Apr 25, 2024

Private Credit’s Answer to Liquidity Problem Finally Takes Shape

, Bloomberg News

(Bloomberg) -- Blow-out growth in the $1.7 trillion private credit market has come at a cost, namely investors’ inability to exit their holdings in a crunch. Now a market where investors can unload their stakes is taking shape.

As many as $15 billion of such portfolio sales are set to close this year, according to a new survey from Ely Place Partners Ltd., which advises sellers of the funds. That’s triple the reported amount of deals closed in each of the previous two years.

The forecast is affirmation for buyers including Apollo Global Management Inc., Ares Management Corp. and Allianz SE, who have lined up billions for new strategies based on the idea that stakes in private credit funds can be recycled. On average, the portfolios are being sold at discounted prices of around 85 cents on the dollar, according to the survey.

Sales offering early exits, known as “secondary” deals, also suggest the liquidity hole at the heart of the private credit market can be bridged.

Investors have plunged headlong into private loans that offer double-digit returns in a bull run, but no get-out clause in a bear market. That’s set off alarms at regulators over what would happen in a crisis when insurers and pension funds that have piled into the asset class want to liquidate.

“By and large most pension funds and family offices we see selling are doing so for liquidity reasons,” said Daniel Roddick, founder of Ely Place Partners.

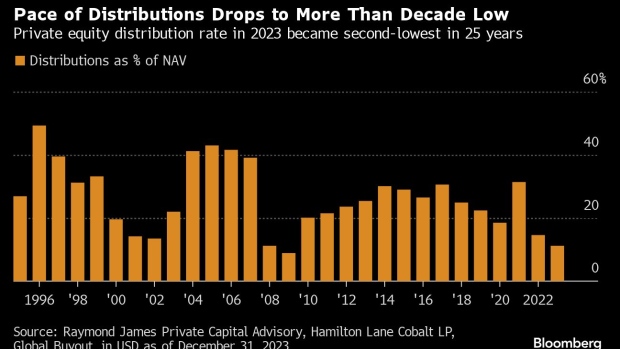

Investors known as limited partners are looking to liquidate stakes as a deal drought slows what they can expect to collect from private equity funds where they have also parked money. In December, buyout firms distributed the smallest amount of cash to their limited partners since 2009.

The shortfall has prompted some limited partners to turn to secondary deals to cash out their investments in both private credit and equity. But there are other reasons an investor may seek an early exit.

“We are seeing sellers bring assets to market due to some idiosyncratic pressures, including liquidity needs, active portfolio rebalancing, regulatory changes, and CIO turnover,” said Dave Schwartz, head of credit secondaries at Ares.

Read More: Show Us Your Money, Investors Tell the Titans of Private Equity

For limited partners the benefits are obvious: they can override standard commitments that keep them locked into private credit funds for an extended period.

For private credit managers, the chance to buy stakes from rival funds and their investors is attractive, particularly as a second slow year for M&A leaves them with fewer opportunities to invest in new buyout loans.

Managers are also pooling hand-picked assets into so-called continuation vehicles that can total $1 billion or more. In this way, they can hand over early distributions to existing investors and allow those willing to redeploy capital to buy into the new fund. While continuation vehicles still only account for 20% of the secondaries market, participants expect them to grow.

“We believe continuation vehicles will be an accelerant for the credit secondaries market,” Schwartz said.

As more players enter the market, some deals are starting to price closer to the fund’s net asset value, according to the Ely Place survey.

Recently, “hotly-contested” high-quality senior loan portfolios have fetched prices close to par, or 100 cents on the dollar, according to the survey. The smaller discounts should set in motion a virtuous cycle that will draw more sellers to the market, driving higher volume, more competition and better prices.

“The good news for sellers is that now there’s a credentialed set of buyers with the right capital and private credit knowledge,” Schwartz said.

Deals

- JPMorgan Chase & Co. is sounding out investors about a pair of large synthetic risk transfer deals ahead of looming changes to capital rules

- The founders of India’s renewable energy firm Continuum Green Energy Ltd. have hired Deutsche Bank AG to raise a $200 million loan to fund a stake purchase from its majority shareholder

- Blue Owl Capital Inc. is the sole lender on a £1.2 billion debt package to help fund the acquisition of a majority stake in Audiotonix, in a win for private credit over its traditional bank rivals

- Private equity firm Naxicap Partners SA, which owns a majority stake in French ophthalmic surgery equipment specialist Moria, is planning to refinance the company’s debt and bring in a new minority investor in the business

- Credit investor SC Lowy Financial HK Ltd. has asked some lenders of an A$1.6 billion loan to Healthscope Ltd. if they want to sell the debt

- Hayfin is leading a unitranche loan to help fund private equity firm Eurazeo’s acquisition of French employee savings firm Eres

- Goldman Sachs Group Inc. has held conversations with private credit lenders to help shore up Beyond Meat Inc.’s liquidity

- Grifols has signed a private offering of €1 billion 7.5% senior secured notes

- Wells Fargo & Co. is looking at essentially buying insurance on some of the loans in its portfolio using a transaction known as a synthetic risk transfer, potentially becoming the latest big bank to use the product to cope with looming capital rules

- Umicore has successfully completed the issue of a fixed-rate, sustainability-linked US Private Placement Notes for a total amount of €499 million equivalent which was priced end of March 2024

- Acentra Health LLC cut its interest rate on a term loan, part of a larger transaction with a group of private credit lenders that refinanced existing loans and raised additional debt

- Library services companies Baker & Taylor and Media Source Inc. have held talks to combine and have approached direct lenders about financing for the potential deal

- The owners of French luggage maker Delsey are weighing options for the company including a potential sale

Fundraising

- Citigroup Inc. Chief Executive Officer Jane Fraser warned that there’s a risk to the growing number of insurers piling funds into direct lending opportunities

Job Moves

- Investment management firm Nuveen has hired three managing directors from HPS to join its energy infrastructure credit (EIC) business

- Silver Point Capital has recruited Charles Brockett from Goldman Sachs Group Inc. as a managing director on its capital markets team

- Cantor Fitzgerald hired former B. Riley Financial Inc. bankers Tim Bottrell and Travis Hogan as managing directors for its new alternative capital solutions group

- Toronto-Dominion Bank’s head of private debt has left the firm amid a restructuring at the Canadian lender that includes cutting 3% of jobs globally

Did You Miss?

- Credit Investors Snap Up ABS Deals Backed by Unusual Collateral

- Private Credit Disrupts Hong Kong Bankers’ Cozy Lives: Shuli Ren

- Shadow Banking Stress in Korea Sends Warning to Global Investors

- BOE Warns of Risks With Private Asset Values Shrouded in Secrecy

- ARK Hits Out at Destiny in Race to Open Private Assets to Masses

--With assistance from Laura Benitez and Swetha Gopinath.

©2024 Bloomberg L.P.