Sep 21, 2020

An Energy Trader Seeks Profit From Batteries In European Markets

, Bloomberg News

(Bloomberg) --

As Tesla Inc. batteries helped balance supply and demand on the U.K. grid for the first time, one startup aims to profit from the growing demand for storage capacity among investors.

Vest Energy, a clean technology trading house, uses algorithms and machine learning to deploy storage and renewable assets at the most profitable times, according to managing director Aaron Lally. That service is set to become increasingly critical as a back-up for a grid absorbing more intermittent flows from wind and solar farms.

“The market is stressed when there’s an under supply of renewables, and that’s going to lead to energy storage and renewable revenues going through the roof,” Lally said in an interview.

Read more here about how use of batteries is set to surge

Using batteries in the balancing market, as Tesla did, shows the technology is able to perform all of the same services as gas and nuclear stations. Even so, big battery plants are still only about a tenth of the size of a gas-fired unit.

There is profit to be made in this market too.

The cost of balancing the power market surged this summer as the effects of the coronavirus pandemic reduced supply and made usage harder to predict. National Grid Plc spent 718 million pounds ($932 million) balancing the network from March to July to cope with low demand and high supply of renewable generation. That’s 39% higher than usual.

Lally, a former trader at Mercuria and Glencore Plc, is signing up large funds and companies looking for ESG investments. They will usually fund or build renewable or battery assets but won’t have the trading capabilities to react quickly to changes in market prices.

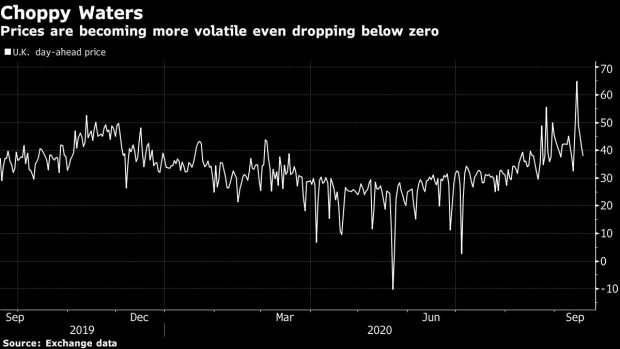

“Over the last four or five years we’ve been in a low volatility environment in the U.K. but also across Europe, and we strongly believe we’re coming to the bottom of that cycle,” Lally said.

If prices look like they will turn negative then a battery needs to be empty and ready to draw power from the grid and earn money while doing it.

Vest Energy, backed by private equity firm CF Partners U.K. LLP, will start focusing on the U.K., which is about two years ahead of other nations in integrating batteries into the power market. Vest wants to move into Germany, Italy, Spain, France and Ireland.

Read more here about the U.K. rules making bigger batteries possible

In Europe, existing energy storage projects have benefited from increased power market volatility due to the rise of share of renewable generation during coronavirus lockdowns, BloombergNEF said in a report. This may improve the business case to build more.

Vest Energy isn’t alone in offering these trading services. Scandinavian companies like Danske Commodities AS, Centrica Energy Trading AS in Denmark have been optimizing renewable assets for years.

In July, commodities trader Hartree Partners Plc launched its venture to build and operate renewable assets to help companies cut emissions from their electricity supply.

©2020 Bloomberg L.P.