Apr 16, 2024

BlackRock’s Aggressive Hunt for Growth in Saudi Arabia

, Bloomberg News

(Bloomberg Markets) -- What’s worth your time when you’ve already built the world’s largest asset management company?

For Larry Fink, chief executive officer of BlackRock Inc., courting the billions of dollars in assets up for grabs in Saudi Arabia is part of the answer. His Gulfstream jet lands in Riyadh several times a year, and he’s had at least two private dinners with de facto ruler Crown Prince Mohammed bin Salman, according to a person with knowledge of the matter. Meanwhile, BlackRock has been quietly increasing its presence in the country: It was the first major global investment manager to open an office in Riyadh, and the company now employs about 20 people there, a larger local workforce than its competition. The CEO of state-owned oil giant Saudi Aramco, Amin Hassan Ali Nasser, joined BlackRock’s board last year.

Saudi Arabia is a small part of BlackRock’s portfolio. The company oversees more than $10 trillion around the globe and has $100 billion-plus across the Middle East and Africa—suggesting that less than 1% comes from the kingdom. (The total market for asset management in the broad region is about $1.6 trillion, according to Boston Consulting Group.) Doing business there courts controversy because of the regime’s human-rights record and the economy’s dependence on oil—Fink for many years has spoken of the need for companies to pay attention to the risks from climate change. And the wider Middle East, as events this past weekend show, remains a volatile, unpredictable place.

Yet, BlackRock has made it a priority to grow in the kingdom, say people familiar with the company’s plans. Fink is an aggressive dealmaker who takes evident relish in his role as a kind of statesman for US-style investor capitalism, and he’s been building relationships in the region for years. BlackRock sees an opportunity in Saudi Arabia to be influential in shaping its fledgling markets and connecting the geopolitically important country with the rest of the world. And the kingdom fits with Fink’s strategic goal of expanding the index fund giant’s footprint in the more profitable business of private asset and infrastructure investing.

It’s also a field to compete with rivals over one of the world’s great sources of fresh capital. The kingdom’s state-owned Public Investment Fund (PIF) controls $925 billion, and it can spin up new pools of cash with breathtaking speed to suit the royal family’s goals. Private equity is also picking up in the country. “This is where the money is,” says Karen Young, a professor at Columbia University who focuses on the region and global energy policy. “The Gulf states are more activist investors now.”

Read More: Wall Street’s Moelis Bet Big on Middle East. Now He’s Cashing In

Saudi Arabia is hardly the only market BlackRock is chasing. It’s expanding in India, Japan and Singapore, and for years it’s managed money for clients and invested across the Gulf in Kuwait, Qatar and the United Arab Emirates (with an office in Dubai). The Kuwait Investment Authority sovereign wealth fund, in turn, was among BlackRock’s top shareholders, according to its latest proxy statement. KIA, PIF, Abu Dhabi’s Mubadala Investment and the Qatar Investment Authority bought shares when PNC Financial Services Group sold its stake in 2020. “The Middle East is an important market for BlackRock, both in terms of the investment opportunity for our clients, and for the continued growth of our international business,” a BlackRock spokesperson wrote in a statement. “We have long-standing client relationships in Kuwait, Qatar, Saudi Arabia and the UAE.”

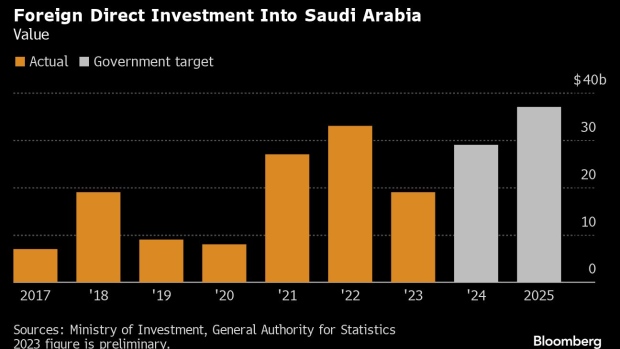

Saudi Arabia is the biggest economy in the region and ranks 17th in the world. The crown prince, widely known as MBS, has touted ambitious plans to diversify away from oil, both by investing abroad and by building at home. The kingdom often seeks outside partners to co-invest in its projects, and asset managers can help organize and raise money for those funds. Even so, foreign investment is growing more fitfully than hoped. Some outsiders are wary of committing to the country, questioning the financial returns there and wondering if all its grand projects will be completed. The Saudi government has scaled back its medium-term plans for construction of a megacity called Neom, Bloomberg News reported in April.

But the state’s potential financial heft was made clear in 2017, when PIF announced it would match as much as $20 billion for a new infrastructure investment fund run by Blackstone Inc., the private equity and alternative asset manager. The announcement coincided with visits to Riyadh by then-President Donald Trump and a group of US business executives, including Blackstone CEO Stephen Schwarzman, one of Trump’s most prominent supporters on Wall Street at the time. Blackstone said at the time that the deal was in the works prior to Trump’s election.

This was a wake-up call inside BlackRock, say people familiar with the matter. (These people and others who spoke with Bloomberg News asked not to be named discussing private matters.) In 2018 investment conglomerate SoftBank Group Corp. won $45 billion more for its technology-driven Vision Fund. Others familiar with Fink’s thinking downplay the importance of these events—BlackRock had already announced plans to open an office in the country—but the company started pushing deeper into the Saudi market soon after.

It wasn’t an easy time to do so. In October 2018, exiled Saudi Washington Post columnist Jamal Khashoggi disappeared after entering the kingdom’s consulate in Istanbul. Later, a Saudi prosecutor said Khashoggi was killed and his body dismembered by government agents sent to bring him back to the country, and a US intelligence assessment said MBS was responsible. The crown prince has denied having a role in Khashoggi’s death. Fink and other top Wall Street executives canceled their appearances at a glitzy financial conference, nicknamed “Davos in the Desert,” in Riyadh that October. But people familiar with the matter say Fink visited the country soon after as part of a trip to the region.

Wall Street’s caution over Saudi Arabia was short-lived, as Blackstone went ahead with its fund and top bankers began flocking back to the annual Riyadh forums. “People didn’t want to be onstage with the crown prince—that has diminished,” says Columbia’s Young. Still, Representative Gerry Connolly, a Virginia Democrat for the district where Khashoggi lived, has vowed not to let the killing be normalized. “It is absolutely imperative that we don’t forget the sheer brutality and utter disregard for international norms with which the Crown Prince acted,” he said in a statement.

Fink has justified BlackRock’s business in Saudi Arabia as a matter of building bridges. In a LinkedIn post, he called Khashoggi’s murder “horrifying” but wrote that “corporate engagement” could help modernize the country’s economy and society. “I have been a lifelong globalist—I’m still proud of being a globalist,” he told CNBC in 2018. “We’re going to continue to do business there.” When asked if he’d cut ties if it became clear MBS ordered the killing, he said, simply, “No.”

Read More: BlackRock CEO Larry Fink Says AI Will Boost Productivity, Worker Pay

Fink has similarly argued there’s no contradiction between working with oil producers and his concern about climate risk, which he’s addressed in open letters to corporate executives and shareholders. Recently, BlackRock has faced some anti-green backlash—a fund for public schools in oil-producing Texas said it would pull $8.5 billion in assets from the firm. But BlackRock’s giant funds have always had investments in oil companies in the US and around the world. “Any energy transition is not going to be a straight line,” he said at a Saudi-backed conference in London in 2022. “It’s better to be working with all the companies that are in hydrocarbons, not against them.” BlackRock is among the asset managers working with the UAE on a $30 billion fund to invest in climate-related ventures.

BlackRock set up its locally licensed business in Saudi Arabia in 2019 and began competing aggressively for investment and advisory mandates from the kingdom. It’s the rare Wall Street company with its name atop an office building in Riyadh. Sulaiman Al Gwaiz, a former governor of Saudi state pension General Organization for Social Insurance, is chair of BlackRock Saudi Arabia’s board of directors. The local CEO is Yazeed Almubarak, a Stanford MBA whose father has twice served as governor of the Saudi central bank, most recently from 2021 to 2023. Almubarak was kept separate from dealings with the central bank, according to someone familiar with the situation.

Doing business in Riyadh has had its challenges. Turnover has been high, according to people with knowledge of BlackRock’s efforts. Foreign executives may be reluctant to live there, preferring the less conservative city of Dubai. One executive who’s made the move is Kashif Riaz, a managing director who came from New York to lead BlackRock’s advisory work on the country’s infrastructure plans. The company’s best pitchman in the region may be the famously gregarious Fink himself. People familiar with his thinking say he’s forged friendships there.

BlackRock’s strength globally is running funds of public stocks and bonds, especially exchange-traded and index funds, a competitive business where fees are razor thin. The company wins on massive scale. Through its funds it’s one of the top shareholders in almost every S&P 500 company, and it oversees 10 times as much money as rival Blackstone, which it was spun out from in 1994. But the real prizes to win in the region are mandates to manage private and illiquid assets, where rivals including Blackstone are heavyweights.

Investments such as private equity and credit, real estate and infrastructure are only 1.3%—about $137 billion—of BlackRock’s current client assets. But the fees are much richer, so these illiquid alternative assets accounted for about 6.5% of revenue in 2023. And BlackRock is intent on doubling revenue from private markets in about five years. It’s also announced the acquisition of Global Infrastructure Partners, a $100 billion manager of infrastructure assets, which will make it the second-biggest infrastructure investor in the world. Saudi Arabia, with its many projects, could be a proving ground for the new combination.

In late 2021, Saudi Aramco announced an agreement to lease rights to its natural gas pipelines for 20 years for $15.5 billion. Aramco retained a 51% stake in the deal and sold the rest to an investor group led by BlackRock and Hassana Investment Co., an arm of the pension fund GOSI. Nasser, the Aramco CEO, hailed the deal as a demonstration of its ability to draw a global investor such as BlackRock to the country. Saudi Arabia benefits from the association with such big, credible brands.

BlackRock is embedding itself in different parts of the country’s institutions and capital markets, even looking at mortgage markets, people with knowledge of the matter say. It’s started a Middle East infrastructure and private-equity-focused fund with PIF and Hassana as well as Abu Dhabi’s Mubadala and other investors. The fund’s initial target was to raise about $1 billion, which could eventually increase to several billion dollars, say people with knowledge of the matter.

Read More: When the Fed Needs Wall Street’s Help, It Turns to BlackRock

Then there’s BlackRock’s Financial Markets Advisory group; it’s a small part of the company’s revenue but a key source of its influence and prestige. It’s already working for the Saudi central bank on stress tests for local lenders, according to two people familiar with the matter. The group has also advised Saudi Arabia on the creation of a national infrastructure fund, which could eventually help finance tens of billions of dollars’ worth of energy, water, transportation and digital projects. In what may be a nod to the Gulf’s strategic importance to BlackRock, Senior Managing Director Charles Hatami oversees both the advisory group and the Middle East region for the company.

Competition awaits. KKR & Co., which has an office in the country, was approved at the beginning of March for a broader license to arrange, manage and operate funds. Macquarie Asset Management said in February that it’s working with the country’s national infrastructure fund to increase foreign investment. Brookfield Asset Management has pledged to put more money to work inside Saudi Arabia. PIF is also working on a plan to boost the local asset management industry, and foreign firms are under increasing pressure to build up a local presence rather than having executives jet in from the UAE. Franklin Templeton recently opened an office in Saudi Arabia.

BlackRock is methodically checking the boxes in the kingdom. Local presence, check. Local hires, check. Investing locally, check. Across the Middle East, states and their sovereign funds are getting more demanding of their investment managers, asking them to throw money into their economies. Saudi Arabia is no exception. “Investing in the region is part of what you have to do to get this money,” says Alexander De Mol, a partner in Bain & Co.’s private equity practice. “But there are also some attractive opportunities.”

Gyftopoulou and Brush cover asset management. Nair reports on deals, and Riyadh-based Martin covers sovereign wealth funds.

©2024 Bloomberg L.P.