May 25, 2018

IMF's Lagarde tells Turkey to ensure central bank independence

, Bloomberg News

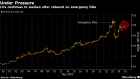

International Monetary Fund Managing Director Christine Lagarde urged the Turkish government to preserve the independence of its central bank after confusion sent the lira sliding.

Mixed signals about whether the central bank is free of political interference created a sense of uncertainty among investors, putting the currency under pressure, Lagarde said in an interview with Bloomberg Television in St. Petersburg.

"In terms of monetary policy, it’s always better for all political leaders to let the central bank governors do the job that they have to do, and to preserve and secure their independence," she said.

Turkey was engulfed by a currency crisis this month as President Recep Tayyip Erdogan said he would exert greater power over central banking if he won reelection. He subsequently pledged allegiance to global principles on monetary policy and the central bank boosted interest rates.

"Some of the comments made alerted the international community and particularly the investors to the fact that suddenly the central bank of Turkey could be under directions, instructions, or influence,” Lagarde said. “That has created a sense of uncertainty and a lack of confidence, which has found its way in the market.”

On Argentina, Lagarde said the IMF has been working actively with its officials to design measures to help stabilize the situation in its economy and restore confidence. She said the process was "progressing well."

"We are really moving ahead and we have committed to President Macri that we will do the best we can in order to move expeditiously and efficiently in order to change the perception about Argentina and the perception that people have about our role," Lagarde said. "So I am very, very focused on that relationship.”

Lagarde said the current outflows seen in emerging markets were expected, but that many markets are in much better shape today than at the time of the "taper tantrum" in 2013.

"We did say that with dollar strengthening and monetary policy tightening in the U.S. we would most likely see a flow back of capital from emerging markets," she said. "That’s obviously going to unsettle some the emerging markets that have not taken the necessary precautions or are weak in their fundamentals."