Apr 18, 2024

Huge Bond Wagers Make Some Hedge Funds Too Big to Fail, IMF Says

, Bloomberg News

(Bloomberg) -- A small group of funds has accumulated such large short wagers in the Treasury market that they could destabilize the broader financial system during times of stress, according to the International Monetary Fund.

“A concentration of vulnerability has built up, as a handful of highly leveraged funds account for most of the short positions in Treasury futures,” the IMF said in its Global Financial Stability Report released this week. “Some of these funds may have become systemically important to the Treasury and repo markets, and stresses they face could affect the broader financial system.”

The IMF’s comments came in a section discussing the so-called basis trade, which contributed to turmoil in the world’s biggest bond market at the time of the pandemic outbreak in 2020.

In this trade, hedge funds exploit tiny differences between the prices of cash Treasuries and futures, using large sums of money borrowed from the repurchase-agreement market to amplify returns. Because of this leverage and reliance on short-term funding, the bet has drawn increasing scrutiny from regulators. And now the IMF is highlighting another risk: concentrated positions.

Read more: The Kings of a Colossal Bond Trade That’s Spooking Regulators

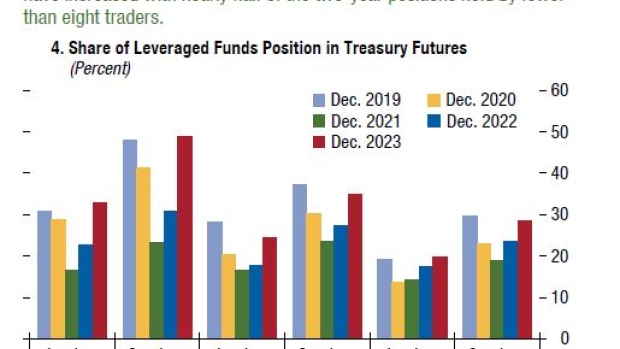

As of December, about half the two-year Treasury short positions in the futures market were in the hands of eight traders or less, according to the IMF. It was at a similar level at the end of 2019, just before a surge in funding costs in the early days of the pandemic spurred traders to unwind the positions, which helped boost volatility in bonds at a time of upheaval across financial markets.

The IMF didn’t cite specific funds, but Bloomberg reported in December that firms including ExodusPoint Capital Management, Millennium Management and Citadel have used the wager.

The IMF acknowledged that basis trades are helpful in providing market liquidity under “normal” conditions. But it also expressed concern that the trade’s rapid growth lifted the leverage in the financial system.

The popularity of basis trades swelled along with the Federal Reserve’s interest-rate hikes, which potentially make the strategy more profitable by widening the price gap between the cash and futures markets.

Read more: What’s the Basis Trade? Why Does It Worry Regulators?: QuickTake

A Fed study last month estimated that hedge funds have amassed at least $317 billion in Treasury holdings related to basis trades since the first quarter of 2022, although the size is “significantly” less than it previously estimated.

The Securities and Exchange Commission has been working to rein in basis trades and increase the transparency of hedge funds’ exposure to the strategy. In December, the SEC required the funds and brokerages to centrally clear far more of their US Treasuries transactions, a move to bolster oversight of basis trades.

Since then, there are signs that use of the trade may be waning: Commodity Futures Trading Commission data shows a decline in leveraged funds’ short positions in bond futures.

The concentration in these bets has also diminished. In two-year futures, net short positions controlled by eight traders or less have dropped to about 38% of total open interest, from 50% in early January, according to CFTC data compiled by Bloomberg.

Despite that unwinding, the IMF noted the short positions of leveraged funds remain large, which means they may still loom as a risk.

As the Fed shrinks its holdings of Treasuries, a process known as quantitative tightening, it also may reduce the liquidity in the financial system, potentially triggering a jump in funding costs and leading the basis trade to unravel, the IMF said.

“Basis trade investors rely on low repo haircuts and low repo rates to leverage their positions and increase basis trade profitability,” the report said. “A spike in repo rates — triggered, for example, by surprises in quantitative tightening — can render the trade unprofitable and could trigger the forced selling of Treasury securities and a brisk unwinding of futures positions as funds seek to quickly delever.”

--With assistance from Liz Capo McCormick and Edward Bolingbroke.

(Adds IMF comment in seventh paragraph.)

©2024 Bloomberg L.P.