Apr 14, 2024

Five Key Charts to Watch in Global Commodity Markets This Week

, Bloomberg News

(Bloomberg) -- The metals world is monitoring the impact of the London Metal Exchange’s banning of new Russian supplies including aluminum, while one of the biggest gatherings for the copper industry — Cesco Week and CRU’s World Copper Conference — kicks off in Santiago. Meanwhile, the annual BNEF Summit will convene in New York, bringing together project developers, government officials and bankers to discuss global trends in the energy transition.

Here are five notable charts to consider in global commodity markets as the week gets underway.

Aluminum

The LME banned delivery of new Russian metal following sanctions imposed by the US and UK, but left the door open for a wave of old stocks to hit the market and raise the risk of pricing dislocations. No Russian metal produced from April 13 onwards will be eligible for delivery to the LME, which plays a central role in the global metals world as the home of benchmark prices for everything from copper to zinc. Aluminum — which is up sharply since the end of February — surged as much as 9.4% when the market opened Monday, before trimming some gains.

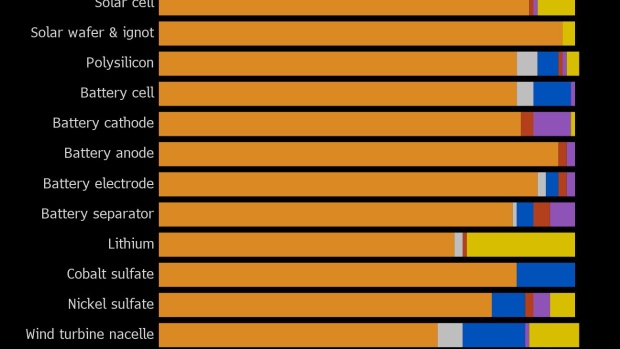

Clean Tech

The world’s dependence on China has increased for technologies needed to support a global transition away from fossil fuels, according to BloombergNEF. Breakneck spending has pushed China’s share of global production capacity above 80% in 11 clean-technology value chain segments. China’s capacity is set to far surpass global demand across solar, batteries and electric vehicles for years to come. Supply chains for clean energy will be among the topics discussed at BNEF’s summit on Tuesday and Wednesday.

Oil

With Mexico curbing its oil exports at the same time that OPEC+ curtails output, investors are watching for any changes to US production, which surprised to the upside last year. Shale production in the first three months of this year has already been predicted by the Energy Information Administration to be flat and the agency expects overall US output in 2024 to grow more slowly than in previous years. EIA’s Drilling Productivity Report that comes out Monday will offer a fresh forecast on where shale output is heading in May.

Eggs

Bird flu is flaring up again: The top US eggs producer reported this month the worst American outbreak since December while the highly pathogenic avian influenza virus made the jump to dairy cattle. Egg prices so far have held relatively in check, but there are expectations they could rise again with more egg-laying chickens potentially catching the virus amid peak migration season for wild birds. The worst-ever outbreak has never fully abated since it was first detected in the US in February 2022.

Energy

A strong oil-fueled rally in energy stocks is gathering momentum, helping them outperform technology indexes this year. The closely watched Energy Select Sector exchange-traded fund, or XLE, is up nearly 15% since the start of the year, while the Nasdaq 100 Index has gained just 7%. Rising oil has helped, after West Texas Intermediate crude broke above $80 a barrel in mid-March. Energy has led the S&P 500’s 11 market sectors since the start of March, rising more than 11% compared with the next closest group, communication services, at 5.8%, and the 0.3% decline in the broader index.

--With assistance from Brian Eckhouse, Geoffrey Morgan, Doug Alexander, Martin Ritchie and Jeff Sutherland.

(Updates aluminum price in third paragraph and adds oil chart in fifth paragraph.)

©2024 Bloomberg L.P.