Mar 11, 2022

Real-estate binge pushes Canadian household debt to new record

, Bloomberg News

Canada's economy is driven by real estate speculation and debt-fueled spending: Martin Pelletier

Canadians continued to pile into real estate last year, pushing prices and debt levels to new records.

The value of real estate owned by households in Canada rose $1.5 trillion (US$1.2 trillion) to $8.3 trillion in 2021, according to national balance sheet data released Friday by Statistics Canada.

Low interest rates, a larger appetite for space during the COVID-19 pandemic, and strong immigration flows led to a record 22 per cent appreciation in the price of dwellings, land and other buildings held by Canadians, the data show.

That increase lifted net worth per person in the country to $449,450 at the end of last year, up by nearly a quarter from 2020.

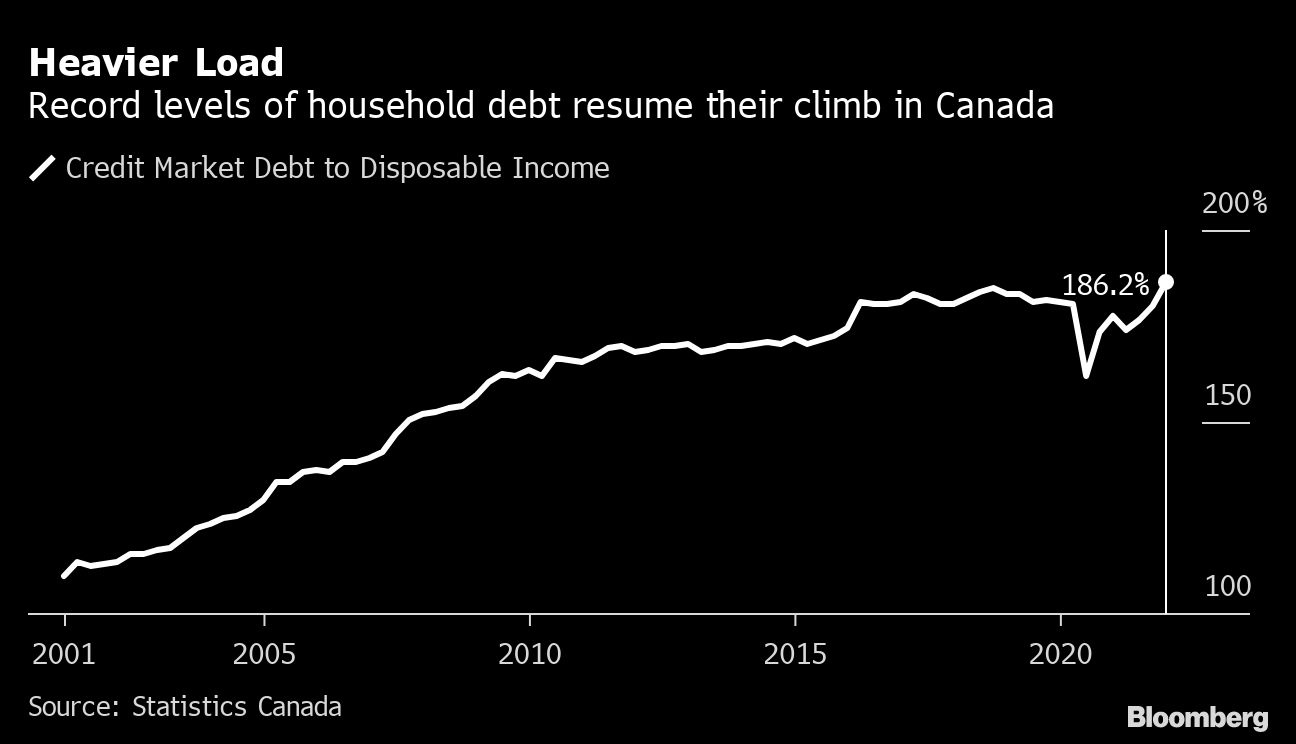

Much of the real estate activity has been driven by new mortgages, with the ratio of household credit market debt to income climbing to a record 186 per cent to end 2021.

The numbers will only fuel worries that historically low interest rates have been inflating the nation’s housing market and fueling financial stability risks through debt, giving the Bank of Canada one more reason to aggressively hike borrowing costs.