Apr 25, 2024

European Stocks Slump as Earnings Upsets Outweigh Mega M&A Boost

, Bloomberg News

(Bloomberg) -- European stocks slipped on Thursday as a big-ticket deal in the mining industry was offset by a slate of glum reports on the busiest earnings day this season.

The Stoxx 600 Index fell 0.7% by the close in London, extending declines in the afternoon after disappointing US economic data led traders to dial back bets on interest-rate cuts. The UK’s FTSE 100 was the only major index to finish higher on the day, notching yet another record high.

Tech stocks in Europe lagged behind after a disappointing earnings report from Meta Platforms Inc. hit sentiment. Earnings in the sector were also underwhelming, with BE Semiconductor dropping as quarterly order intake and guidance came in well below expectations. STMicroelectronics NV, however, reversed early declines as it said sales to carmakers are expected pick up at the end of the year, after a slump in demand from the sector hit the chipmaker’s revenue.

Anglo American Plc jumped as bigger rival BHP Group Ltd. made a takeover approach, a move that could spark the biggest shakeup in the industry in over a decade. That news, as well as a rally in iron ore prices, boosted the broader mining index.

In other earnings-related moves, Nestle SA shares fell as it said sales growth sputtered in the first quarter as the maker of Nespresso coffee was hit by cooler demand in North America and supply constraints at its vitamins unit. Adyen NV shares slumped after the Dutch payment firm’s report showed a decline in take rate — what the payment processor charges merchants, which offset stronger-than-expected growth in processing volumes.

Among bank stocks, Barclays Plc and BNP Paribas SA gained after earnings.

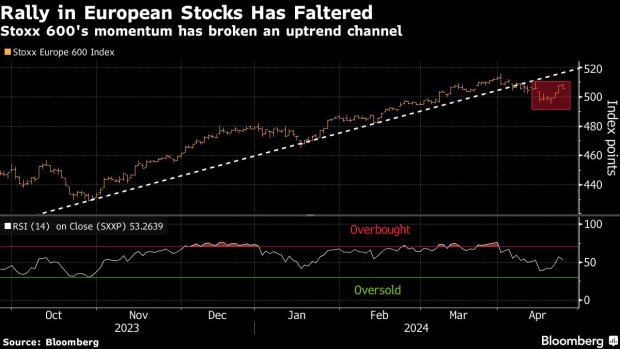

The rally in European stocks has cooled this month as investors worried about geopolitical risks and higher-for-longer rates. The corporate earnings season is adding another layer of risk, with analysts expecting MSCI Europe firms to report an 11% decline in year-over-year profits, according to data compiled by Bloomberg Intelligence.

Florian Ielpo, the head of macro research at Lombard Odier Asset Management, said both micro and macro factors were weighing on “still fragile market sentiment.”

A rise in real yields and tougher funding conditions are “making equity markets uneasy” and “it remains hard to see how M&A could offset the negative combination of earnings disappointment and deteriorating longer-term prospects,” Ielpo said.

Not everyone is as pessimistic. Ulrich Urbahn, head of multi-asset strategy and research at Berenberg, said they had used the recent pullback to increase their equity exposure.

“Macro data are improving and liquidity is also ample,” Urbahn said. “However, positioning and some valuations remain a concern. Until the US election, we expect volatility and sideways markets.”

SECTORS IN FOCUS:

- Miners as BHP Group has made a takeover approach for rival Anglo American. Meanwhile, iron ore extended its climb to the highest level in seven weeks on signs of economic recovery in top consumer China and a drop in export flows from Australian producers, while Vale reported first-quarter results that missed analyst estimates.

- Spanish shares after Prime Minister Pedro Sanchez said he’s considering resigning due to the attacks that he and his wife have faced in recent weeks.

For more on equity markets:

- FTSE’s Comeback Is Seen as Bigger Than Just a Blip: Taking Stock

- M&A Watch Europe: Anglo American, BHP, Moonpig, Hipgnosis

- CVC and Puig Debuts Set to Test European IPO Rebound: ECM Watch

- US Tech Stocks Set to Slump as Glum Meta Earnings Spark Jitters

- Are Premium Brands Back?: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika.

©2024 Bloomberg L.P.