Apr 17, 2024

Real’s Worst-in-World Currency Slide Attracts a Specific Kind of Bear

, Bloomberg News

(Bloomberg) -- Foreign funds are stepping up bets against the Brazilian real, turning the currency into the worst major performer in the world amid a mix of negative local news and a massive repricing of the outlook for global interest rates.

The real is down 4.5% this month, by far the weakest showing among all major currencies tracked by Bloomberg. Using derivatives, foreign funds have added the equivalent of $9.4 billion in real shorts since April 9, increasing positioning against the currency to $70.3 billion on Tuesday. That’s the highest level going back to at least 2012.

Traders and portfolio managers have been pointing to a specific type of foreign fund to explain the downward moves. CTAs, or commodity trading advisers, are hedge funds that use derivatives to trade following a systematic approach guided by a certain trend. With the Brazilian currency breaching key moving averages of the past few months, those funds began looking at the real more closely, according to FX traders who aren’t authorized to speak publicly.

The currency is getting some reprieve on Wednesday as sentiment improves across global markets, but the drivers for the recent deterioration — including a flight to safe-haven assets amid concerns about increasing tensions in the Middle East and the potential for the Federal Reserve to hold interest rates higher for longer — remain.

Read More: Powell’s US Rates Warning Means Headaches for Rest of the World

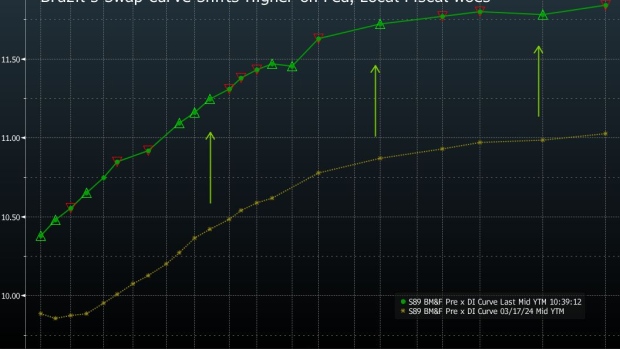

The real, along with the Brazilian swaps curve, has gotten an additional hit from concerns the administration of President Luiz Inacio Lula da Silva isn’t committed to improving fiscal accounts. Congress has approved measures that allow for spending beyond a limit set by the country’s fiscal framework. This week, the government soured the mood further by relaxing its fiscal goal for 2025. The focus on increasing revenues rather than cutting spending also disappointed traders.

Read More: Brazil Weakens Key 2025 Budget Target as Spending Rises

Local swap contracts maturing in January 2027 have jumped 86 basis points since April 9, while the equivalent contract in Mexico went up 30 basis points. The move was so intense that traders no longer view a June rate cut by the Brazilian central bank as given. Stocks are also being hit, with foreigners pulling $590 million from the local exchange this month.

Investor sentiment is “souring very quickly,” as the Brazilian government seems to have “thrown in the towel” on fiscal adjustment, said former Treasury Secretary Mansueto Almeida. The country needs to take advantage of the time of global uncertainty to differentiate itself positively from other emerging countries, according to Almeida, now a partner and chief-economist at BTG Pactual.

--With assistance from Josue Leonel.

©2024 Bloomberg L.P.