Apr 18, 2024

Czechs Can’t Afford to Accelerate Rate Cuts, Central Banker Says

, Bloomberg News

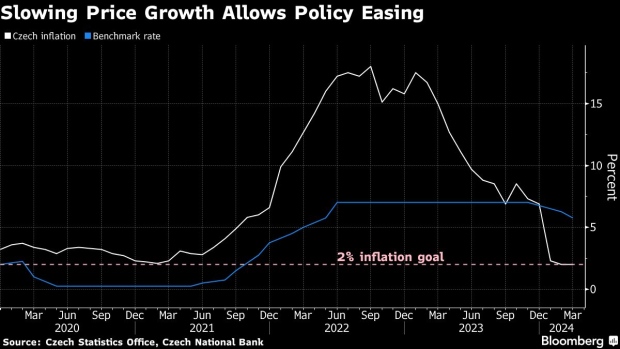

(Bloomberg) -- Persistent inflation risks and hawkish signals from the US Federal Reserve are preventing the Czech central bank from accelerating its interest-rate cuts, according to board member Jan Prochazka.

Policymakers in Prague lowered borrowing costs by half a percentage point at each of their last two meetings, although a minority on the rate-setting panel sought an even bigger move in March. The bank should maintain the current pace of easing on May 2 and potentially beyond as it seeks to stave off a resurgence in price growth, Prochazka said on Wednesday.

“We have been right to cut rates in moderate steps — and there is now almost zero likelihood that I personally would want to accelerate the process,” he said in an interview. “At the same time, I don’t see any strong signals from the economy that would prompt us to slow the pace.”

The Czech Republic’s $300 billion economy is recovering from two years of stagnation after inflation slowed to reach the 2% inflation target in the first quarter, sooner than initially expected and ahead of regional peers. With real wages rising again and household consumption picking up, policymakers are now “more optimistic about growth” than a few months ago, according to Prochazka.

But the improving economic outlook is also a reason for caution. While headline inflation has been driven down by a drop in more volatile food and energy costs, the price of services — such as restaurants and hotels — are still growing almost three times faster than in past periods of stable inflation, Prochazka said. A nascent recovery in the housing market is another risk.

The rate cuts have also contributed to the koruna’s 7.3% depreciation against the euro over the past 12 months. That’s the worst performance among European Union currencies and adding to local price pressures by boosting exporters’ profits and making imported goods more expensive.

“I’m very happy we have reached the inflation target, but the situation remains fragile and it’s too early to celebrate,” he said. “I’m confident that inflation will stay within the tolerance band, but we are concerned about its structure. In services, the disinflationary process is basically not happening at all.”

Investors have recently scaled back bets on the scope of further Czech monetary easing along with expectations that the Fed and the European Central Bank will keep high rates for longer than previously considered. The likely delay in rate cuts abroad will be “the biggest source of changes” in the Czech central bank’s forecasts and is a key focus of policy discussion in Prague, Prochazka said.

Read more: Rate Chokehold on World Economy Is Set to Loosen Only Slowly

After a cumulative 125 basis points in cuts since December, money-market prices are now implying borrowing costs will drop to about 4% over the next 12 months from 5.75% now.

That compares with the central bank’s February staff projections that saw the benchmark falling to 2.6% by the end of the year, but Prochazka reiterated the board’s view that rates will be higher than in the baseline forecast within the monetary-policy horizon.

“I don’t feel the need to verbally push back against the current pricing,” the 45-year-old board member said. “The markets are now reading us well.”

Czech policymakers are currently debating what the so-called neutral interest rate should be going forward. While the central bank plans to present its findings after the May 2 meeting, the conclusions may not come in the form of a specific number, according to Prochazka.

“The neutral interest rate should be seen as an academic concept rather than a target or terminal level for the current monetary-policy process,” he said.

(Updates with the koruna in sixth paragraph, comments on neutral rate from 12th.)

©2024 Bloomberg L.P.