Apr 17, 2024

New York Fed Says Quantitative Tightening Could Stop in 2025

, Bloomberg News

(Bloomberg) -- The US central bank could halt the unwind of its balance sheet in 2025, according to Federal Reserve Bank of New York projections.

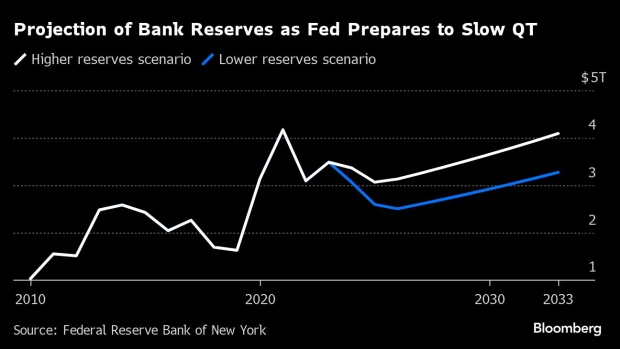

In two scenarios published Wednesday in an annual report, the New York Fed’s trading desk estimated balance-sheet reduction — a process known as quantitative tightening — could end in early or mid-2025, with bank reserves falling to about $2.5 or $3 trillion by the following year.

Fed officials began discussing a plan to begin slowing balance-sheet reduction at last month’s policy meeting, though no decisions were made at the gathering. Minutes of the meeting showed policymakers decided it would be appropriate to take a cautious approach given market turmoil in 2019 — the last time the Fed tried to shrink its portfolio — and judged it would be prudent to begin slowing the pace of runoff of maturing assets “fairly soon.”

In the “higher reserves” scenario outlined in the New York Fed report, the balance sheet would be wound down to around $6.5 trillion, while in the “lower reserves” scenario, it would fall to $6 trillion.

The Fed has been reducing its holdings of Treasuries and mortgage-backed securities at a rate of as much as $95 billion per month. Wall Street strategists expect the central bank to slash the size of its runoff cap for Treasuries to $30 billion from $60 billion, while keeping its limit for mortgage-backed securities unchanged.

Read More: Fed Walks Fine Line Between Ample and Abundant Reserves in QT

Officials generally favored keeping the existing cap on mortgage-backed securities, but adjusting the cap on Treasuries, minutes of the March policy meeting showed.

Wall Street is homing in on what level of bank reserves is appropriate to guarantee liquidity and avert past blowups in financial markets. Bank reserves — the amount of cash institutions have parked at the Fed — currently stand at about $3.6 trillion. That’s a level policymakers characterize as “abundant,” and they say they’re aiming for “ample,” which Fed Chair Jerome Powell defined at last month’s post-meeting press conference as “a little bit less” than that.

Separately, the New York Fed’s projections suggested net income generated by the central bank’s bond portfolio could remain negative through 2024, driven by the increased cost of interest-bearing Fed liabilities, before returning to positive levels in subsequent years.

The Fed’s expenses exceeded its earnings in 2023 by $114.3 billion, leading to its largest operating loss ever, forcing the central bank to forgo remittances to the Treasury as interest rates remain elevated.

©2024 Bloomberg L.P.