Apr 8, 2024

After Bitcoin Surge, Crypto VC Creeps Toward a Comeback

, Bloomberg News

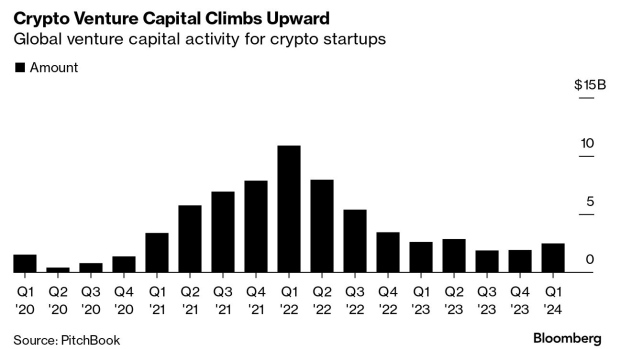

(Bloomberg) -- Crypto startup deals are back. After a brutal year for cryptocurrency and blockchain-related companies, venture capital investment in the industry ticked up by nearly one-third from the previous quarter, according to new data.

VC investment in crypto startups reached $2.5 billion during the first quarter of 2024, a 32% increase from the last quarter and roughly even with the same period last year, PitchBook data show. At the same time, crypto startups are raising more capital and venture firms are launching new digital asset funds.

“Investors are spending money again,” PitchBook crypto analyst Robert Le said. “Over the last two years, 18 months, they’d been holding onto the capital that they’ve raised.”

Le said that the refreshed enthusiasm for crypto was partly sparked by the approval of Bitcoin exchange-traded funds in January and interest in the intersection of crypto and artificial intelligence. During the doldrums of 2023 and late 2022, VCs were loathe to tap into the funds they raised during the last crypto bull market. This year that’s started to change.

Anand Iyer, managing general partner of early stage venture fund Canonical Crypto, said that he’s seen funding activity pick up in recent months. He noted that some founders now raising money aren’t newcomers to the industry. “They actually built something in the last cycle that didn’t pan out,” Iyer said.

Some early features of crypto that were prominent during the last bull market have come back as well. For example, the latest memecoin frenzy has echoes of past crazes. Websites like pump.fun have enabled anyone with an internet connection to create pointless tokens inspired by animals, pop culture or virtually any other subject. “They’re funny and all these things, but it is very cultural to crypto,” Iyer said.

Other VCs are latching onto signs of maturity for the industry.

John Lo, a managing partner who oversees digital asset investing at Recharge Capital, was previously part of the leadership at decentralized crypto exchange Sushi under the pseudonym “Omakase,” and even used an Anime character filter during a webinar appearance to conceal his identity.

While Lo said that there are some teams still raising capital pseudonymously, that trend is a nostalgic “remnant” of past crypto culture. Instead, he and his team are excited about the impact of established financial institutions diving deeper into crypto, as evidenced by the Bitcoin ETF approvals.

“We’re seeing usage of Bitcoin and adoption of Bitcoin at a scale that we haven’t seen before,” he said.

At the same time, there’s still room for improvement. Recharge is focused on backing startups that can build better crypto infrastructure and make the industry more appealing to investors. “Crypto is still very early,” Lo said.

©2024 Bloomberg L.P.