Apr 16, 2024

China's Loosening Grip on Yuan Allows Currency to Test a Key Milestone

, Bloomberg News

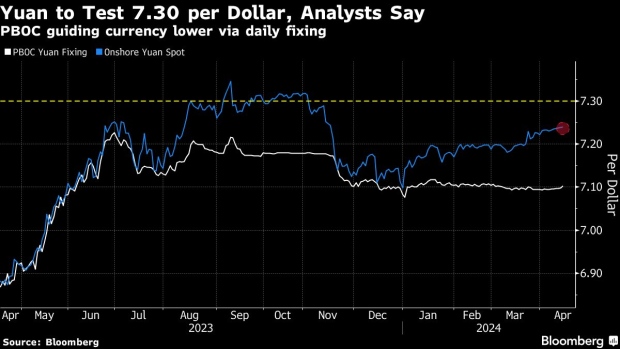

(Bloomberg) -- China’s second attempt in a month to loosen its grip on the yuan is opening up the door for the currency to test a psychological milestone that hasn’t been seen since November.

The yuan will weaken to test 7.30 per dollar by the end of this quarter, according to 10 analysts polled by Bloomberg after Beijing moved to guide the managed currency weaker Tuesday through its daily reference rate. While that is less than 1% from the yuan’s current level, the path leading to it will be paved with official pushback against sharp declines, they said.

The People’s Bank of China faces a constant battle to find the optimal pace for yuan weakness, so it can benefit the economy without triggering market panic or capital outflows. That job is getting harder by the day as investors seize every chance to sell the currency, due to poor sentiment toward the nation’s growth.

That’s why the PBOC can seem to be sending mixed signals about its foreign-exchange management. Tuesday’s move to weaken the so-called fixing came after it held the rate broadly flat for three weeks. In late March Beijing jolted the market by cutting the daily rate and then flipping back to support it again.

“The drop of the yuan may be very slow,” said He Wei, a China economist at Gavekal Dragonomics who sees the currency to test 7.30 by the end of June. A gradual weakening path allows the PBOC to balance bolstering growth with stabilizing market sentiment, he said.

The PBOC kept the fixing little changed at 7.1025 on Wednesday.

Apart from He, analysts at DBS Group Holdings Ltd., Malayan Banking Bhd and Standard Chartered Plc are among those saying the yuan may drop to or weaker than 7.30 in the near term. The onshore currency traded as just below the 7.24 per dollar level Tuesday.

PBOC Tools

To prevent sharp declines from becoming self-propelling, the PBOC can wield tools ranging from the fixing to verbal intervention. State banks were already seen selling dollars in a push to bolster the Chinese currency on Tuesday, according to traders who asked not to be identified.

But despite the support, the yuan remains close to the weak edge of its allowed 2% trading range versus the dollar. Like most global currencies, it is also weighed by a resurgent greenback which is benefiting from bets that the Federal Reserve won’t cut interest rates as soon as previously expected amid sticky US inflation.

“Unless there is a softening of dollar, there will eventually have to be some sporadic flexibility from the daily dollar-yuan fixing moving higher,” said Craig Chan, global head of foreign-exchange strategy at Nomura Holdings Inc. There could also be “some draining of foreign-exchange holdings from state banks or the PBOC, while some restrictions on capital flows may also materialize.”

On Friday, JPMorgan Chase & Co. lowered its near-term forecast for the yuan to 7.30 from 7.25 due to ongoing repricing in US rates and a shallower rate-cut cycle by the Fed.

“The question remains around how long foreign-exchange intervention can or should last,” Tiffany Wang, an emerging markets strategist at the bank, wrote on Friday. “Central bank management on FX can’t and shouldn’t last indefinitely.”

--With assistance from Wenjin Lv and Ran Li.

(Updates with Wednesday’s fixing in 6th paragraph.)

©2024 Bloomberg L.P.