Oct 31, 2023

South Korean Exports Return to Growth in Boost to Outlook

, Bloomberg News

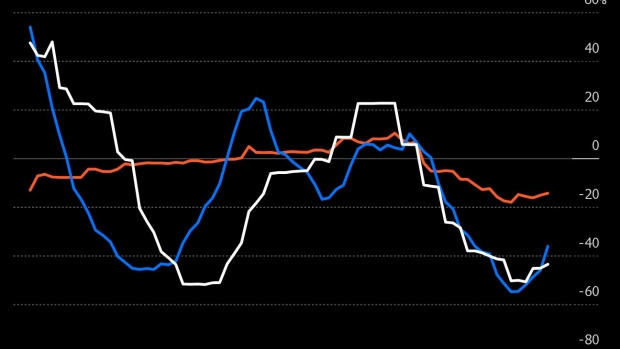

(Bloomberg) -- South Korea’s exports rose for the first time since late last year in a positive sign for the nation’s growth outlook and an indication that global demand is showing resilience.

Exports increased 5.1% from a year earlier in October, according to data released Wednesday by the trade ministry. Ruling out working-day differences, average daily shipments also rose 7.6%. Imports fell 9.7%, resulting in a trade surplus of $1.6 billion.

The export improvement will likely boost confidence among policymakers that South Korea’s economy will grow in line with their forecasts this year and may perform better next year, should demand hold up both overseas and at home.

“For now a lot of the economic momentum we’re seeing is from inventories being worked through,” said An Young-jin, an economist at SK Securities, hinting at the possibility of production ramping up going ahead and further helping growth. “Still, domestic consumer deman needs to keep improving and it’s looking uncertain for now with interest rates staying high.”

South Korea’s exports are driven largely by the country’s ability to find markets for its high-tech products abroad and a rebound in prices for some types of semiconductors is raising hopes momentum in exports may accelerate.

The country’s trade figures are also viewed by some economists as a rough proxy for global demand, especially in the tech sector.

In a positive sign for the chip industry, Samsung Electronics Co. on Tuesday reported better-than-expected earnings and offered an improving outlook. Separately, global silicon wafer shipments will likely resume growth next year after a decline this year, according to SEMI, an association of chipmaking equipment producers.

Read More: Samsung Says Chip Recovery Is Taking Hold After Profit Beat

South Korea produces goods that make their way into a variety of items, ranging from machinery and displays to refined oil products. Export growth will likely be led by autos, machinery and semiconductors, enabling the nation to grow 1.4% this year as forecast by policymakers, according to Dave Chia, lead Korea economist at Moody’s Analytics.

Demand for South Korean goods is growing evenly across the world rather than in a limited number of regions in a boost for the outlook, South Korean Trade Minister Ahn Duk-geun said last week in a briefing.

Still, there are challenges as well. While the export increase also points to an improvement in overseas demand the outlook for the global economy remains far from clear. Global central banks are likely to continue their fight against inflation for some time to come with restrictive monetary policies.

What Bloomberg Economics Says...

“South Korea’s outbound shipments increased in October for the first time in a year, but a narrowing in the trade surplus implies that net exports probably won’t be a strong growth booster in 4Q.”

— Hyosung Kwon, economist

For the full report, click here

Slack demand in China, the world’s second-biggest economy, remains a point of concern. While exports there slipped again in October, the 9.5% drop from a year earlier was the smallest since September. But a renewed contraction of factory activity in China in October, according to PMI figures released Tuesday, shows that the recovery there is sputtering.

The Israel-Hamas conflict, meanwhile, threatens to fuel oil prices and inflation that would dent consumer sentiment.

Other geopolitical tensions are adding to risks for Korea, too. Days after the US made it more difficult for China to import advanced chips, Beijing said last month it would strengthen its export controls on graphite, essential for electric-battery production.

An improvement in Korean exports would likely ease over the coming quarters, as world economic growth is expected to slow to 2.1% next year from 2.5% this year, according to BMI, a unit of Fitch Group.

The data showed that Korean exports of chips decreased 3.1% from a year earlier in October, easing from a double-digit fall. Exports to the US rose 17.3%.

Shipments of petroleum products were up 18%. Overseas deliveries of automobiles jumped 19.8%.

--With assistance from Jon Herskovitz.

(Adds details and a chart)

©2023 Bloomberg L.P.