Apr 3, 2024

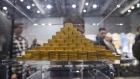

Gold sets another record high above US$2,300 after Powell comments

, Bloomberg News

The balance of risk on gold has begun to tilt to the downside: commodity strategist

Gold retreated after hitting a fresh record, as investors weighed U.S. Federal Reserve Chair Jerome Powell’s comments on the potential for a cut in interest rates in the coming months.

Bullion pulled back from an intraday peak of US$2,304.96 an ounce, though it’s still trading near that level. The market took comfort in Powell’s assurance on Wednesday that it will likely be appropriate to begin lowering borrowing costs “at some point this year.”

Expectations on when the Fed will start cutting rates have been the key driver of the price increase for precious metals, which don’t yield interest. Silver earlier jumped to the highest level in almost three years before easing.

Gold has been on a tear since mid-February, setting a record each day so far this week. It has also found support from heightened geopolitical risks, including in the Middle East and Ukraine, as well as central-bank purchases.

Bullion is attracting investors who seek a portfolio diversifier and hedge against uncertainty, according to Joni Teves, a precious metals strategist at UBS Group AG. “The case for building strategic allocations is strong, in our view, given persistent geopolitical risks and the scope for higher volatility and macro uncertainty this year,” she said, citing the looming U.S. presidential election as an example.

Still, gold’s upswing has left some market watchers puzzled, especially as real U.S. rates remain elevated, something that’s typically a headwind for bullion.

“I definitely think if we continue like this, there has to be some sort of an air pocket, or we hit a correction,” said Kyle Rodda, senior market analyst at Capital.Com Inc. “There doesn’t seem to be a particularly good, fundamental reason that is clear and available to everyone to pin the move on.”

Spot gold eased 0.3 per cent to $2,293.26 an ounce by 12:31 p.m. in London, following a seven-session rally. That advance has lifted the metal’s 14-day relative-strength index to a level some investors see as an indication that prices have risen too far, too fast.

Silver for immediate delivery edged lower after reaching the highest intraday level since June 2021. Palladium fell and platinum gained. The Bloomberg Dollar Spot Index declined.