Apr 17, 2024

Wall Street Bank Leaders Hail IPO Market’s Budding Revival

, Bloomberg News

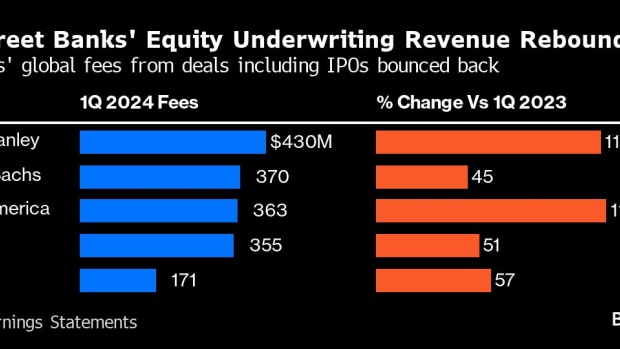

(Bloomberg) -- The leaders of Wall Street’s largest banks are optimistic about the reopening of the market for initial public offerings, after listings by firms such as Reddit Inc. and Galderma Group AG boosted underwriting revenues.

Companies going public in the first quarter globally raised $27.8 billion, a 10% jump from the same period in 2023, according to data compiled by Bloomberg. The increase in volume and the resilience of these companies’ gains in early trading is giving encouragement to the industry after slumping equity capital markets activity was among the factors leading to job cuts across the sector.

“It’s clear that we’re in the early stages of a reopening of the capital markets, with the first few months of 2024 seen a reinvigoration in new issue market access,” said David Solomon, Goldman Sachs Group Inc.’s chairman and chief executive officer, on the bank’s first-quarter earnings call Monday.

Citigroup Inc. CEO Jane Fraser echoed that view on the bank’s earnings call April 12. There’s “a measured reopening of the IPO market in the second quarter in light of improved market valuations,” she said.

The IPO market’s rebound began in fits and starts in 2023, with a handful of sizable listings giving issuers, bankers and investors alike false hope that a speedy recovery would take place. More recently, deal flow has showed promising signs of stabilizing.

In the US, several of the largest recent deals are trading above their IPO prices. Astera Labs Inc., which raised $820 million in March, has nearly doubled its IPO price, while Reddit’s shares rose as much as 92% after its $860 million IPO before paring some of the gains. UL Solutions Inc., whose listing raised $946 million earlier this month, is up more than 20%.

In Europe, Galderma — the largest listing this year — raised $2.6 billion in Zurich, and is trading about 19% above its IPO price.

This contrasted sharply with the high expectations and subsequent disappointments for a crop of listings last year led by Arm Holdings Plc, which treaded water below its offer price for a short time. It has now more than doubled.

“Some cohorts and ventures of IPOs have performed somewhat disappointingly. And I think that narrative has changed to a meaningful degree this quarter,” JPMorgan Chase & Co. Chief Financial Officer Jeremy Barnum said on his bank’s earnings call. “I think we’re seeing better IPO performance.”

While bankers are optimistic about a steady rebound of the market, some tempered their comments with caution.

“I think it will be a slow march back,” said Morgan Stanley CEO Ted Pick. “People are not going to jump into some of the speculative paper that we saw during the SPAC period clearly, but the receptivity to recent IPOs that were high-quality was quite impressive, quite broad interest among investors.”

©2024 Bloomberg L.P.