Apr 11, 2024

Gold jumps to top US$2,400 as Middle East risks stoke demand

, Bloomberg News

There's not a lot of interest in gold from North American investors: research analyst

Gold climbed to a fresh record as the safe haven asset was boosted by simmering Middle East tensions.

Bullion broke the US$2,400-an-ounce mark for the first time on Friday morning, climbing as much as 1.2 per cent to $2,400.67. The U.S. and its allies believe a major missile attack by Iran or its proxies is imminent in retaliation for an Israeli strike on its embassy compound in Syria.

“Gold prices are up again this morning, as more investors view it as a better hedge against geopolitical risk than government bonds due to U.S. inflation concerns,” Mohamed A. El-Erian, the president of Queens’ College in Cambridge and a Bloomberg Opinion columnist, wrote in a post on X.

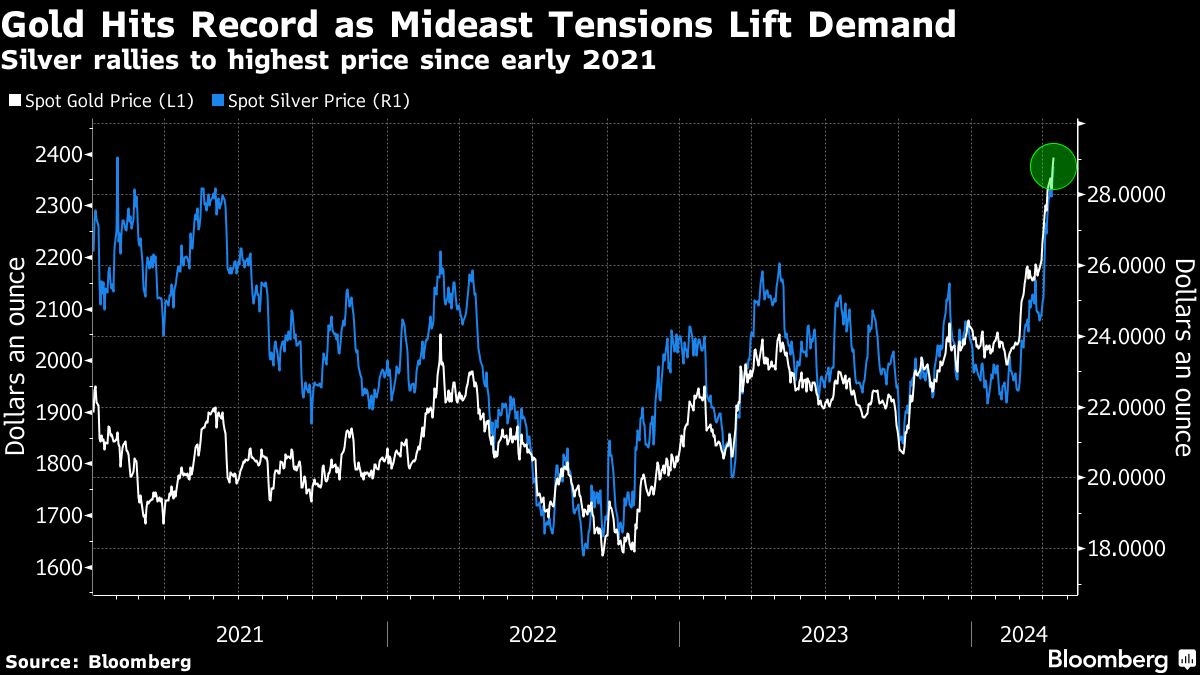

The precious metal has powered higher this year, dragging silver along with it, as central banks including China’s stepped up purchases of the costlier metal. In addition, traders have also been assessing the scope for rate cuts from the Federal Reserve over 2024, though still-strong U.S. inflation prints have muddied that outlook.

Spot gold was 0.9 per cent higher at $2,393.73 an ounce at 1:09 p.m. in London, with the metal on track for a fourth weekly advance, the longest such run since early 2023. Silver rallied to as much as $29.2295 an ounce, the highest since February 2021. Both metals’ 14-day relative-strength indexes are hovering near 80, well beyond the level that some investors see as overbought, potentially heralding a pause.

Platinum and palladium also advanced, even as the Bloomberg Dollar Spot Index traded near the highest level since November. A stronger U.S. currency is typically a headwind for commodities priced in the greenback as it can dull interest from overseas buyers.

“Geopolitical risk is the fulcrum here,” said Rhona O’Connell, head of market analysis at StoneX Financial Ltd. In a year with more than 50 local and national elections, ongoing tensions in the Middle East add “further fuel to the fire.”