points this week.

The rationale for such an increase is to ensure that the one-week repo rate remains the main policy tool, they said in a note. The average cost of funding provided by the central bank exceeded 52% last week, approaching the upper bound of the rate corridor that policymakers widened in March.

What Bloomberg Economics Says...

“Underlying inflation dynamics warrant a tightening in borrowing costs. We maintain our earlier call for the central bank to deliver necessary tightening by shifting funding across different facilities in its interest rate corridor.”

— Selva Bahar Baziki, economist. Click here to read more.

Though the central bank unexpectedly opted to hike just over a week before pivotal local elections last month, Morgan Stanley now sees rates on pause but staying “higher for longer.”

“Financial conditions have tightened significantly in the past month,” Morgan Stanley economist Hande Kucuk said in a report. “We expect the Turkish central bank to retain a tightening bias amid risks to the inflation outlook.”

--With assistance from Beril Akman and Joel Rinneby.

(Updates with Deutsche Bank comment in eighth paragraph.)

©2024 Bloomberg L.P.