Feb 10, 2022

Traders now betting at least one U.S. Fed hike will be supersized

, Bloomberg News

See inflation moderation, don't expect U.S. Fed hiking 50 basis points: PIMCO economist

Traders ramped up wagers that the Federal Reserve will raise interest rates a full percentage point over the course of its next three scheduled meetings, reflecting growing conviction that surging inflation will drive the bank to enact its single biggest hike in over two decades.

The selling pressure in the Treasury market intensified after St. Louis Fed President James Bullard said in an interview with Bloomberg News that he supports such a course, which would require the first half-percentage-point hike since 2000, unless the Fed made a rare between-meetings move.

His comments stoked the selloff in the Treasury market, which began early Thursday after the Labor Department reported that inflation accelerated at a faster-than-expected pace. The yield on the policy-sensitive two-year Treasury note doubled its rise for the session and climbed as much as 22 basis points to 1.58 per cent.

The jump in the two-year yield was set to be the largest one-day increase since June 2009, while the 10-year yield breached 2 per cent, a level not seen since 2019.

The sharp repricing of rate-hike estimates and Treasury benchmark yields came after the Labor Department reported that consumer prices jumped at a 7.5 per cent annual pace in January, higher than the 7.3 per cent economists expected. It was the biggest hit to Americans’ paychecks since 1982 and highlighted the pressure on the Fed to pull back the near-zero interest rates it has kept in place since the early stages of the pandemic.

“What we do know is that an inflation rate of 7.5 per cent when the funds rate is zero means the Fed has to get going now,” said Gene Tannuzzo, global head of fixed income at Columbia Threadneedle Investments. Given the expectation that growth slows and inflation moderates during 2022, Tannuzzo said they are sticking with their case that the Fed delivers 4 rate hikes this year.

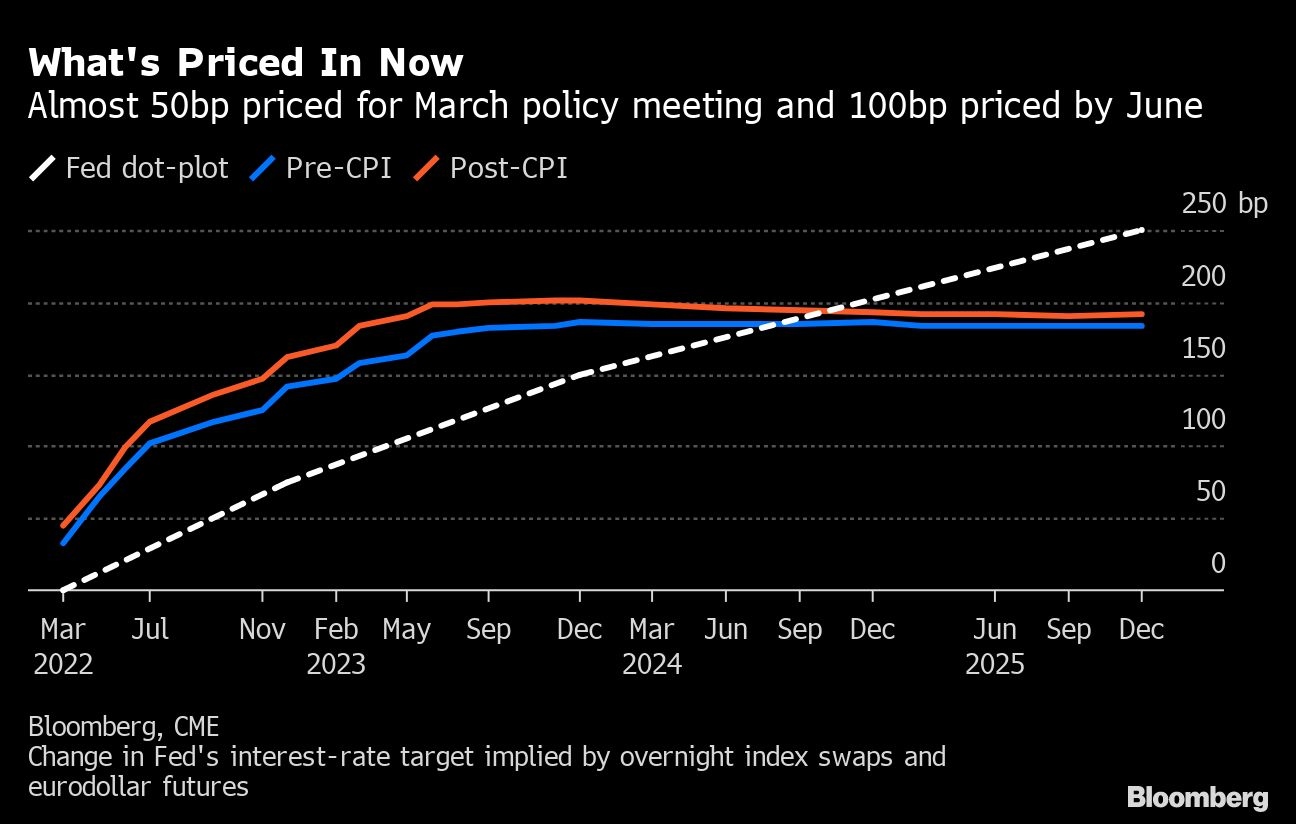

Overnight index swaps are pricing 85 per cent odds of a 50 basis point liftoff at the March policy meeting, with an additional 25 basis points priced for May and June. By Thursday afternoon, a total of 160 basis points, or just under six and a half quarter-point moves were priced into the December Fed meeting.

Rates on swaps linked to scheduled Fed meeting dates at one point on Thursday suggested the central-bank benchmark could be 1.12 per cent after the June meeting, more than 100 basis points above the current effective rate of 0.08 per cent. Interest-rate futures also indicated the Fed’s hiking cycle with end with the overnight rate at 2 per cent in late 2023, up from a recent estimate of 1.6 per cent.

The inflation report and Bullard’s comments sent short-dated yields jumping the most and flattened the Treasury curve, which is traditionally a signal that traders expect economic growth to slow as rates move higher. The gap between five- and 30-year yields narrowed to as little as 35 basis points, its flattest level since late 2018, signaling expectations of slowing growth in the face of rising rates. The move stalled after weak demand for the regular monthly auction of 30-year bonds caused long-dated yields to climb further.

“Monetary policy works with a lag,” said David Kelly, the chief global strategist at JPMorgan Asset Management. “We’re looking at very much slower growth, and that’s something that the bond market is pricing in -- and that’s why you’re seeing this flattening yield curve.”

Rising Treasury yields have saddled bondholders with losses, with an index of the securities losing 3 per cent so far in 2022, marking its worst start to a year since 2009. The Treasury index declined 2.3 per cent in 2021, its first annual slide since 2013.

Consumer prices climbing by more than 7 per cent was a hallmark of the early 1980s and compelled aggressive tightening by the Fed that pushed the economy into recession.

The bond market and many economists expect inflation is nearing its pandemic-related peak and will subside over the course of the year to 4.8 per cent and then ease to 2.4 per cent by the end of 2023, according to a Bloomberg survey. Bond market expectations of inflation have fallen in recent months, with long-term expectations pacing the move back toward the Fed’s 2 per cent target.