Sep 6, 2019

Hidden gem Equitable Group may join big leagues after Canada index shuffle

, Bloomberg News

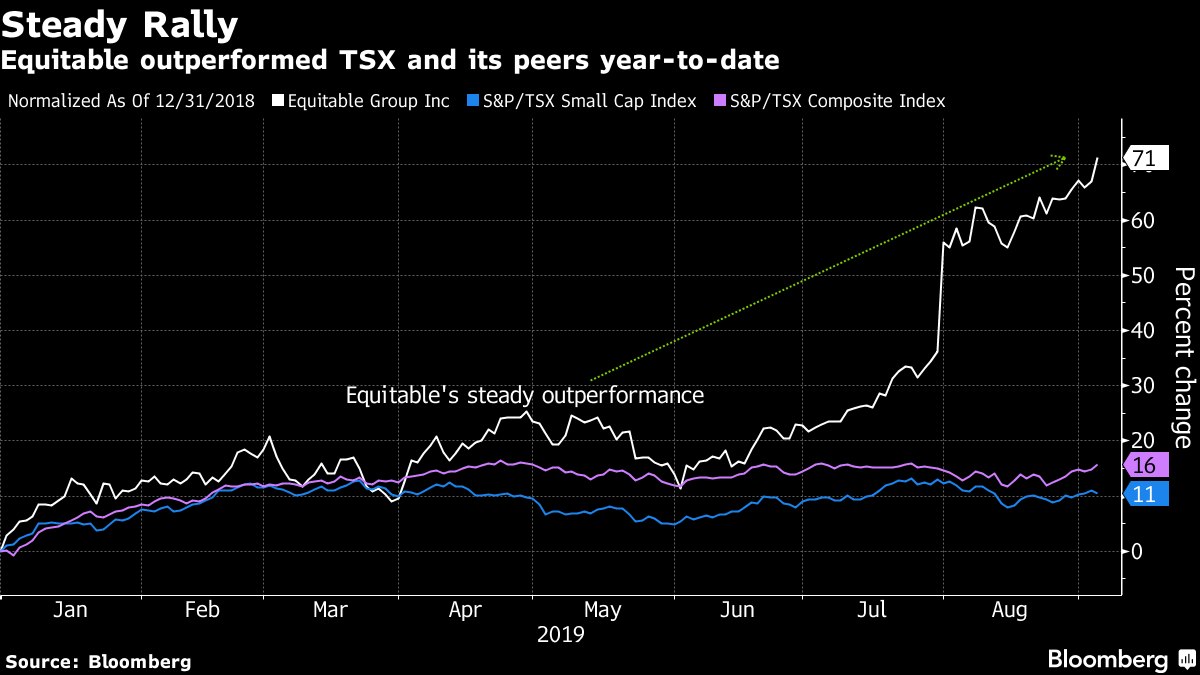

Equitable Group, a small-cap stock which has quietly outperformed its peers in the alternative mortgage lender space, could be added to the S&P/TSX Composite as soon as next week, when a quarterly index review takes place, according to a Bloomberg News survey of index analysts.

Index reshuffles are important events for fund managers as they aim to minimize the risk of their portfolio’s equity asset allocation. They typically cause short-term share price spikes and elevated trading volumes as the popularity of passive investing grows. The S&P Dow Jones Indices Canadian Index Services is expected to announced the results of its quarterly review on Sept. 13.

Equitable was among a short list of stocks that could be up for an inclusion, according to survey of four index analysts in Canada. The mortgage provider has gained more than 70 per cent this year. Unsurprisingly, some small-cap gold and silver miners also were also favored to be added amid a surge in precious metal prices.

Here are the companies that showed up more than three times in the survey as potential S&P/TSX Composite additions:

| Company | Ticker |

|---|---|

| Equitable Group | EQB:CT |

| Wesdome Gold Mines | WDO:CT |

| Ballard Power Systems | BLDP:CT |

Meanwhile, CannTrust Holdings was the only pot stock within the survey that all analysts expect will be deleted from the index. The stock has slumped 65 per cent this year and is now trading below its IPO price of $2.50, after revealing that it broke Canadian regulations by growing cannabis in unlicensed areas. Other stocks that showed up within the potential deletion survey list mostly include energy companies, given this year’s volatility in the oil market.

Here are the companies that showed up more than three times in the survey as candidates that could be removed:

| Company | Ticker |

|---|---|

| CannTrust Holdings | TRST:CT |

| Nuvista Energy | NVA:CT |

| Ensign Energy Services | ESI:CT |

| Kelt Exploration | KEL:CT |

| Precision Drilling | PD:CT |

| Western Forest Products | WEF:CT |

| Torc Oil & Gas | TOG:CT |

| Sierra Wireless | SW:CT |

| NexGen Energy | NXE:CT |

| Birchcliff Energy | BIR:CT |

| Peyto Exploration & Development | PEY:CT |

With the iShares S&P/TSX 60 Index ETF being the largest exchange-traded fund tracking Canadian stocks, strategists are also watching for additions and deletions on the S&P/TSX 60 Index.

Scotiabank’s Andrew Moffatt pointed to Kirkland Lake Gold, Air Canada, CAE, Brookfield Property Partners and Algonquin Power & Utilities as ones to watch for possible inclusions into the large-cap index. Husky Energy, SNC-Lavalin Group and Bombardier are on his watchlist for removals.

Bombardier and SNC-Lavalin -- among the smallest stocks on the S&P/TSX 60 -- are also on AltaCorp’s deletion shortlist. Air Canada, CAE and WSP Global are the largest industrial names in Canada’s main stock gauge and are not in the TSX 60, the broker said.