Apr 15, 2024

Canada's Trans Mountain project seen spelling trouble for OPEC member Iraq

, Bloomberg News

Oil prices could go higher still on the back of gasoline demand: Robert Yawger

Canada’s newest oil pipeline may spell trouble for a Middle Eastern country almost 7,000 miles away: Iraq.

The Trans Mountain pipeline’s expansion, which will almost triple Alberta oil-sands producers’ ability to ship their heavy crude to the Pacific Coast, will most directly affect a similar grade called Basrah Heavy that’s produced in OPEC member Iraq, Susan Bell, a Rystad Energy analyst, said in an interview.

“When you look at the yield profile of that crude oil, the distillation profile of that crude oil, it’s very similar to Canadian heavy — so it’s very substitutable,” she said in Calgary.

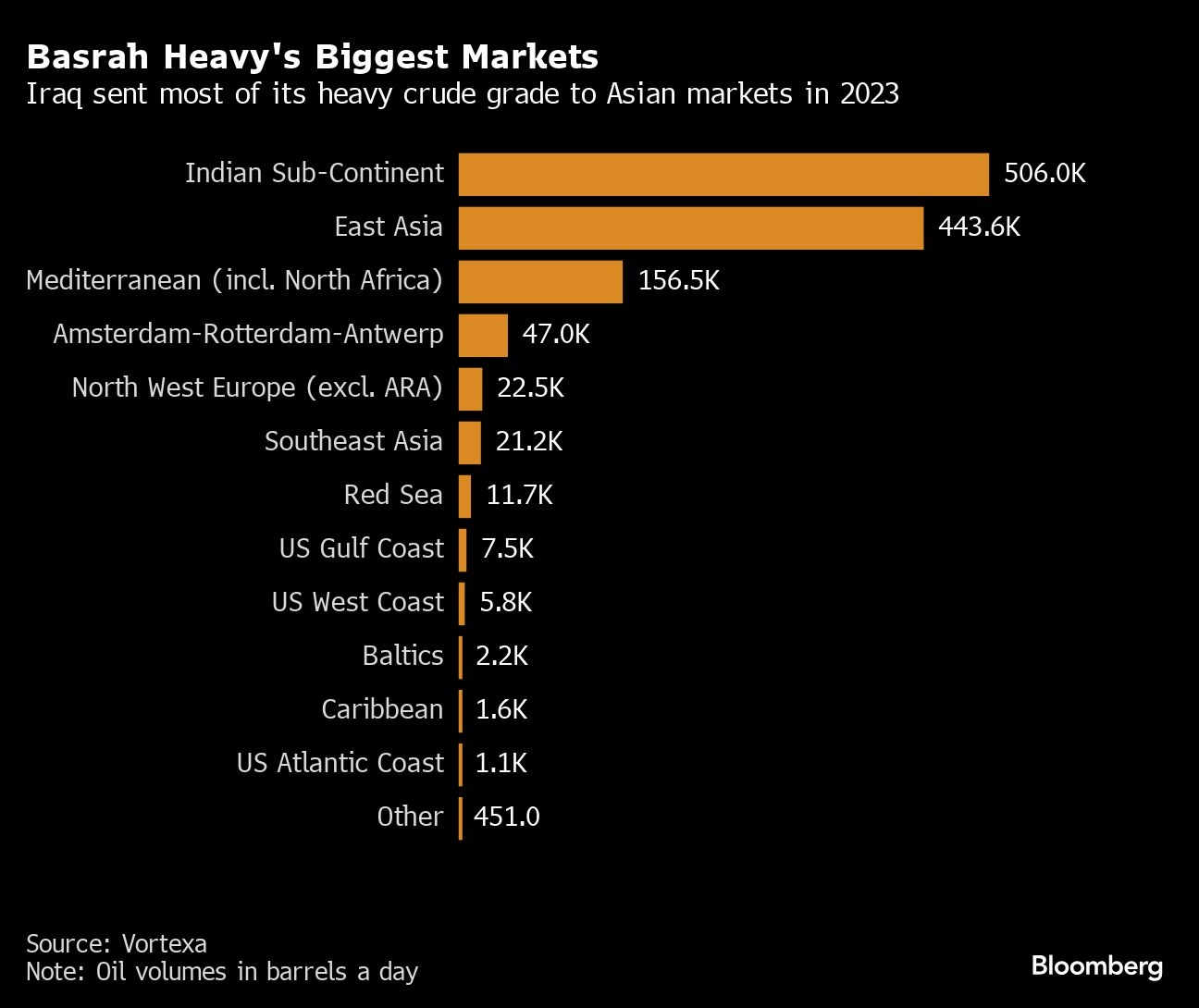

U.S. West Coast refiners that have relied on Basrah heavy and other crudes from the Middle East will have incentives to switch to Canadian oil, which is cheaper and located right next door, she said. Trans Mountain also will allow more Canadian oil to be shipped across the Pacific to Asia, where most Basrah Heavy is sold, potentially putting downward pressure on prices.

Trans Mountain’s expansion — scheduled to start commercial operation on May 1 after years of delays and cost overruns — will allow as much as 890,000 barrels of crude a day from the Canadian oil-sands to be shipped to the Vancouver area for transport by tanker to foreign markets.

The line promises to lessen Canada’s almost total dependence on the U.S. market, particularly refiners in the Midwest and Gulf Coast. The first two cargoes off the new line have been purchased by Chinese companies.

The ability to reach new markets may reduce the discounts to the U.S. benchmark that Canadian crude sells for, with Bell estimating the differential narrowing by US$3 a barrel compared with if the expansion wasn’t built, Bell said.

Trans Mountain also may shift geographical spreads for Basrah Heavy prices, such as the roughly $2-a-barrel premium the grade sells for in Singapore versus on the U.S. Gulf Coast, Bell said. That premium may shrink as Gulf Coast refiners seek more Basrah Heavy to replace the Canadian oil that Trans Mountain is allowing to flow to Asia as well as the Mexican crude that the government there is reducing exports of.