Apr 25, 2024

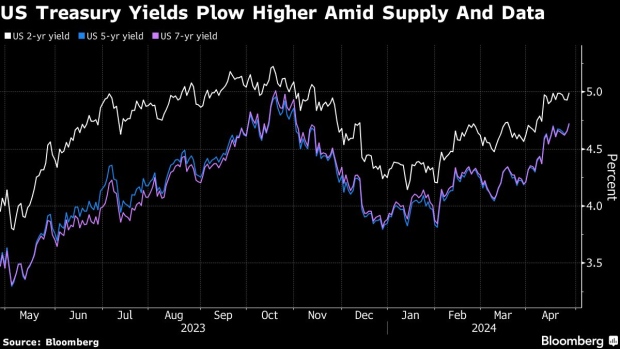

US Bond Market Sells Off as Sticky Prices Weigh on Fed Rate Path

, Bloomberg News

(Bloomberg) -- A selloff in global bonds paused as traders waited for US inflation data to shed light on whether the Federal Reserve will be able to cut interest rates this year.

Treasuries gained on Friday after a rout this week pushed yields to their highest levels of the year, with European rates following suit. Japan’s benchmark securities advanced after the nation’s central bank indicated monetary policy will stay easy for now.

Evidence is mounting that a slowdown in US consumer price growth toward the Fed’s 2% goal has stalled. That’s forced the market over recent weeks to push back the expected timing of the first rate to the end of this year, and unwind positions betting on a rally in fixed income assets.

“The jury is still out on whether this is a temporary blip or a significant inflation breakout,” said Justin Onuekwusi, chief investment officer at St James Place Management. “But if it’s the latter, 10-year yields could easily break 5%.”

All eyes are now turning to the Fed’s preferred gauge of inflation — the core personal consumption expenditures price index — which is due later Friday. The data is projected to show the monthly rate was unchanged at 0.3% in March. The yearly figure will show it slowed to 2.7% from 2.8% in February.

Read More: US Yields Soar as Traders See Fed Delaying First Cut to December

US 10-year Treasury yields fell two basis points to 4.68%. They touched a high of 4.74% Thursday, a level last seen in November, taking an increase since the end of last year to around a full percentage point. The German equivalent rate dropped two basis points to 2.61%.

Traders are now only fully pricing a quarter-point reduction by December, compared with July as recently as three weeks ago.

“I think we are at peak pessimism,” said Gareth Hill, a portfolio manager at Royal London Asset Management. “There are pockets of value now that 10-year yields are around 4.7%. At that level a lot of the pessimism is already in the price.”

Economic data on Thursday promoted the market to temper its expectations for lower borrowing costs. Gross domestic product increased at a 1.6% annualized rate last quarter, while a closely watched measure of underlying inflation advanced at a greater-than-expected 3.7% clip.

The Fed sets monetary policy on Wednesday and attention will likely focus on any commentary from Chair Jerome Powell on recent economic readings and the implications for the rate path ahead. In March, Fed officials laid out a forecast of three quarter-point cuts in 2024.

Employment data at the end of next week will also offer more clarity about the economy.

“Whatever way you crunch the numbers, this just isn’t the type of inflation momentum where the Fed will be comfortable cutting rates,” said Onuekwusi at St James Place Management.

--With assistance from Liz Capo McCormick, Elizabeth Stanton, Ruth Carson, Sujata Rao and James Hirai.

(Updates with global bond moves starting in paragraph one.)

©2024 Bloomberg L.P.